- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

What Does ePlus inc.'s (NASDAQ:PLUS) Share Price Indicate?

While ePlus inc. (NASDAQ:PLUS) might not have the largest market cap around , it received a lot of attention from a substantial price increase on the NASDAQGS over the last few months. The recent jump in the share price has meant that the company is trading at close to its 52-week high. As a well-established company, which tends to be well-covered by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. However, could the stock still be trading at a relatively cheap price? Today we will analyse the most recent data on ePlus’s outlook and valuation to see if the opportunity still exists.

View our latest analysis for ePlus

What's The Opportunity In ePlus?

The stock is currently trading at US$79.31 on the share market, which means it is overvalued by 31% compared to our intrinsic value of $60.54. This means that the buying opportunity has probably disappeared for now. But, is there another opportunity to buy low in the future? Given that ePlus’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

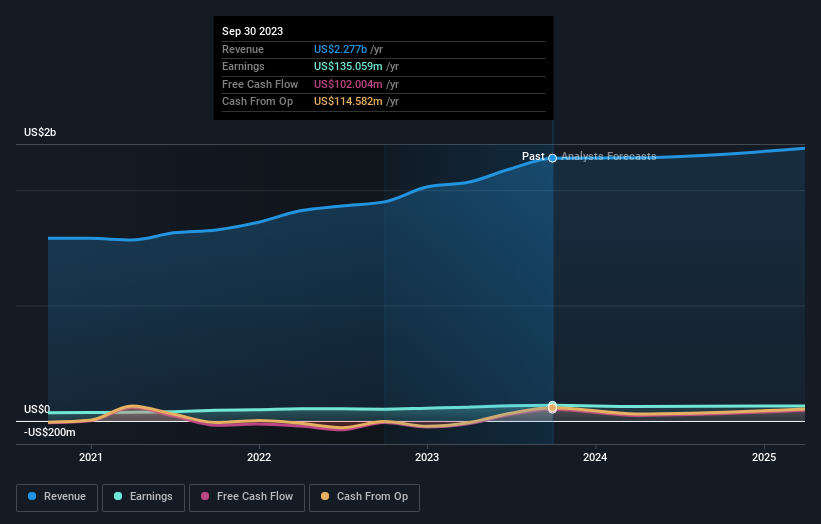

What kind of growth will ePlus generate?

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. However, with a negative profit growth of -5.3% expected next year, near-term growth certainly doesn’t appear to be a driver for a buy decision for ePlus. This certainty tips the risk-return scale towards higher risk.

What This Means For You

Are you a shareholder? If you believe PLUS should trade below its current price, selling high and buying it back up again when its price falls towards its real value can be profitable. Given the risk from a negative growth outlook, this could be the right time to reduce your total portfolio risk. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on PLUS for a while, now may not be the best time to enter into the stock. Its price has risen beyond its true value, on top of a negative future outlook. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Should the price fall in the future, will you be well-informed enough to buy?

If you want to dive deeper into ePlus, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 1 warning sign for ePlus you should know about.

If you are no longer interested in ePlus, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Promigas E.S.P looks to a promising future with 35% revenue growth

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks