- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

NetApp (NTAP): Assessing Valuation as Shares Quietly Extend Recent Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for NetApp.

NetApp’s momentum has been gradually picking up pace, with recent share price gains stacking onto earlier advances as tech valuations remain in focus. Looking back, the stock’s long-term total shareholder returns are impressive, with gains of almost 95% in three years and over 195% over five years. Despite a flat performance in the past year, this suggests many investors continue to see solid growth potential and are undeterred by shorter-term fluctuations.

If you want to see what other technology companies are catching investor attention right now, check out our curated See the full list for free..

With NetApp’s steady climb and robust historical returns, the critical question for investors now is whether shares are still attractively valued or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: 30% Overvalued

NetApp’s last close at $120.07 puts it well above the most popular fair value estimate of $92.47, setting up a debate between strong operating momentum and market optimism. The narrative points to future cloud growth and profitability but suggests the market may already be factoring these upside catalysts into the share price.

Expanding portfolio of AI-ready innovations, operating efficiencies, and consistent improvements in Public Cloud gross margins (now guided to 80 to 85 percent, up from 75 to 80 percent), are expected to further enhance profitability and drive long-term earnings growth.

Want to know how this outlook transforms into the bold price target above? The forecast assumes an ambitious leap in recurring revenues, profit margins, and operational leverage not seen in NetApp’s history. Find out which pivotal numbers fuel this high-stakes valuation narrative and why analysts are so confident. Uncover the full story right now.

Result: Fair Value of $92.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in traditional product revenues and concentrated growth in the Americas could present challenges to NetApp’s long-term earnings trajectory if these trends intensify.

Find out about the key risks to this NetApp narrative.

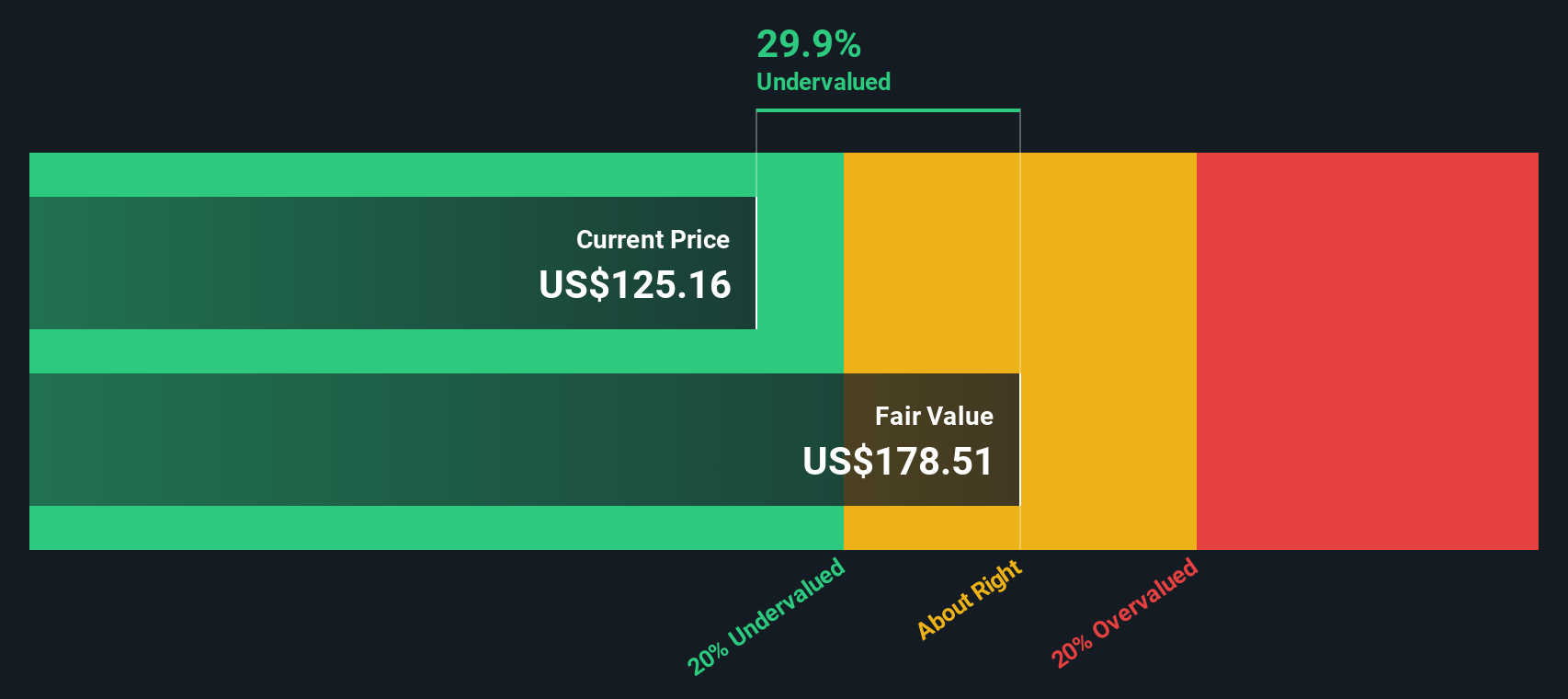

Another View: Discounted Cash Flow Model Signals Deep Value

To challenge the market-based view, our DCF model values NetApp shares at $179.26. This is far above today’s share price and suggests the stock could be significantly undervalued. This method weighs all future cash flows and discounts them to the present, raising the question: are investors overlooking material upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NetApp Narrative

Feel free to dive into the numbers and develop your own perspective on NetApp’s value. You can take just a few minutes to shape your narrative: Do it your way.

A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your best opportunities could be just a click away. Stay ahead of the curve by targeting companies set for growth, exceptional income, or major innovation breakthroughs. Don’t miss the movers everyone will talk about soon.

- Capitalize on high-yield opportunities by checking out these 19 dividend stocks with yields > 3%, showcasing companies offering strong dividend returns above 3%.

- Ride the unstoppable momentum in artificial intelligence with these 24 AI penny stocks, where tomorrow’s market leaders are emerging right now.

- Generate impressive returns by focusing on real value. Find your next bargain with these 909 undervalued stocks based on cash flows, featuring stocks substantially undervalued based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives