Viewing insider transactions for NetApp, Inc.'s (NASDAQ:NTAP ) over the last year, we see that insiders were net sellers. This means that a larger number of shares were sold by insiders in relation to shares purchased.

Although we don't think shareholders should simply follow insider transactions, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Check out our latest analysis for NetApp

The Last 12 Months Of Insider Transactions At NetApp

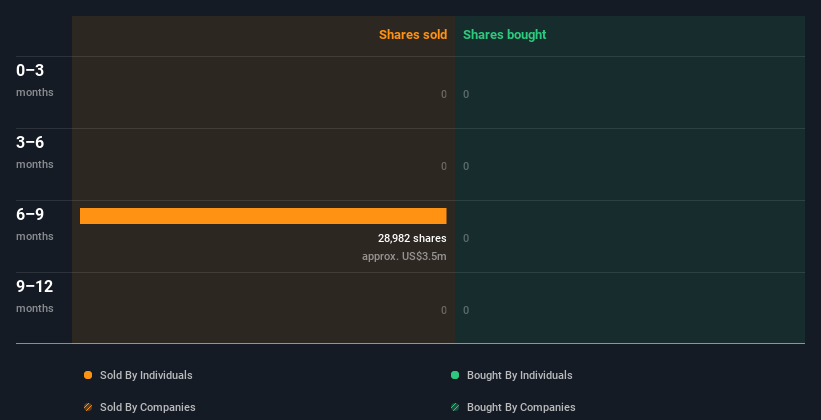

In the last twelve months, the biggest single sale by an insider was when the insider, George Shaheen, sold US$3.5m worth of shares at a price of US$122 per share. So we know that an insider sold shares at around the present share price of US$116. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign. George Shaheen was the only individual insider to sell over the last year.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 0.4% of NetApp shares, worth about US$95m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The NetApp Insider Transactions Indicate?

It doesn't really mean much that no insider has traded NetApp shares in the last quarter. We don't take much encouragement from the transactions by NetApp insiders. But it's good to see that insiders own shares in the company. Therefore, you should definitely take a look at this FREE report showing analyst forecasts for NetApp.

Of course NetApp may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion