- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OUST

Evaluating Ouster’s Value After Major Partnerships and 271% Share Price Surge

Reviewed by Bailey Pemberton

- Wondering if Ouster's recent momentum is a sign that it's a bargain or just the hype machine in overdrive? You are not alone in asking if there is real value under the headline moves.

- The stock has seen some dramatic swings lately, pulling back 16.4% in the past week and 7.3% over the last month. Its year-to-date return is an astonishing 124.1% and it is up 271.0% over twelve months.

- These moves have been fueled by several high-profile developments, including major new partnerships and industry contracts that suggest wider adoption of Ouster's lidar technology. Investors have interpreted this news as a signal of increasing demand and long-term market potential, causing the stock to catch more attention than usual.

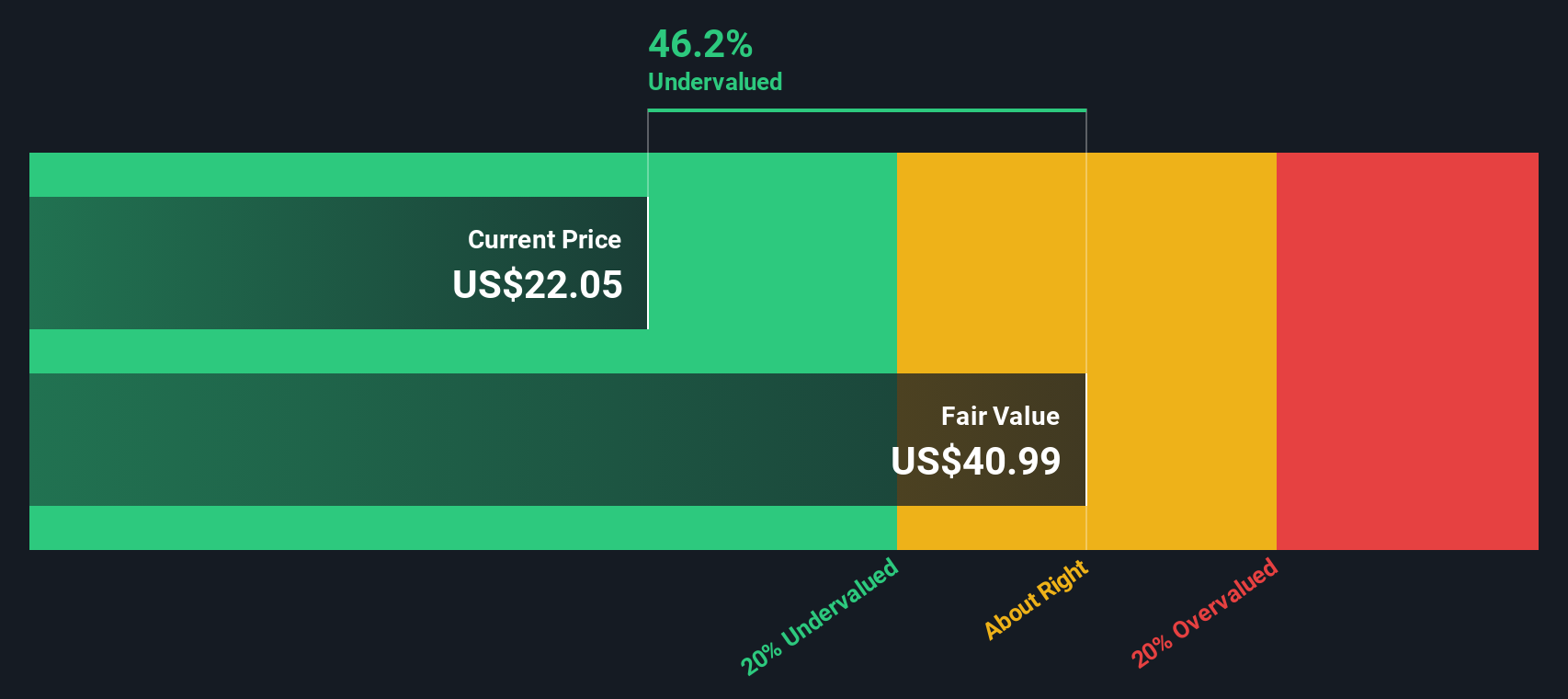

- On Simply Wall St’s valuation checks, Ouster scores just 2 out of 6 for being undervalued, so there is ongoing debate about what is driving this performance. Here is a look at different ways to value Ouster to offer perspective on what these numbers might be missing.

Ouster scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ouster Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting those cash flows back to today's value. This approach helps investors understand what a business is truly worth, beyond current hype or market swings.

For Ouster, the DCF model uses current Free Cash Flow (FCF) of -$18.0 million, highlighting that the company is still investing heavily in its growth. Analyst forecasts provide projections up to five years, with FCF estimates of -$20.8 million in 2026 and $1.4 million in 2027. Beyond these years, Simply Wall St extrapolates further and estimates FCF to reach $60.9 million by 2029. These numbers reflect optimism about Ouster's future cash generation as its products gain wider industry adoption.

Based on this two-stage Free Cash Flow to Equity DCF analysis, Ouster’s intrinsic value is calculated at $42.80 per share. This figure suggests the stock is currently trading at a 35.3% discount compared to its fair value, which may indicate potential for meaningful upside if growth forecasts are met.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ouster is undervalued by 35.3%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Ouster Price vs Sales

For companies like Ouster that are not yet profitable, the Price-to-Sales (P/S) ratio is often the most insightful valuation metric. The P/S ratio helps investors compare companies on the basis of their sales achievements, which is especially useful when earnings are negative or highly variable.

The "normal" or "fair" P/S ratio for a stock can depend on a number of factors, including expectations for future growth and the level of risk in the business. Generally, higher growth potential justifies a higher sales multiple, while greater risks call for a discount.

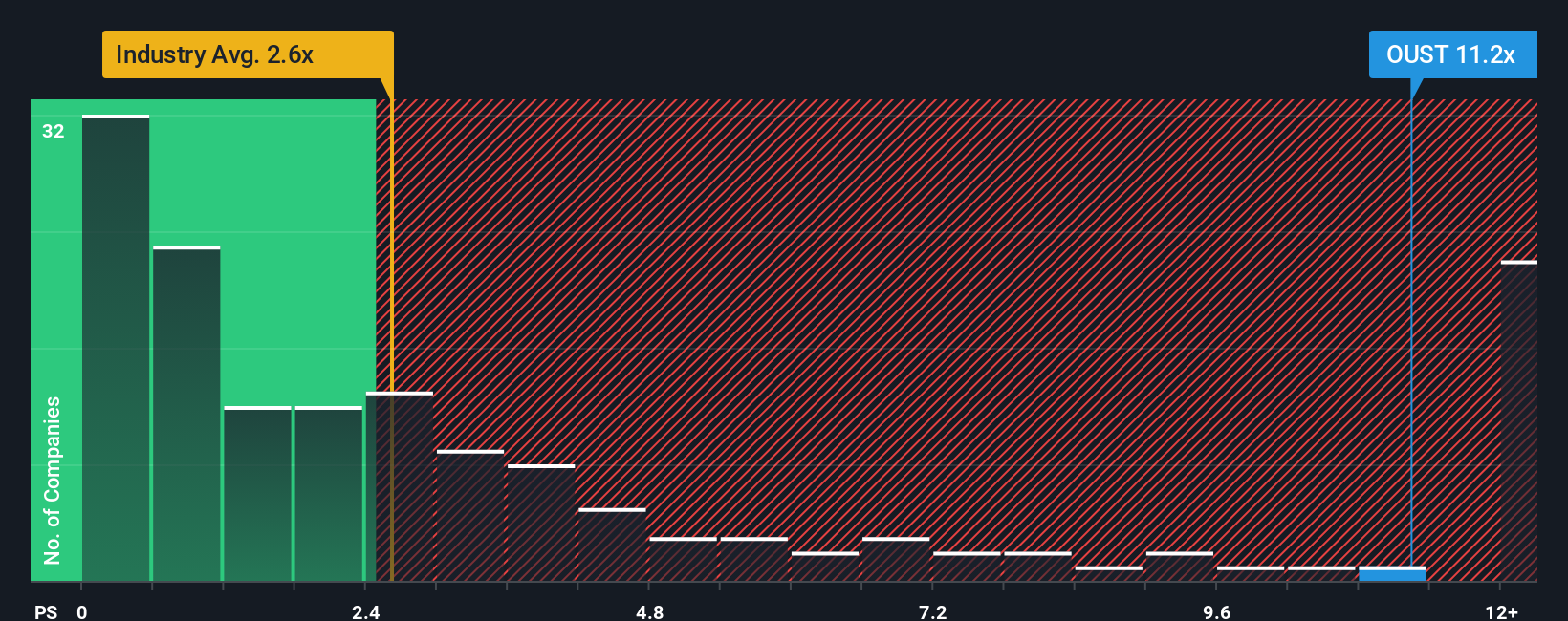

Currently, Ouster trades at a P/S multiple of 12.7x. This is considerably higher than both the Electronic industry average of 2.6x and the peer average of 5.9x. On the surface, this suggests the market is pricing in much higher expectations for Ouster than for its peers.

However, Simply Wall St calculates a proprietary “Fair Ratio” of 5.3x for Ouster. The Fair Ratio is considered more meaningful than peer or industry comparisons because it factors in the company’s specific growth prospects, risk profile, profit margins, industry context, and market capitalization. This tailored benchmark provides a more holistic sense of what Ouster should reasonably be worth.

Comparing the current P/S of 12.7x to the Fair Ratio of 5.3x, Ouster appears significantly overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

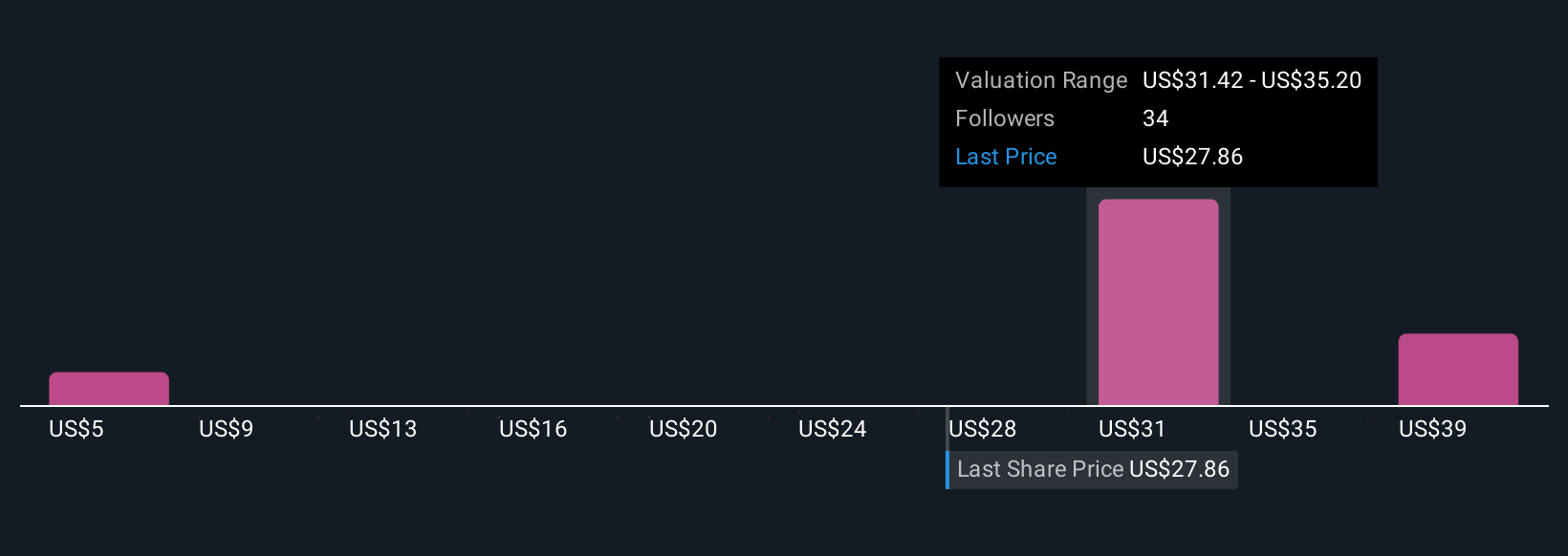

Upgrade Your Decision Making: Choose your Ouster Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective on a company, tying together what you think about its future prospects and how those beliefs translate into actual financial forecasts and a fair value. Rather than relying solely on numbers and ratios, Narratives let you explain why you think a company is undervalued or overvalued by connecting real-world developments, industry trends, and personal predictions directly to possible outcomes for revenue, earnings, and margins.

On Simply Wall St's platform, which is used by millions of investors, you can create and adjust your Narrative right from the Community page, making it easy to see how your view stacks up. Narratives aren't static; they automatically update whenever there's fresh news or earnings, helping you react quickly and make smarter decisions about whether to buy, hold, or sell based on the difference between Fair Value and the current Price.

For example, one user might believe Ouster’s adoption in traffic management and new hardware means a higher fair value of $50, while another, cautious about competition and margins, might set it at $30. Narratives offer a dynamic way for each investor to clearly see and track their unique viewpoint.

Do you think there's more to the story for Ouster? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OUST

Ouster

Provides lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives