- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Can Red Cat (RCAT) Partnerships Reveal a New Edge in Defense Tech Collaboration?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Red Cat Holdings announced new collaborations with AeroVironment and Redwire’s Edge Autonomy subsidiary to integrate its FANG FPV drones and Teal Drones Black Widow into advanced Group 2 uncrewed aerial systems (UAS) for enhanced defense applications.

- These alliances aim to demonstrate how modular, interoperable drone technologies can broaden mission flexibility and intelligence capabilities for U.S. Army and allied forces.

- We'll look at how Red Cat's focus on cross-platform drone deployment with major defense partners may shape its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Red Cat Holdings' Investment Narrative?

For anyone looking at Red Cat Holdings, the big picture has always hinged on whether its investments in modular drone systems could translate into strategic defense contracts and sustainable revenue. The newly announced collaborations with AeroVironment and Edge Autonomy bring the company’s tech into larger defense ecosystems, potentially placing Red Cat’s products directly in the hands of the U.S. Army and allied forces. These partnerships may accelerate the timeline for commercial adoption and contract wins, making them possible short-term catalysts, especially as they demonstrate how Red Cat’s drones can enhance operational flexibility for defense clients. However, Red Cat remains unprofitable and has seen its losses grow, with a history of volatile share price moves and past shareholder dilution. The company’s reliance on successful integration and future defense orders keeps key business risks firmly in play, despite this progress. Yet, recent insider selling is something investors should keep an eye on.

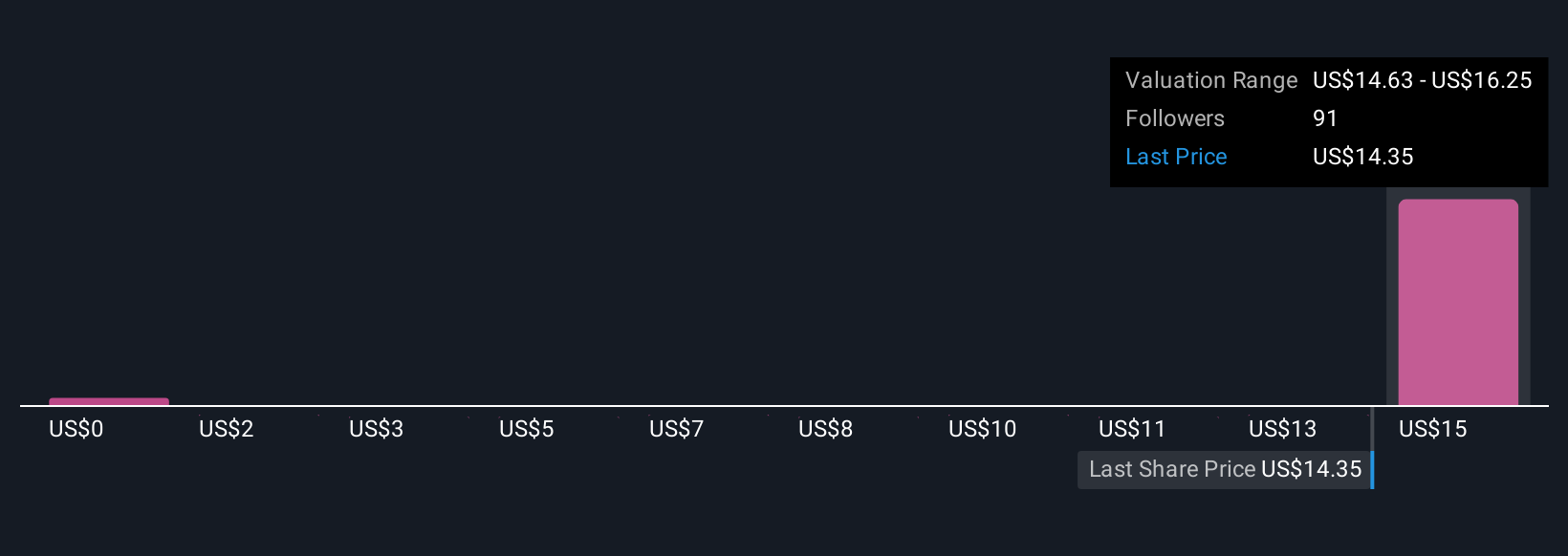

Our valuation report here indicates Red Cat Holdings may be overvalued.Exploring Other Perspectives

Explore 15 other fair value estimates on Red Cat Holdings - why the stock might be worth as much as 60% more than the current price!

Build Your Own Red Cat Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Cat Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Red Cat Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Cat Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCAT

Red Cat Holdings

Provides products, services, and solutions to the drone industry in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives