- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Red Cat Holdings (RCAT): Valuation in Focus Following $172.5 Million Stock Offering and Maritime Expansion

Reviewed by Kshitija Bhandaru

Red Cat Holdings (RCAT) just wrapped up a big move, successfully pricing a public stock offering that raised $172.5 million. The cash infusion is earmarked for expanding its freshly launched unmanned surface vessel division, fueling both day-to-day operations and future growth in autonomous maritime systems. For investors weighing their next move, this capital raise comes just as Red Cat redoubles its focus on manufacturing, research, and partnerships with key players in the defense space. This signals bolder ambitions ahead for the company.

This fresh round of funding follows the company’s recent steps to grow its maritime footprint, notably through new facility openings and a collaboration with Safe Pro Group to add advanced AI-driven threat detection to its drone line-up. Momentum has clearly been building: shares climbed 58% over the past three months, and the one-year return now stands at a strong 258%. While short-term performance has been impressive, the volatility around the secondary offering saw the stock give back some gains following the announcement of new shares on the market.

With Red Cat Holdings shifting gears and the market reacting to its latest moves, investors are weighing whether the current share price reflects all that future potential for RCAT.

Price-to-Book of 11.8x: Is it justified?

Red Cat Holdings currently trades at a price-to-book ratio of 11.8x, which is significantly higher than both its direct peers and the wider US Electronic industry.

The price-to-book multiple measures the market’s valuation of a company compared to its book value. It is commonly used to gauge the cost of acquiring a company’s net assets. In technology and growth sectors, higher price-to-book ratios are sometimes justified by rapid revenue expansion or innovation potential, but they may also indicate that investors are pricing in strong future performance or accepting greater risk.

In Red Cat’s case, the elevated ratio means investors are paying a premium relative to both its peers (7.8x) and the industry average (2.6x). This suggests big expectations for the company’s future growth or innovation. However, with current unprofitability and a smaller revenue base, there is a question whether such a valuation is sustainable without clear progress toward profitability or scale.

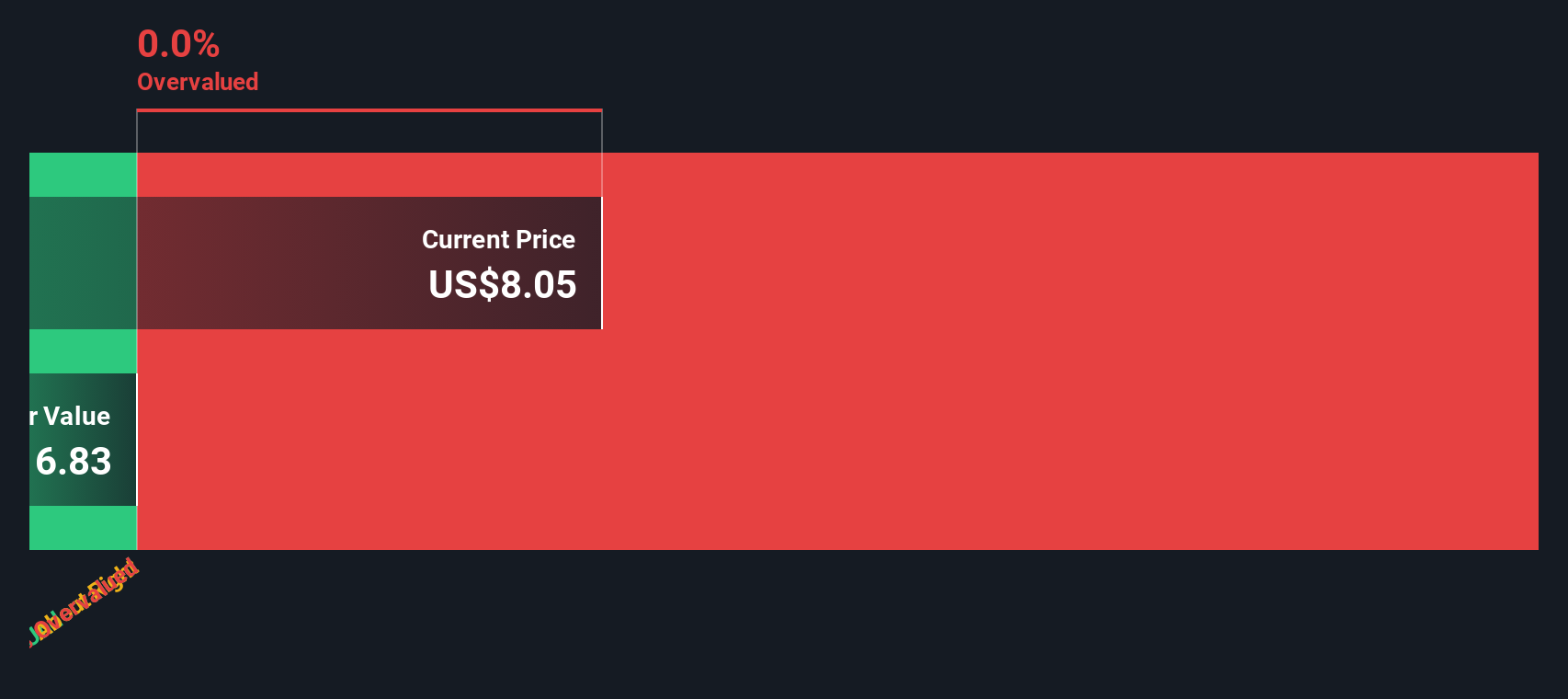

Result: Fair Value of $15.33 (OVERVALUED)

See our latest analysis for Red Cat Holdings.However, RCAT’s persistent unprofitability and sharp valuation could quickly become pressure points if expected growth or partnerships do not materialize as anticipated.

Find out about the key risks to this Red Cat Holdings narrative.Another View: What Does Our DCF Model Say?

While the market price suggests lofty expectations, the SWS DCF model could offer a reality check or confirmation. This method weighs future cash flows instead of relying on current market sentiment. Will this approach change your perspective?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Red Cat Holdings Narrative

If you see things differently, or want to dig into the details yourself, it only takes a few minutes to build your own perspective on Red Cat Holdings. Do it your way

A great starting point for your Red Cat Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. The right screener can help you spot your next winning stock, accelerate your search, and help you jump on new trends.

- Uncover companies at the intersection of medicine and cutting-edge tech by checking out healthcare AI innovators through healthcare AI stocks.

- Secure steady, reliable income by tracking top-performing businesses offering yields above 3 percent with dividend stocks with yields > 3%.

- Catch undervalued gems with strong cash flow potential before the crowd spots them via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCAT

Red Cat Holdings

Provides products, services, and solutions to the drone industry in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion