- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OUST

Will Ouster's (OUST) Global Push Redefine Its Competitive Edge in High-Margin Software?

Reviewed by Sasha Jovanovic

- Ouster recently identified international expansion as a critical part of its growth plan, aiming to access broader lidar and smart infrastructure markets through targeted distribution partnerships.

- This move is designed not only to boost revenue but also to mitigate customer concentration risk and accelerate growth in higher-margin software and analytics offerings such as BlueCity and Gemini.

- Next, we’ll explore how Ouster’s expanded global reach and distribution partnerships could reshape its long-term investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ouster Investment Narrative Recap

To be a shareholder in Ouster, you need to believe in the company's ability to leverage advanced lidar and smart infrastructure technology for large-scale commercial success, with meaningful revenue from both hardware and higher-margin software. While the recent international expansion signals ambition and may aid in reducing customer concentration and scaling software like BlueCity, it does not materially alter the key short-term catalyst, which remains capturing more Intelligent Transportation Systems contracts, nor does it diminish the biggest risk of price pressure from formidable Chinese competitors.

The May 2025 agreement to deploy Ouster’s 3D lidar technology across Europe with LASE PeCo stands out as the most relevant recent announcement, showing tangible progress in international markets. This supports Ouster's push into global markets, directly linked to securing new deployments of BlueCity and Gemini, which could help accelerate both short-term adoption and longer-term profitability goals.

However, investors should be aware that, despite growing international partnerships, there remains a considerable threat from aggressive pricing by Chinese lidar manufacturers, meaning...

Read the full narrative on Ouster (it's free!)

Ouster's outlook anticipates $335.6 million in revenue and $30.3 million in earnings by 2028. This scenario depends on a 38.7% annual revenue growth rate and a $122.3 million improvement in earnings from the current loss of $-92.0 million.

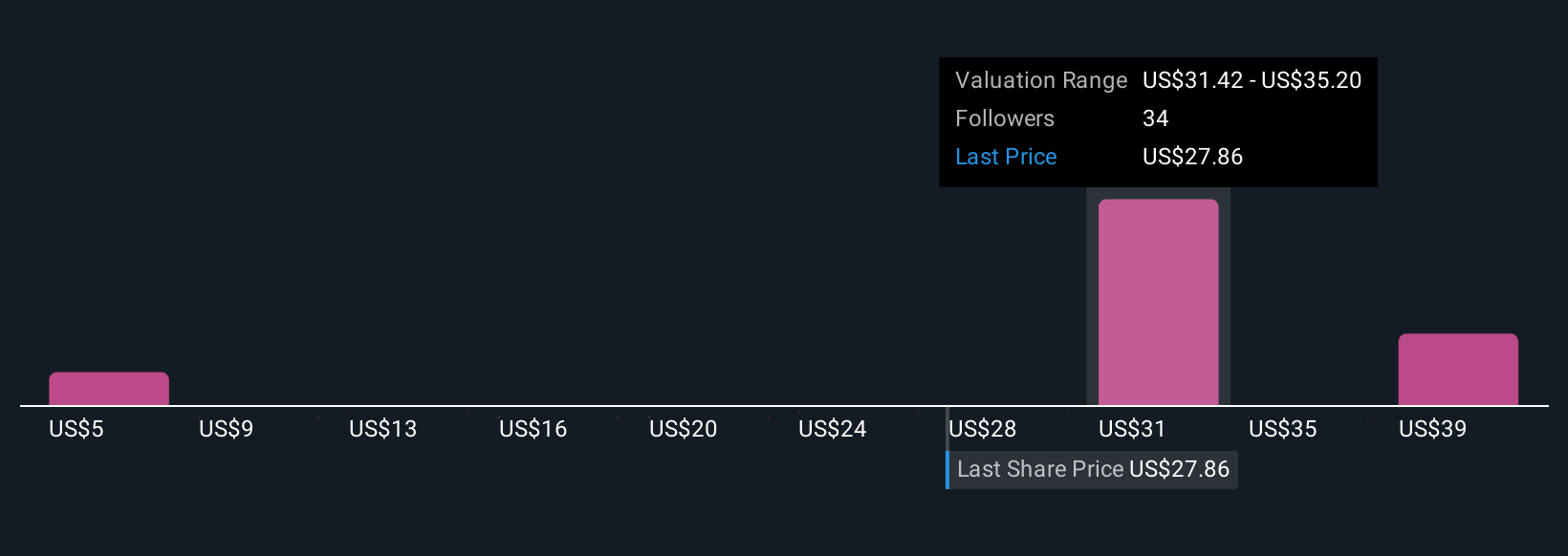

Uncover how Ouster's forecasts yield a $35.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community range from US$5.77 to US$64.46, highlighting sharp differences in how investors assess Ouster’s potential. With pricing risk from Chinese competitors still in play, be sure to consider several perspectives when forming your view on the company.

Explore 12 other fair value estimates on Ouster - why the stock might be worth less than half the current price!

Build Your Own Ouster Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ouster research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ouster research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ouster's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OUST

Ouster

Provides lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion