- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Shareholders Will Probably Not Have Any Issues With ePlus inc.'s (NASDAQ:PLUS) CEO Compensation

Performance at ePlus inc. (NASDAQ:PLUS) has been reasonably good and CEO Mark Marron has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 16 September 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for ePlus

How Does Total Compensation For Mark Marron Compare With Other Companies In The Industry?

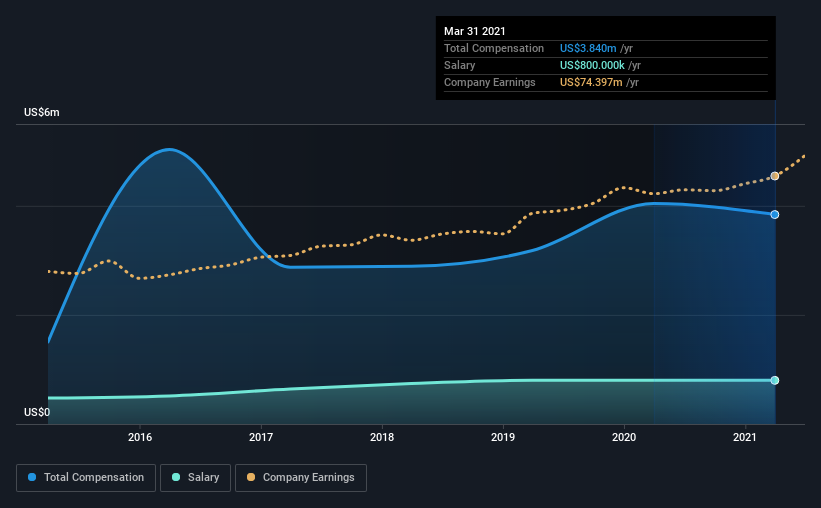

Our data indicates that ePlus inc. has a market capitalization of US$1.5b, and total annual CEO compensation was reported as US$3.8m for the year to March 2021. That's a slight decrease of 5.0% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$800k.

On examining similar-sized companies in the industry with market capitalizations between US$1.0b and US$3.2b, we discovered that the median CEO total compensation of that group was US$3.5m. This suggests that ePlus remunerates its CEO largely in line with the industry average. Furthermore, Mark Marron directly owns US$9.3m worth of shares in the company, implying that they are deeply invested in the company's success.

On an industry level, around 29% of total compensation represents salary and 71% is other remuneration. It's interesting to note that ePlus allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

ePlus inc.'s Growth

ePlus inc. has seen its earnings per share (EPS) increase by 13% a year over the past three years. In the last year, its revenue is up 4.3%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has ePlus inc. Been A Good Investment?

With a total shareholder return of 6.1% over three years, ePlus inc. has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at ePlus.

Important note: ePlus is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading ePlus or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

CSL: The Dip Is the Opportunity

Apple will shine with a 6% revenue growth in the next 5 years

NVIDIA: Durable Infrastructure in AI Leadership, but Nigh-Perfect Precision is Required

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026