- United States

- /

- Tech Hardware

- /

- NasdaqCM:OSS

Who Has Been Selling One Stop Systems, Inc. (NASDAQ:OSS) Shares?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in One Stop Systems, Inc. (NASDAQ:OSS).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.'

View our latest analysis for One Stop Systems

The Last 12 Months Of Insider Transactions At One Stop Systems

In the last twelve months, the biggest single sale by an insider was when the Vice President of Sales & Marketing, Jim Ison, sold US$75k worth of shares at a price of US$2.66 per share. While we don't usually like to see insider selling, it's more concerning if the sales take price at a lower price. The silver lining is that this sell-down took place above the latest price (US$1.76). So it is hard to draw any strong conclusion from it. Jim Ison was the only individual insider to sell over the last year.

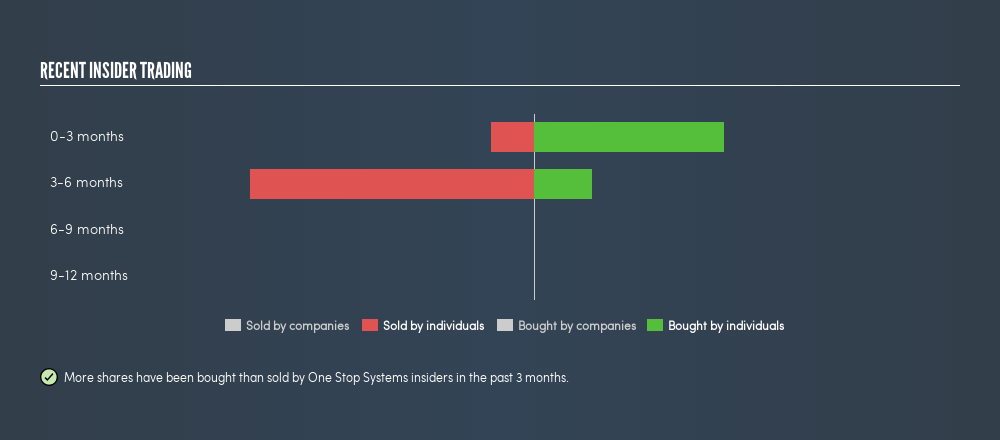

Happily, we note that in the last year insiders paid US$93k for 68485 shares. On the other hand they divested 70329 shares, for US$168k. Jim Ison sold a total of 70329 shares over the year at an average price of US$2.38. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like One Stop Systems better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

One Stop Systems Insiders Bought Stock Recently

We saw some One Stop Systems insider buying shares in the last three months. In total, insiders bought US$66k worth of shares in that time. However, Jim Ison netted US$19k for sales. While it's good to see the insider buying, the net amount bought isn't enough for us to gain much confidence from it.

Does One Stop Systems Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that One Stop Systems insiders own 42% of the company, worth about US$11m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At One Stop Systems Tell Us?

We note a that there has been a bit of insider buying recently (but no selling). That said, the purchases were not large. It's great to see high levels of insider ownership, but looking back at the last year, we'd need to see more buying to gain confidence from the One Stop Systems insider transactions. Of course, the future is what matters most. So if you are interested in One Stop Systems, you should check out this free report on analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:OSS

One Stop Systems

Designs, manufactures, and markets rugged high-performance compute, high speed switch fabrics, and storage systems for edge applications of artificial intelligence and machine learning, sensor processing, sensor fusion, and autonomy in the United States and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives