- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Why Investors Shouldn't Be Surprised By Ondas Holdings Inc.'s (NASDAQ:ONDS) 96% Share Price Surge

Despite an already strong run, Ondas Holdings Inc. (NASDAQ:ONDS) shares have been powering on, with a gain of 96% in the last thirty days. The last month tops off a massive increase of 131% in the last year.

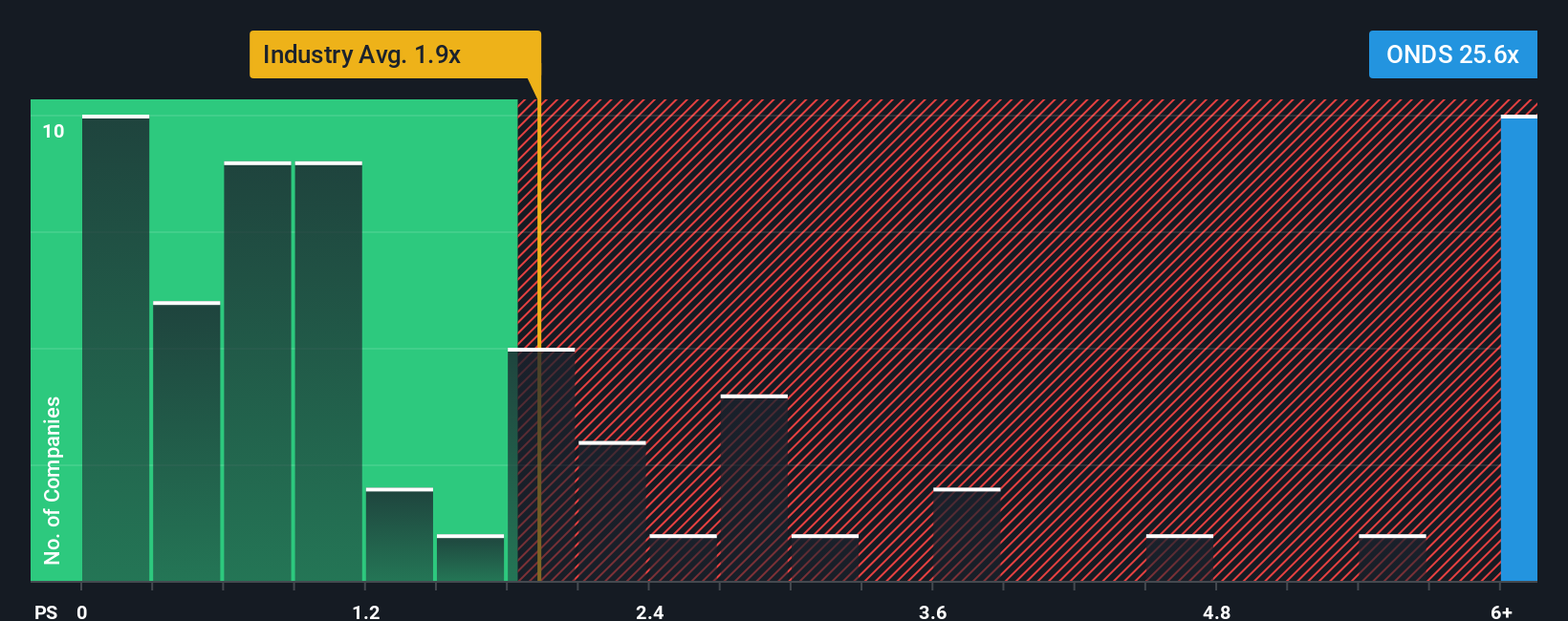

Since its price has surged higher, you could be forgiven for thinking Ondas Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 25.6x, considering almost half the companies in the United States' Communications industry have P/S ratios below 1.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Ondas Holdings

How Has Ondas Holdings Performed Recently?

While the industry has experienced revenue growth lately, Ondas Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ondas Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Ondas Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 187% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.1%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Ondas Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Ondas Holdings' P/S

The strong share price surge has lead to Ondas Holdings' P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ondas Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Communications industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ondas Holdings (at least 2 which are a bit unpleasant), and understanding these should be part of your investment process.

If you're unsure about the strength of Ondas Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives