- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSSC

Assessing Napco Security Technologies (NSSC) Valuation After Strong Recent Share Price Performance

What recent performance tells you about Napco Security Technologies

With no single headline event setting the tone, Napco Security Technologies (NSSC) has quietly drawn attention through its recent returns, including a move of 0.4% over the past day and 18.3% over the past week.

See our latest analysis for Napco Security Technologies.

That recent 18.3% 7 day share price return sits alongside a more measured 3.6% 30 day and 3.1% 90 day share price return, while the 1 year total shareholder return of 72.5% points to longer term investors already seeing a very different outcome from short term traders.

If Napco Security Technologies has you thinking about where else strong price and volume action might be forming, it could be worth scanning a wider field through our list of 24 power grid technology and infrastructure stocks.

With the shares up sharply over the past year, trading at $43.65 and sitting below an analyst price target of $49.67, the key question now is simple: Is Napco still undervalued, or is future growth already priced in?

Most Popular Narrative: 10.6% Undervalued

With Napco Security Technologies closing at $43.65 against a narrative fair value of $48.83, the most followed view points to some upside still on the table, built on detailed revenue, margin and valuation assumptions.

Persistent growth in high-margin, recurring monthly service revenue, driven by increased deployments of StarLink fire radios and the expected ramp-up of new cloud-based platforms like MVP, positions Napco to expand margins and achieve more stable, predictable earnings over the long term.

Curious what kind of revenue mix supports that conclusion? The narrative leans heavily on recurring service streams, margin resilience and a future earnings multiple that sits above the broader electronics group. The specific revenue path, margin assumptions and discount rate are all laid out there, not in the current share price.

Result: Fair Value of $48.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view still depends on equipment demand stabilising and on StarLink not becoming an over relied growth engine that could be challenged by newer alternatives.

Find out about the key risks to this Napco Security Technologies narrative.

Another View: Earnings Multiple Sends A Different Signal

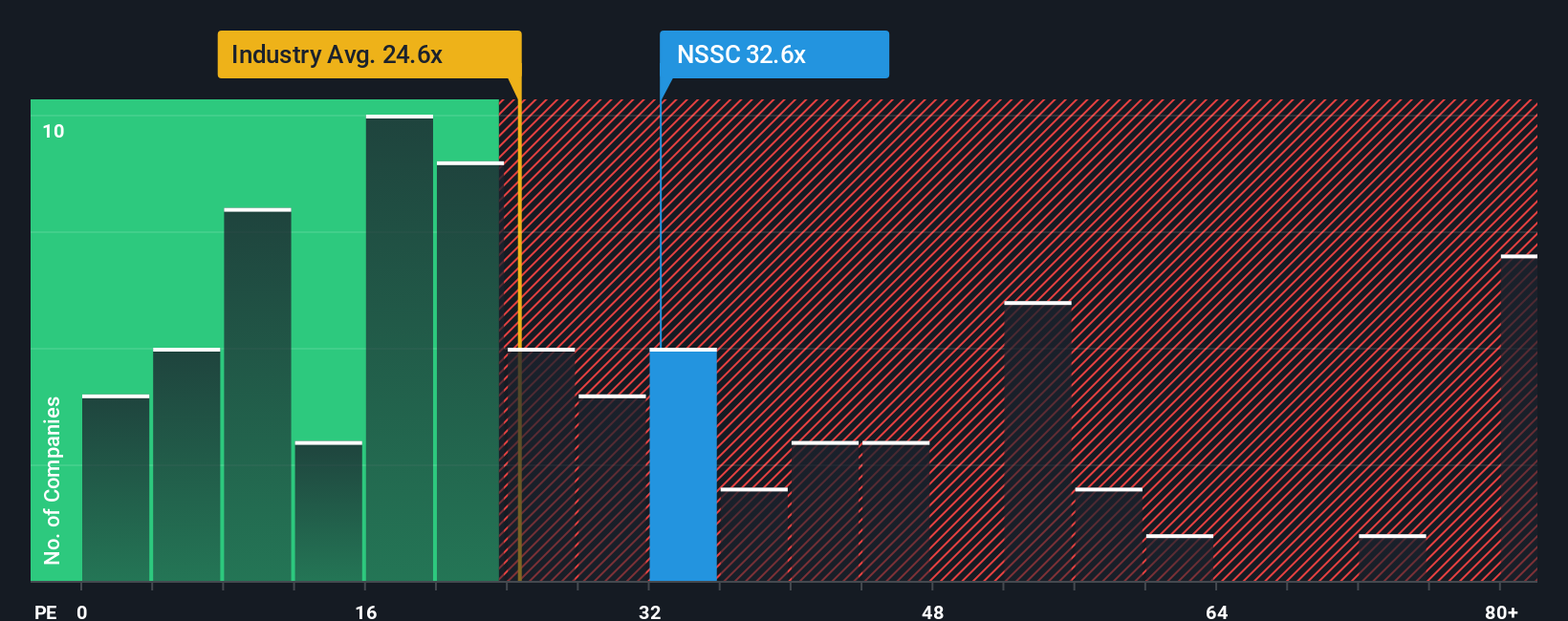

While the narrative fair value of $48.83 frames Napco Security Technologies as 10.6% undervalued, the current P/E of 32.8x paints a tighter picture. It sits above the US Electronic industry at 27.4x and well above a fair ratio of 22.5x, even though it is far below peers at 94.6x. That mix of rich pricing versus the industry, but cheaper versus close peers, raises a simple question for you: is the market already paying up for quality or still catching up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Napco Security Technologies Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Napco Security Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss chances that fit your style even better, so keep widening your funnel and let the data work for you.

- Target potential value opportunities by reviewing companies our screener flags as 52 high quality undervalued stocks on quality and pricing.

- Prioritise resilience by focusing on businesses highlighted in our 82 resilient stocks with low risk scores that score well on risk metrics.

- Hunt for early stage opportunities with strong fundamentals using our screener containing 24 high quality undiscovered gems before they attract wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Napco Security Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSSC

Napco Security Technologies

Engages in the development, manufacturing, and sale of electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.