- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

How NetApp's (NTAP) AI and Cybersecurity Launches Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- At its recent INSIGHT 2025 conference, NetApp introduced a host of new enterprise-grade products and services focused on AI-ready data platforms, cyber resilience, and expanded integrations with partners such as Google Cloud, Red Hat, Cisco, and Equinix.

- These announcements showcase NetApp's efforts to unify data infrastructure and security across hybrid and multicloud environments, aiming to accelerate AI adoption and streamline enterprise operations.

- We'll explore how NetApp's new AI and cybersecurity offerings, particularly the launch of NetApp AFX and AI Data Engine, impact its investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NetApp Investment Narrative Recap

To own NetApp as a shareholder, you need confidence in the company’s ability to evolve with the ongoing shift toward AI, hybrid cloud, and data security while maintaining stable growth despite competition and changing customer preferences. The latest integration of advanced cyber resilience and AI-powered security features, highlighted by partnerships with Google Cloud, Cisco, and OPSWAT, supports the bullish catalyst of AI-driven demand but does not materially offset ongoing risks from competition with hyperscalers or near-term margin pressure.

Among the recent announcements, NetApp’s enhanced Ransomware Resilience service stands out for amplifying its data security value proposition. These updates directly reinforce NetApp’s push to be a key provider for enterprises needing built-in protection and reliability as they move data across hybrid and multicloud environments, a trend tied to the company’s most important growth catalyst in AI and advanced analytics workloads.

In contrast, investors should also be aware that competition from hyperscalers and evolving pricing pressure continues to pose ...

Read the full narrative on NetApp (it's free!)

NetApp's outlook anticipates $7.5 billion in revenue and $1.4 billion in earnings by 2028. This scenario assumes a 4.3% annual revenue growth and a $0.2 billion increase in earnings from the current $1.2 billion level.

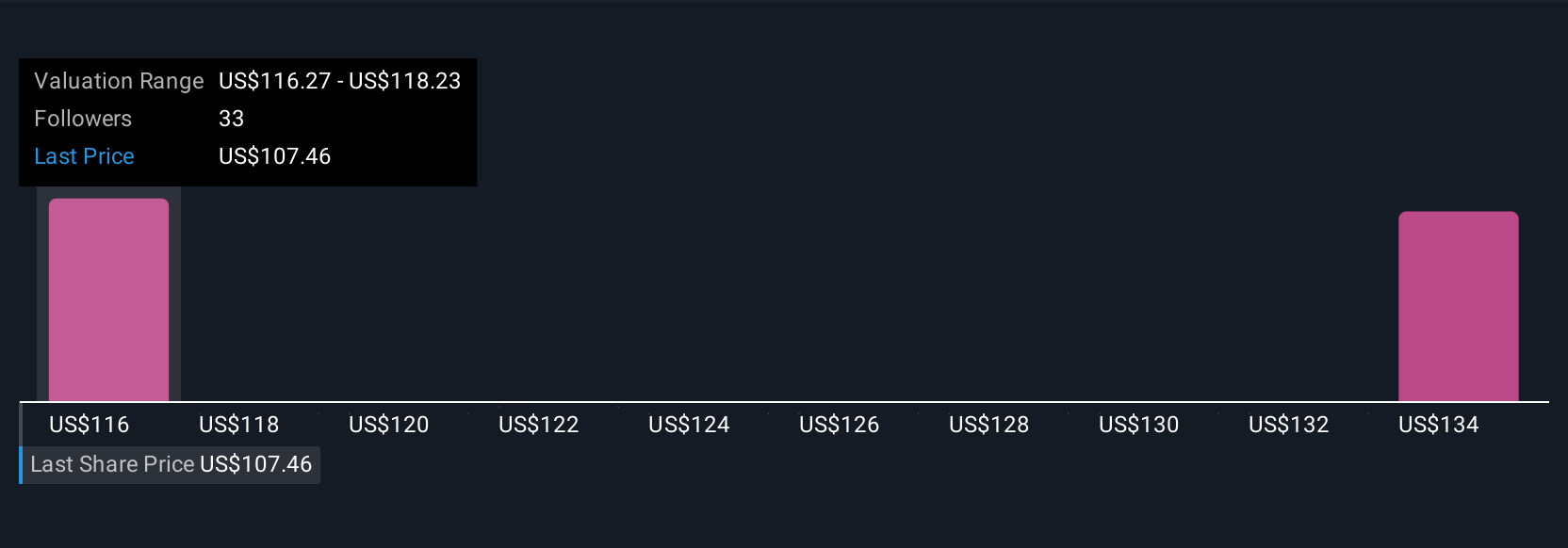

Uncover how NetApp's forecasts yield a $121.14 fair value, in line with its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community place fair value estimates on NetApp shares between US$121.14 and US$179.03. As AI-driven infrastructure demand continues to drive attention, the many viewpoints show how widely opinions can differ, review a variety of outlooks to inform your decision.

Explore 4 other fair value estimates on NetApp - why the stock might be worth as much as 50% more than the current price!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives