- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Ondas Holdings (ONDS): How New Defense Partnerships and Leadership Moves Could Influence Valuation

Reviewed by Simply Wall St

Most Popular Narrative: 17.2% Overvalued

According to community narrative, Ondas Holdings is currently viewed as overvalued. The narrative cites bold assumptions about future earnings growth, profit margin expansion, and ambitious revenue forecasts to underpin a higher fair value than current market price.

"The strategic partnership with Palantir Technologies aims to leverage advanced AI capabilities to enhance operational efficiencies and scale OAS’s operations. This is expected to support the revenue ramp and broaden their customer base, influencing earnings and margins through improved operational scale."

Ready to discover what’s fueling this eye-opening valuation call? The narrative is built on projections that could completely transform the company’s future, if they come true. The fair value comes down to some significant financial leaps and high-stakes growth bets. Which assumptions drive the numbers up? Find out what makes this forecast stand out.

Result: Fair Value of $5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, persistent high operating expenses and volatile gross margins could undermine analyst optimism, particularly if revenue growth does not meet ambitious projections. Find out about the key risks to this Ondas Holdings narrative.Another View: Discounted Cash Flow Offers a Different Perspective

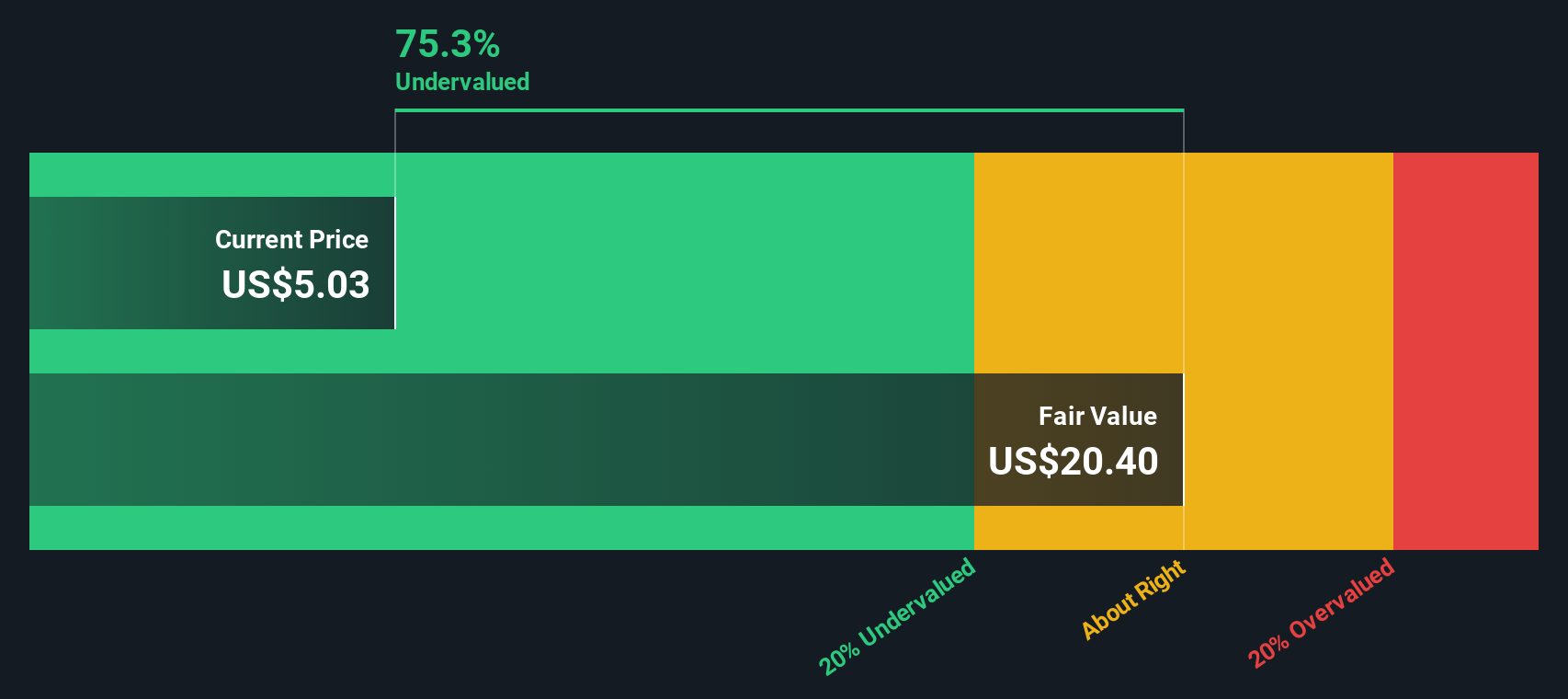

While the first valuation suggests Ondas Holdings is overvalued, our DCF model tells a very different story. This approach points toward substantial undervaluation and challenges the earlier price outlook. Could expectations be outpacing reality, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ondas Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ondas Holdings Narrative

If the current outlook doesn’t quite fit your view, or you want to dig into the details and build your own perspective, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Want to spot the next breakout opportunity or refine your strategy? The Simply Wall Street Screener makes it easy to uncover unique picks tailored to your interests. Don’t wait for others to claim tomorrow’s winners; take the lead and track down investments matched to your ambitions right now.

- Unlock potential in rapidly growing companies with strong financials by using penny stocks with strong financials to find dynamic, affordable stocks that may be flying under the radar.

- Tap into long-term income opportunities by browsing dividend stocks with yields > 3% for stocks offering attractive dividend yields and steady returns above 3%.

- Zero in on tomorrow’s technology front-runners by using quantum computing stocks to connect with pioneers in quantum computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives