- United States

- /

- Tech Hardware

- /

- NasdaqGM:PMTS

CPI Card Group Inc. (NASDAQ:PMTS) Stock Rockets 27% But Many Are Still Ignoring The Company

CPI Card Group Inc. (NASDAQ:PMTS) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

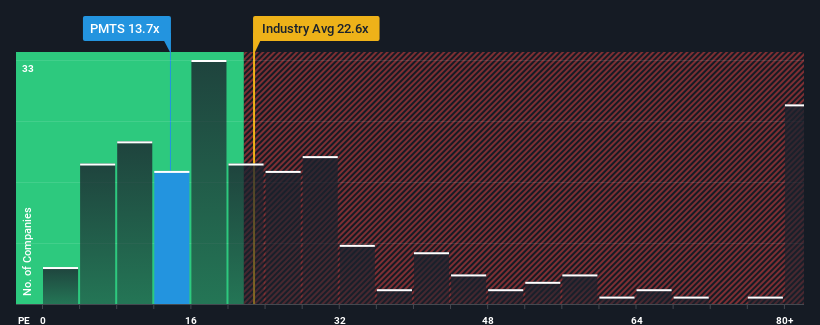

Even after such a large jump in price, CPI Card Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.7x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 32x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for CPI Card Group as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for CPI Card Group

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, CPI Card Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 55%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 43% over the next year. Meanwhile, the rest of the market is forecast to only expand by 13%, which is noticeably less attractive.

In light of this, it's peculiar that CPI Card Group's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Despite CPI Card Group's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that CPI Card Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for CPI Card Group you should be aware of, and 1 of them is a bit concerning.

Of course, you might also be able to find a better stock than CPI Card Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PMTS

CPI Card Group

Engages in the design, production, data personalization, packaging, and fulfillment of payment cards in the United States.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives