- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

NetApp (NasdaqGS:NTAP) Partners With NVIDIA To Enhance AI Data Management Solutions

Reviewed by Simply Wall St

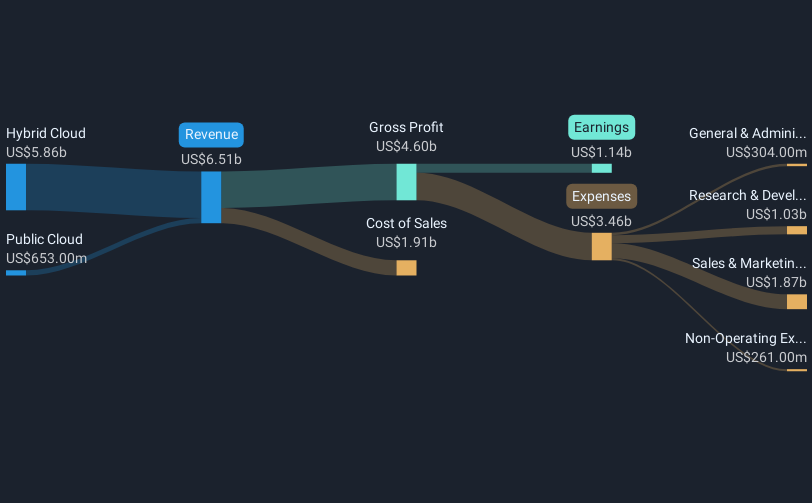

NetApp (NasdaqGS:NTAP) recently announced a significant partnership with NVIDIA to enhance the NVIDIA AI Data Platform using the NetApp AIPod solution, aiming to accelerate enterprise adoption of AI. This collaboration occurred alongside the launch of the NetApp AIPod Mini with Intel, designed to simplify enterprise AI inferencing. These strategic movements may have contributed to the company's share price increase of 23% over the past month. The price move aligns with the broader positive market trend, as major indices such as the S&P 500 also experienced gains during the same period, despite recent minor fluctuations.

Buy, Hold or Sell NetApp? View our complete analysis and fair value estimate and you decide.

The partnership between NetApp and NVIDIA is poised to strengthen the company's position in the rapidly growing AI sector. With the launch of innovative solutions like the NetApp AIPod and the AIPod Mini with Intel, NetApp aims to capitalize on the enterprise demand for AI capabilities. This collaboration is expected to positively influence NetApp's revenue and earnings forecasts, leveraging enhanced AI and cloud solutions to capture a larger market share.

Over the past five years, NetApp's total shareholder return, which includes share price appreciation and dividends, was 159.68%. This reflects a robust growth trajectory, outperforming its recent one-year performance where it did not keep pace with the broader US market return of 11.7%. Despite this, the long-term performance underscores the company's ability to generate significant shareholder value over time.

The recent developments could support the projected growth trajectory, given the estimated revenue increase of 4.5% annually and earnings growth of 5.9% per year, both driven by strategic advancements in the company's product offerings. However, challenges like sales execution inconsistencies and divestiture-related impacts on revenue remain potential hurdles.

Currently, with NetApp's share price at US$92.26, it stands at an approximate 19% discount to the consensus price target of US$113.65. This suggests room for potential appreciation, assuming the company meets or exceeds the optimistic analyst expectations, including a PE ratio of 20.7x by 2028. As always, it's vital for investors to carefully assess their assumptions and the associated risks when evaluating potential investments.

Learn about NetApp's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion