- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OSIS

How Investors Are Reacting To OSI Systems (OSIS) Surpassing Industry ROE With Reinvestment-Focused Growth

Reviewed by Simply Wall St

- In the past three months, OSI Systems delivered strong market performance, supported by a return on equity of 16%, exceeding the industry average of 11%.

- This focus on reinvesting all profits rather than paying dividends reflects a disciplined growth strategy that has contributed to substantial earnings growth.

- Next, we’ll explore how OSI Systems’ efficient capital deployment enhances its investment narrative and long-term earnings trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

OSI Systems Investment Narrative Recap

To invest in OSI Systems, investors need confidence in the company’s ability to capture ongoing demand for critical security and inspection systems, maintain solid contract backlogs, and efficiently reinvest profits for growth. While OSI’s recent 12% stock gain and strong return on equity validate effective capital allocation, this news does not significantly change the short-term catalyst of Security division contract momentum or alter the key risk from shifting US government defense policies, especially with the recent RF Solutions acquisition.

Of the recent announcements, the July 10, 2025, $34 million contract for high-throughput inspection systems aligns directly with short-term growth drivers, enhancing OSI's Security division backlog, a main catalyst underpinning near-term revenue visibility and investor confidence. These sizable, multi-year service agreements provide additional support amidst fluctuating international and defense policy environments.

Yet, in contrast, investors should still be mindful of the company’s exposure to evolving defense budgets and how future US government policy could impact...

Read the full narrative on OSI Systems (it's free!)

OSI Systems' outlook anticipates $2.0 billion in revenue and $199.5 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.1% and a $57.9 million earnings increase from the current $141.6 million level.

Uncover how OSI Systems' forecasts yield a $243.33 fair value, a 8% upside to its current price.

Exploring Other Perspectives

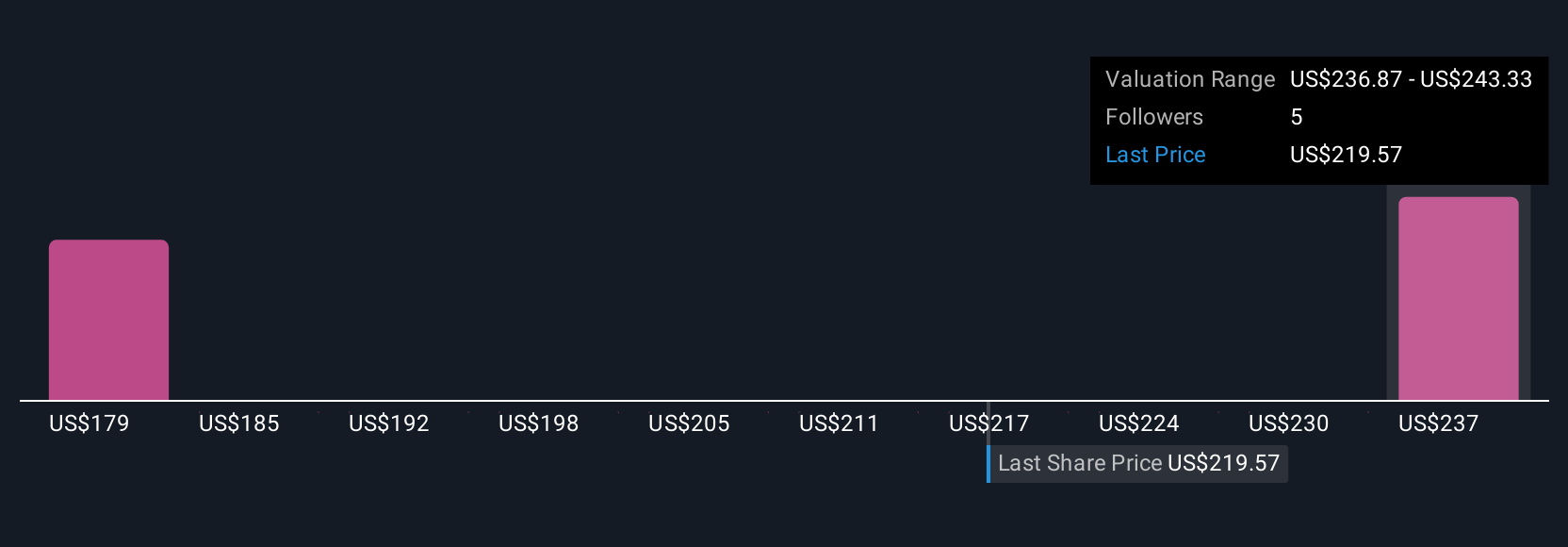

The Simply Wall St Community’s fair value estimates for OSI Systems range from US$179.25 to US$243.33 across two distinct analyses. With contract wins lifting the Security division’s backlog, your views on government spending cycles may shape how you interpret these valuations, see how other market participants size up the potential.

Explore 2 other fair value estimates on OSI Systems - why the stock might be worth 20% less than the current price!

Build Your Own OSI Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OSI Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OSI Systems' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSIS

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives