- United States

- /

- Communications

- /

- NasdaqGM:OCC

This Is Why Optical Cable Corporation's (NASDAQ:OCC) CEO Compensation Looks Appropriate

Despite positive share price growth of 30% for Optical Cable Corporation (NASDAQ:OCC) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 30 March 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Optical Cable

How Does Total Compensation For Neil Wilkin Compare With Other Companies In The Industry?

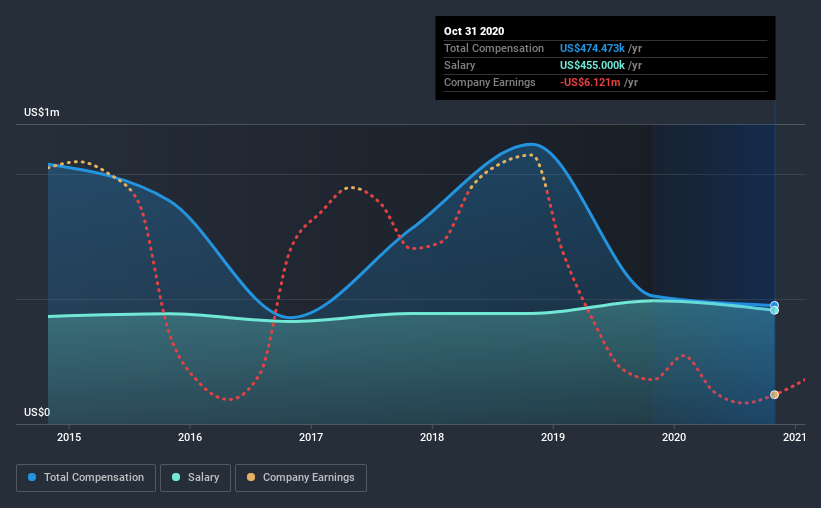

According to our data, Optical Cable Corporation has a market capitalization of US$29m, and paid its CEO total annual compensation worth US$474k over the year to October 2020. We note that's a small decrease of 7.3% on last year. In particular, the salary of US$455.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$429k. So it looks like Optical Cable compensates Neil Wilkin in line with the median for the industry. What's more, Neil Wilkin holds US$3.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$455k | US$493k | 96% |

| Other | US$19k | US$19k | 4% |

| Total Compensation | US$474k | US$512k | 100% |

On an industry level, around 29% of total compensation represents salary and 71% is other remuneration. Investors will find it interesting that Optical Cable pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Optical Cable Corporation's Growth Numbers

Optical Cable Corporation has reduced its earnings per share by 66% a year over the last three years. It saw its revenue drop 20% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Optical Cable Corporation Been A Good Investment?

Optical Cable Corporation has generated a total shareholder return of 30% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Optical Cable pays its CEO a majority of compensation through a salary. Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for Optical Cable you should be aware of, and 2 of them are concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Optical Cable, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:OCC

Optical Cable

Manufactures and sells fiber optic and copper data communications cabling and connectivity solutions primarily for the enterprise market in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion