- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OSIS

OSI Systems (OSIS) Is Up 5.7% After Securing $20 Million Security Contract - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- OSI Systems, Inc. recently announced that its Security division received an order worth approximately US$20 million from an international customer for a comprehensive radiological threat detection solution, aimed at establishing a radiation monitoring network to detect and track radioactive threats.

- This contract signifies rising international demand for advanced security technology and could strengthen OSI Systems’ position in delivering specialized solutions for global safety concerns.

- We’ll examine how this sizable security contract could enhance the company’s recurring revenue prospects and shape the broader investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OSI Systems Investment Narrative Recap

Shareholders in OSI Systems are generally aligned with a belief in increasing global demand for integrated security and threat detection technologies, particularly for border and critical infrastructure. The recent US$20 million radiological threat detection order supports short-term revenue momentum but does not materially reduce the biggest risk: ongoing exposure to delayed sovereign payments and working capital swings that could impact cash flow stability.

Among recent announcements, the October US$37 million RF-based communication and surveillance order stands out as most relevant, highlighting the company's ongoing ability to secure large international contracts, a key factor in maintaining a robust pipeline, but also a reason revenue remains closely tied to the timing and execution of such major deals.

In contrast, investors should be aware that concentrated reliance on large contracts also exposes OSI Systems to...

Read the full narrative on OSI Systems (it's free!)

OSI Systems' narrative projects $2.0 billion revenue and $199.7 million earnings by 2028. This requires 5.6% yearly revenue growth and a $50.1 million increase in earnings from $149.6 million.

Uncover how OSI Systems' forecasts yield a $286.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

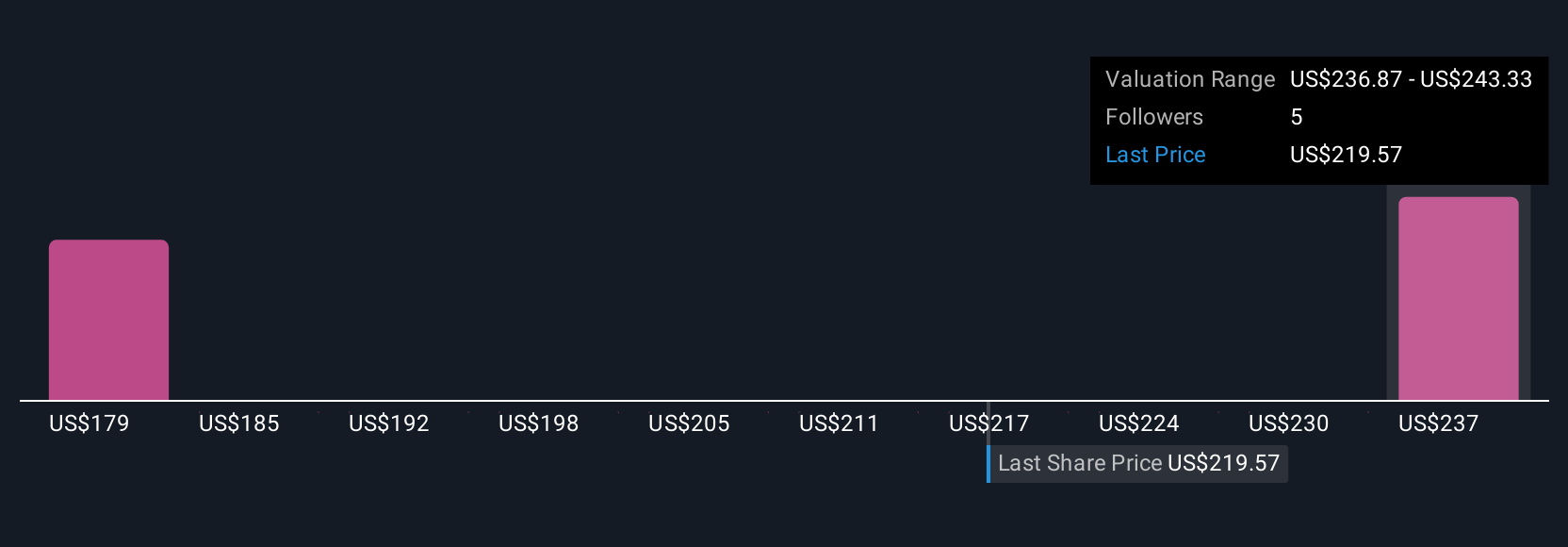

Simply Wall St Community members provided three fair value estimates for OSI Systems, ranging from US$195 to US$286 per share. While investor opinions span a wide value range, unpredictable sovereign customer payment cycles remain an important factor that could shape future results.

Explore 3 other fair value estimates on OSI Systems - why the stock might be worth as much as 6% more than the current price!

Build Your Own OSI Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OSI Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OSI Systems' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSIS

OSI Systems

Designs and manufactures electronic systems and components in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026