- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Is Ondas Holdings’ Rail Contract Win a Sign to Reconsider Its Stock in 2025?

Reviewed by Bailey Pemberton

- Curious if Ondas Holdings might actually be a bargain or overpriced right now? You are not alone, and this is exactly the right place to figure it out.

- Ondas Holdings has delivered an eye-catching 173.0% return year-to-date and an astounding 906.9% gain over the past year, but did fall 24.5% in the last month. This has made many wonder whether this pace is sustainable or just a sign of volatility ahead.

- Industry watchers have been abuzz about Ondas' recent contract win with a major rail operator and its expansion into industrial drone technologies. Both developments have fueled investor excitement and contributed to the significant share movements. These headlines suggest both fresh opportunities and new risks that are influencing the stock price.

- Right now, Ondas Holdings scores a 2 out of 6 on our undervaluation checks, so there is plenty to unpack. We will lay out the usual valuation approaches next and, even better, reveal a smarter way to think about what Ondas is really worth at the end of this article.

Ondas Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ondas Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its potential future cash flows and then discounting them back to present value. This approach helps investors assess if the current share price accurately reflects the company's future potential.

For Ondas Holdings, the most recent Free Cash Flow (FCF) stood at -$33.48 million. While this negative starting point may concern some, analysts forecast rapid growth, projecting annual FCF to climb to $107.67 million by 2029. Beyond this, Simply Wall St extrapolates further growth, with FCF expected to approach $388.46 million by 2035. All these projections are denominated in USD, the reporting currency for Ondas' financials.

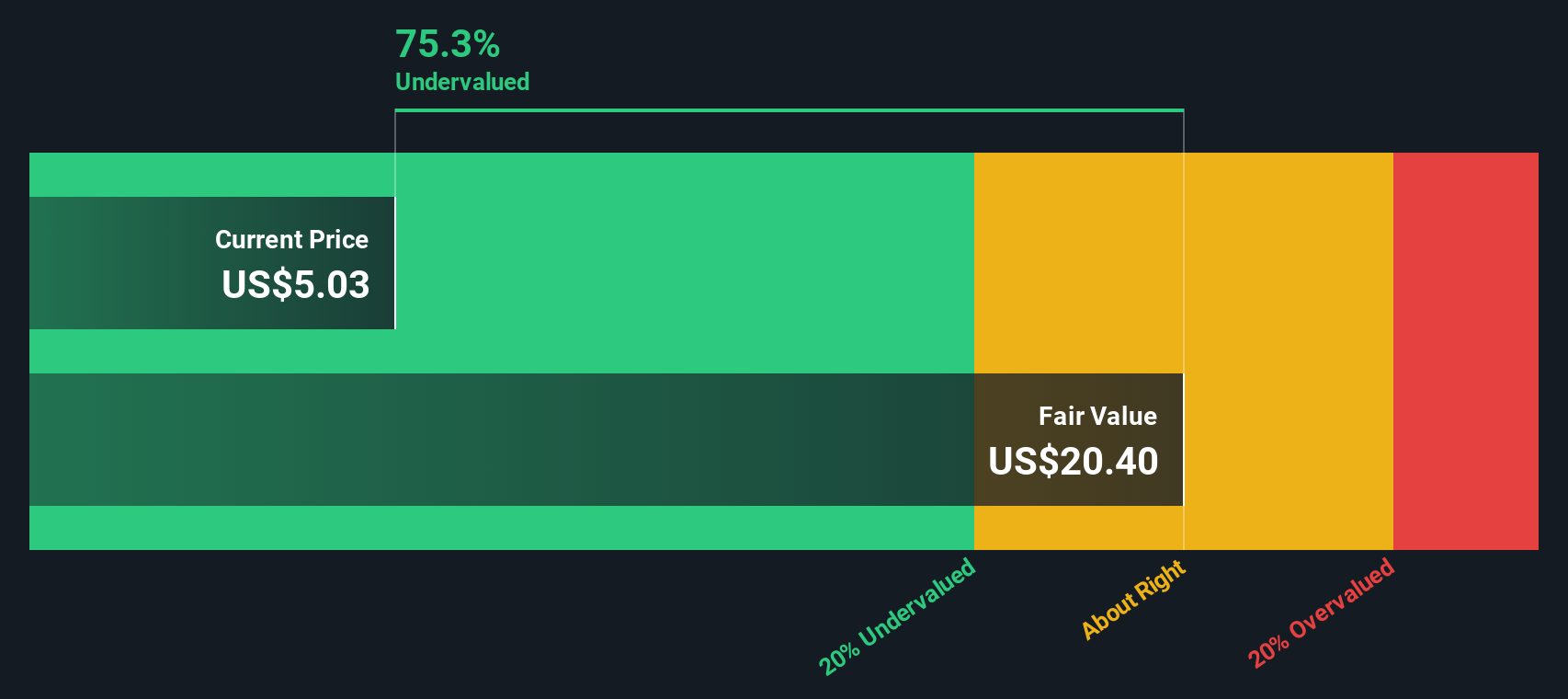

Based on these calculations, the DCF model values Ondas Holdings at an intrinsic fair value of $14.00 per share. Given the latest share price, this implies the stock is currently trading at a 48.7% discount to its estimated intrinsic value. This suggests significant undervaluation with room for upside if forecasted growth materializes.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ondas Holdings is undervalued by 48.7%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Ondas Holdings Price vs Book

The price-to-book (PB) ratio is often used for companies where tangible assets and equity value outweigh consistent profitability. This makes it an appropriate yardstick for valuing Ondas Holdings. This multiple helps investors understand how the market is valuing the company's net assets on its balance sheet.

Growth expectations and perceived business risk heavily influence what is considered a "normal" PB ratio. Companies with high growth prospects or stable asset bases can command a higher PB ratio. Those facing uncertainty or slower expansion tend to trade closer to or even below their book value.

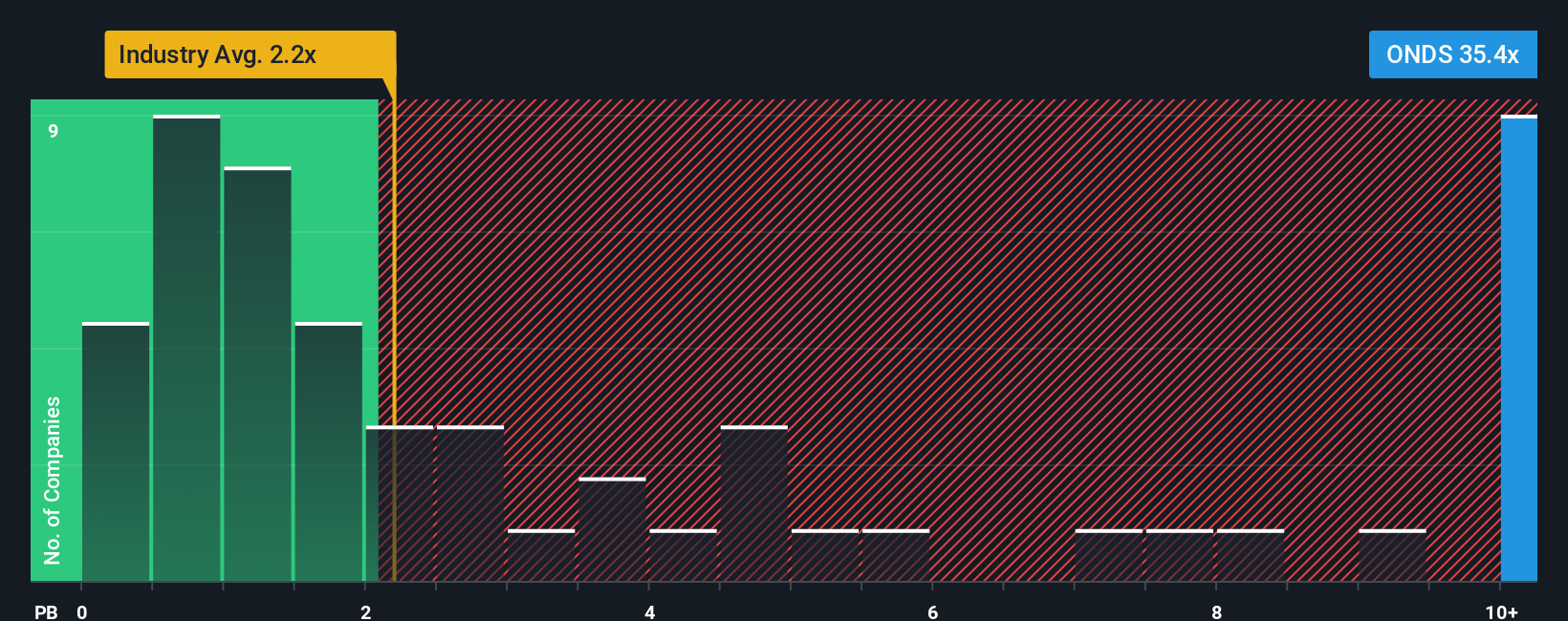

Currently, Ondas Holdings trades at a PB ratio of 27.6x. This is significantly above both the industry average of 1.94x and the peer average of 1.80x. On the surface, such a premium might worry value-conscious investors.

However, rather than relying solely on a comparison with industry peers, the Simply Wall St Fair Ratio goes deeper by factoring in Ondas’ specific earnings growth, risk profile, margins, industry context, and market capitalization. This proprietary metric tailors the expected multiple more accurately to the company's characteristics.

Based on this nuanced approach, Ondas Holdings’ PB ratio is meaningfully higher than its Fair Ratio. This indicates that the stock is currently overvalued on this metric.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ondas Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful, yet approachable, tool that allow investors to tell the story behind a company’s numbers. They blend your perspective on future revenue, earnings, and margins with your assumed fair value.

Essentially, a Narrative links what’s actually happening at a business to a financial forecast, and then estimates a fair value based on that story. Unlike static models, Narratives are easy to create and share right on the Simply Wall St Community page, used by millions of investors to refine their views collaboratively.

This means you can decide whether Ondas Holdings is a buy or sell by comparing your Narrative-based Fair Value to the current market price. As new news or earnings are released, Narratives update dynamically, helping you stay ahead of the curve.

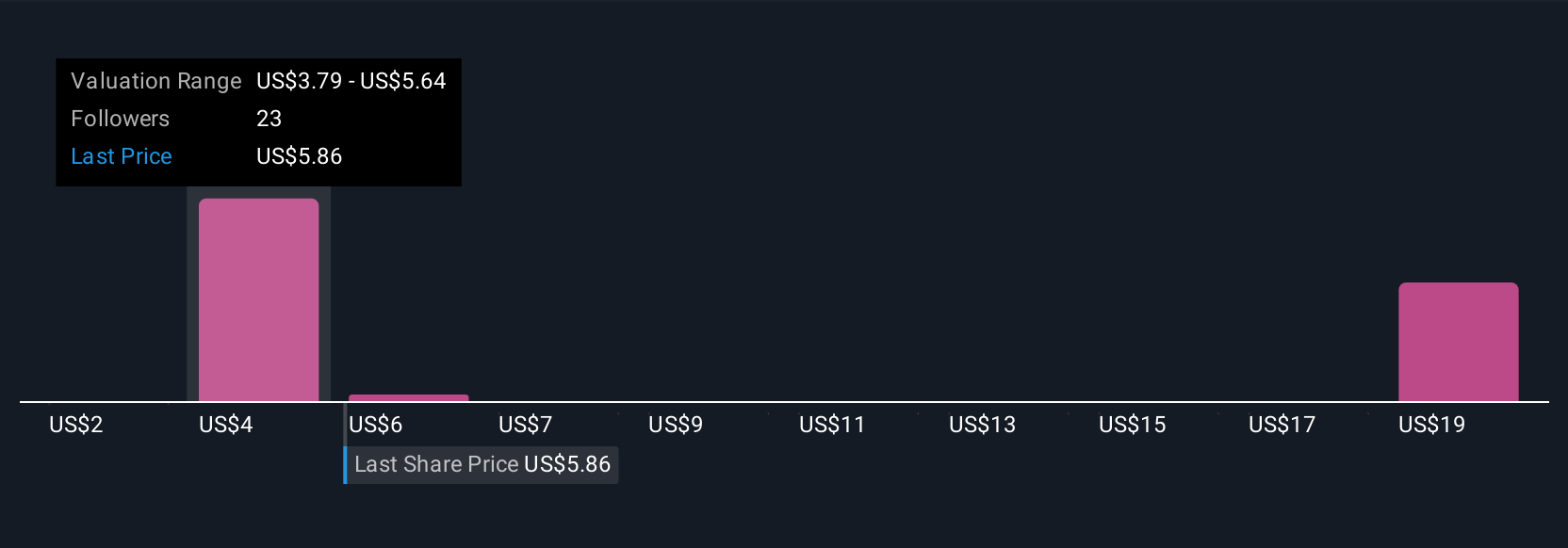

For example, looking at Ondas Holdings, some investors might build a bullish Narrative expecting a fair value as high as $9.5 per share, while more cautious forecasts might land closer to $2.0, all depending on how they view the company’s growth and risks.

Do you think there's more to the story for Ondas Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives