- United States

- /

- Communications

- /

- NasdaqGS:NTCT

Taking a Fresh Look at NetScout Systems (NTCT) Valuation After its Recent Share Price Gains

Reviewed by Simply Wall St

NetScout Systems (NTCT) keeps drifting under many investors radars, yet the stock is quietly up about 20% over the past year while revenue and net income continue to grow in the low single digits.

See our latest analysis for NetScout Systems.

At around $26.98, NetScout’s share price has delivered a roughly 25% year to date share price return and a near 20% one year total shareholder return, signaling quietly improving sentiment after a weak three year total shareholder return.

If NetScout’s steady climb has you rethinking what qualifies as “under the radar,” it might be a good time to broaden your search and discover high growth tech and AI stocks.

Yet with revenue only inching higher and shares still trading at a notable discount to analyst targets and some intrinsic value estimates, is NetScout quietly mispriced, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 13.2% Undervalued

With NetScout last closing at $26.98 against a narrative fair value of $31.09, the most followed view sees meaningful upside still on the table.

The analysts have a consensus price target of $25.817 for NetScout Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $21.0.

Curious why a modest revenue growth outlook still supports a higher valuation? The narrative leans heavily on margins, cash flows, and a future earnings multiple that might surprise you. If you want to see which specific profit profile and long term multiple underpin that fair value, you will need to dig into the full story.

Result: Fair Value of $31.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, cloud migration and IT stack consolidation could erode legacy product demand and margins, which may challenge the optimistic valuation implied by AI driven growth expectations.

Find out about the key risks to this NetScout Systems narrative.

Another Lens On Value

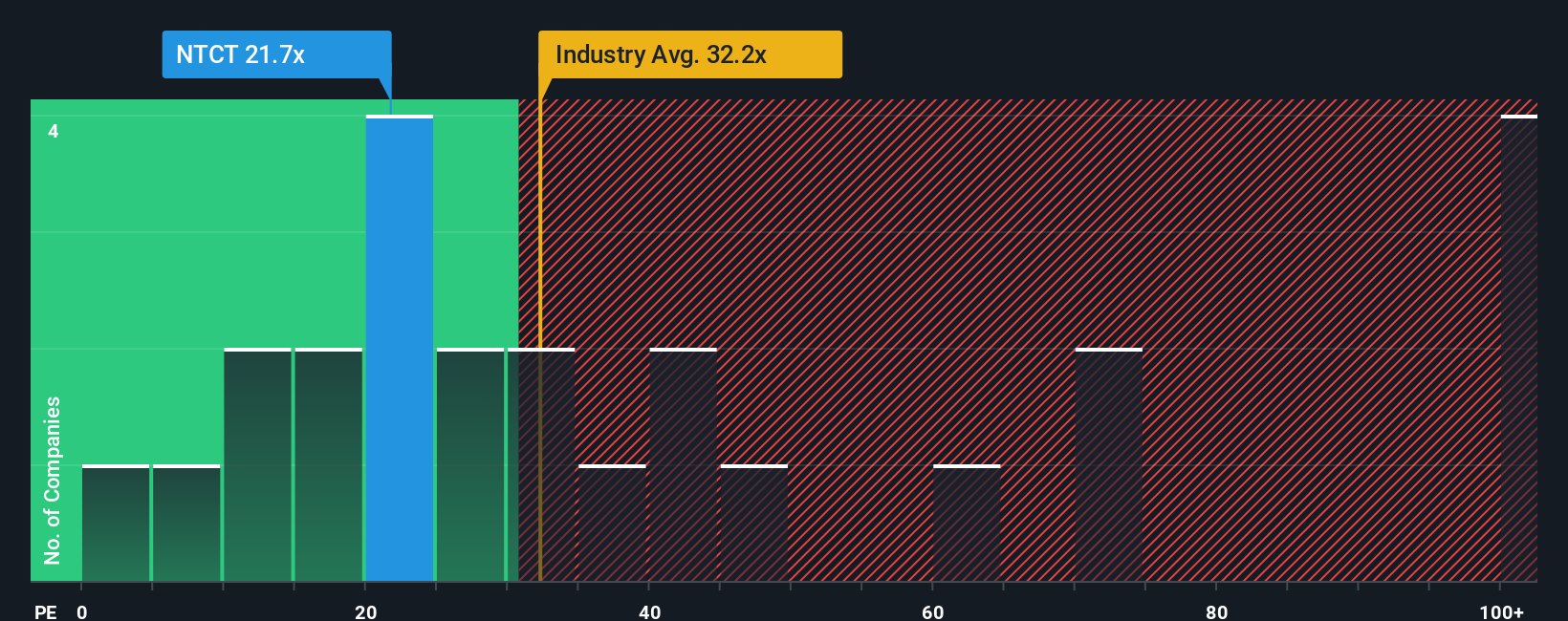

On earnings, NetScout looks much more ordinary. Its 21.7x price to earnings ratio is only slightly cheaper than peers at 22.4x, and actually above its 18.1x fair ratio, hinting at limited margin of safety if growth or AI execution disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NetScout Systems Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NetScout Systems.

Looking for your next investing move?

Turn NetScout into just the start of your watchlist. Use the Simply Wall Street Screener to pinpoint focused opportunities before other investors catch on.

- Capitalize on high growth potential by scanning these 26 AI penny stocks that could benefit most from accelerating innovation and expanding real world adoption.

- Lock in the power of compounding income by targeting these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow over time.

- Seize mispriced opportunities early through these 914 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetScout Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTCT

NetScout Systems

Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026