- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

With ePlus inc.'s (NASDAQ:PLUS)) price down 3.9% this week, insiders might find some solace having sold US$601k worth of shares earlier this year.

Over the past year, insiders sold US$601k worth of ePlus inc. (NASDAQ:PLUS) stock at an average price of US$56.19 per share allowing them to get the most out of their money. After the stock price dropped 3.9% last week, the company's market value declined by US$57m, but insiders were able to mitigate their losses.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for ePlus

ePlus Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Independent Director, Eric Hovde, for US$554k worth of shares, at about US$55.92 per share. So what is clear is that an insider saw fit to sell at around the current price of US$52.82. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

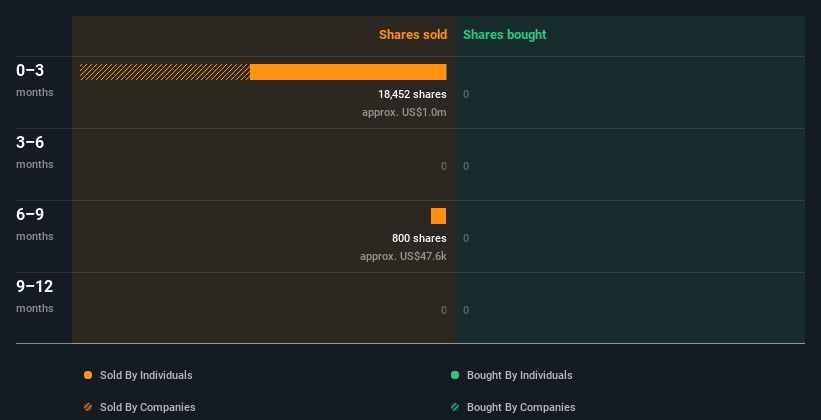

Insiders in ePlus didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at ePlus Have Sold Stock Recently

The last three months saw significant insider selling at ePlus. In total, Independent Director Eric Hovde sold US$554k worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Insiders own 2.2% of ePlus shares, worth about US$31m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The ePlus Insider Transactions Indicate?

An insider hasn't bought ePlus stock in the last three months, but there was some selling. And there weren't any purchases to give us comfort, over the last year. But it is good to see that ePlus is growing earnings. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. We'd practice some caution before buying! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To that end, you should learn about the 2 warning signs we've spotted with ePlus (including 1 which is concerning).

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Safaricom: Why I'm Holding Long

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.