- United States

- /

- Communications

- /

- NasdaqGM:OCC

Optical Cable (NASDAQ:OCC) Is Doing The Right Things To Multiply Its Share Price

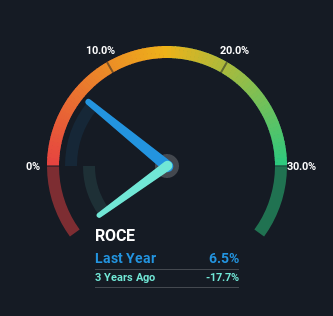

There are a few key trends to look for if we want to identify the next multi-bagger. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Optical Cable (NASDAQ:OCC) so let's look a bit deeper.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Optical Cable is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.065 = US$2.3m ÷ (US$43m - US$7.7m) (Based on the trailing twelve months to January 2023).

Therefore, Optical Cable has an ROCE of 6.5%. In absolute terms, that's a low return and it also under-performs the Communications industry average of 10%.

Check out our latest analysis for Optical Cable

Historical performance is a great place to start when researching a stock so above you can see the gauge for Optical Cable's ROCE against it's prior returns. If you'd like to look at how Optical Cable has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From Optical Cable's ROCE Trend?

Shareholders will be relieved that Optical Cable has broken into profitability. While the business was unprofitable in the past, it's now turned things around and is earning 6.5% on its capital. Interestingly, the capital employed by the business has remained relatively flat, so these higher returns are either from prior investments paying off or increased efficiencies. So while we're happy that the business is more efficient, just keep in mind that could mean that going forward the business is lacking areas to invest internally for growth. So if you're looking for high growth, you'll want to see a business's capital employed also increasing.

Our Take On Optical Cable's ROCE

To sum it up, Optical Cable is collecting higher returns from the same amount of capital, and that's impressive. Since the stock has only returned 39% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. Given that, we'd look further into this stock in case it has more traits that could make it multiply in the long term.

Optical Cable does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is concerning...

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:OCC

Optical Cable

Manufactures and sells fiber optic and copper data communications cabling and connectivity solutions primarily for the enterprise market in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion