- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

Plexus (PLXS): Exploring Valuation as Investors Weigh High P/E Against Slowing Earnings Growth

Reviewed by Simply Wall St

If you follow Plexus (PLXS), you might have noticed the stock has become a talking point lately after discussions emerged around its relatively high price-to-earnings ratio compared to the average US stock. Investors seem to be weighing whether the above-average P/E signals faith in Plexus’ ongoing ability to generate earnings, or if it points to expectations already running ahead of reality. This is especially relevant since forecasts suggest the company’s earnings may grow more slowly than the overall market. This recalibration of outlook is showing up in share price action, as the market works to make sense of future risks and rewards for shareholders.

Looking at the numbers, it has been a year of steady, if not spectacular, progress for Plexus. The stock has delivered just under a 9% return over the past 12 months, with a decent 4% climb in the past month alone, although it remains down about 11% for the year to date. Over a longer horizon, the picture brightens considerably, as Plexus has more than doubled in value over five years and grown over 53% in the past three. This suggests underlying momentum persists, but perhaps at a slower pace. Recent comments about its growth potential and P/E premium tie back to this balance between optimism and caution that has been at play for much of the year.

So, is Plexus poised for another leg higher thanks to untapped growth, or is the market already pricing in all the good news?

Most Popular Narrative: 10.7% Undervalued

According to the most widely followed narrative, Plexus is currently undervalued by just over 10% based on analysts’ consensus price target and future earnings projections.

Plexus is capitalizing on the growing demand for advanced electronics manufacturing fueled by digital transformation, IoT expansion, and emerging technologies like AI and connected vehicles. This is reflected in a robust pipeline of new program wins across high-growth sectors, which is likely to drive sustained multi-year revenue growth and larger addressable markets.

Curious how Plexus stacks up to its tech competitors? Analysts are betting on multi-year growth and improved margins, and the narrative is driven by ambitious forecasts for sales and profit expansion, as well as bold financial targets that go beyond current market expectations. Want to uncover which big metrics unlock that valuation? The details behind the numbers might surprise even experienced investors.

Result: Fair Value of $154.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff uncertainty or demand slowdowns from major customers could quickly challenge the upbeat outlook that many analysts share for Plexus.

Find out about the key risks to this Plexus narrative.Another View: The DCF Model Challenges Consensus

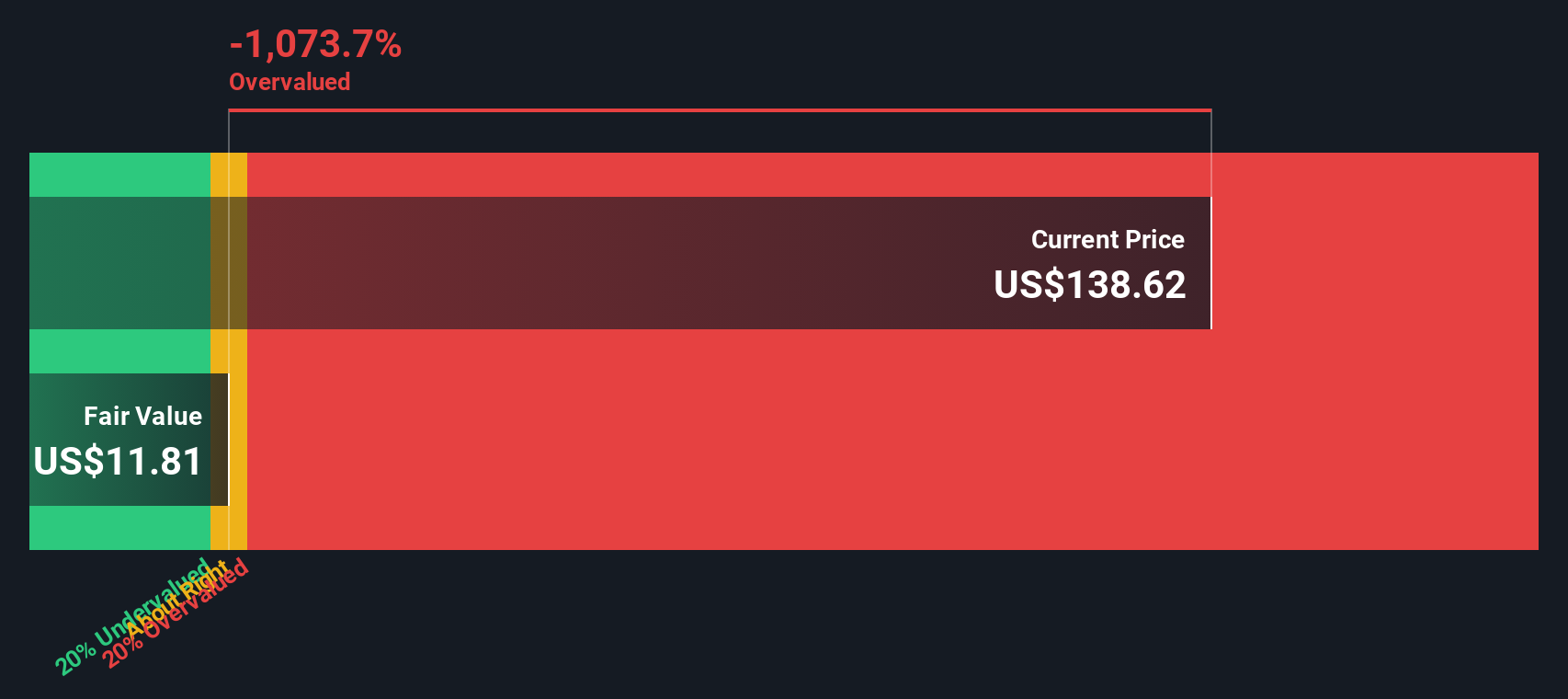

Switching gears, our SWS DCF model paints a much less optimistic picture than the analyst target. This suggests Plexus could actually be overvalued based on projected future cash flows. Could this be a warning sign, or might the market know something the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Plexus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Plexus Narrative

If you see the numbers differently or would rather dive into your own analysis, you have the flexibility to craft your own take in just a few minutes. Do it your way

A great starting point for your Plexus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stick to just one opportunity when the market is full of fresh possibilities? Secure your edge by stepping into new themes and trends right now.

- Uncover high-potential companies shaking up the world of digital finance by kicking off your research with cryptocurrency and blockchain stocks.

- Spot tomorrow’s game-changers by tapping into cutting-edge breakthroughs with AI penny stocks.

- Boost your income potential by targeting top-paying options with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives