- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Why We're Not Concerned Yet About Ondas Holdings Inc.'s (NASDAQ:ONDS) 26% Share Price Plunge

Ondas Holdings Inc. (NASDAQ:ONDS) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

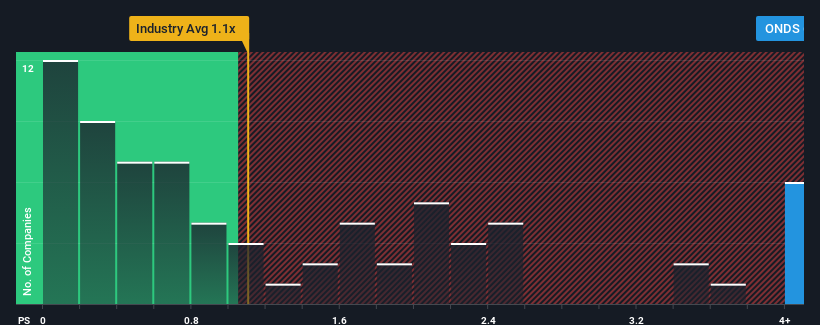

Even after such a large drop in price, when almost half of the companies in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Ondas Holdings as a stock not worth researching with its 6.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ondas Holdings

How Has Ondas Holdings Performed Recently?

Recent times have been advantageous for Ondas Holdings as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ondas Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Ondas Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 176% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.4%, which would indicate the company is doing very well.

With this information, we can see why Ondas Holdings is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What Does Ondas Holdings' P/S Mean For Investors?

A significant share price dive has done very little to deflate Ondas Holdings' very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We can see that Ondas Holdings maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

Having said that, be aware Ondas Holdings is showing 4 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Slight with limited growth.

Market Insights

Community Narratives