- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSIT

Insight Enterprises (NSIT) Is Down 17.4% After Revenue and Net Income Drop in Q2 2025 – Has The Bull Case Changed?

Reviewed by Simply Wall St

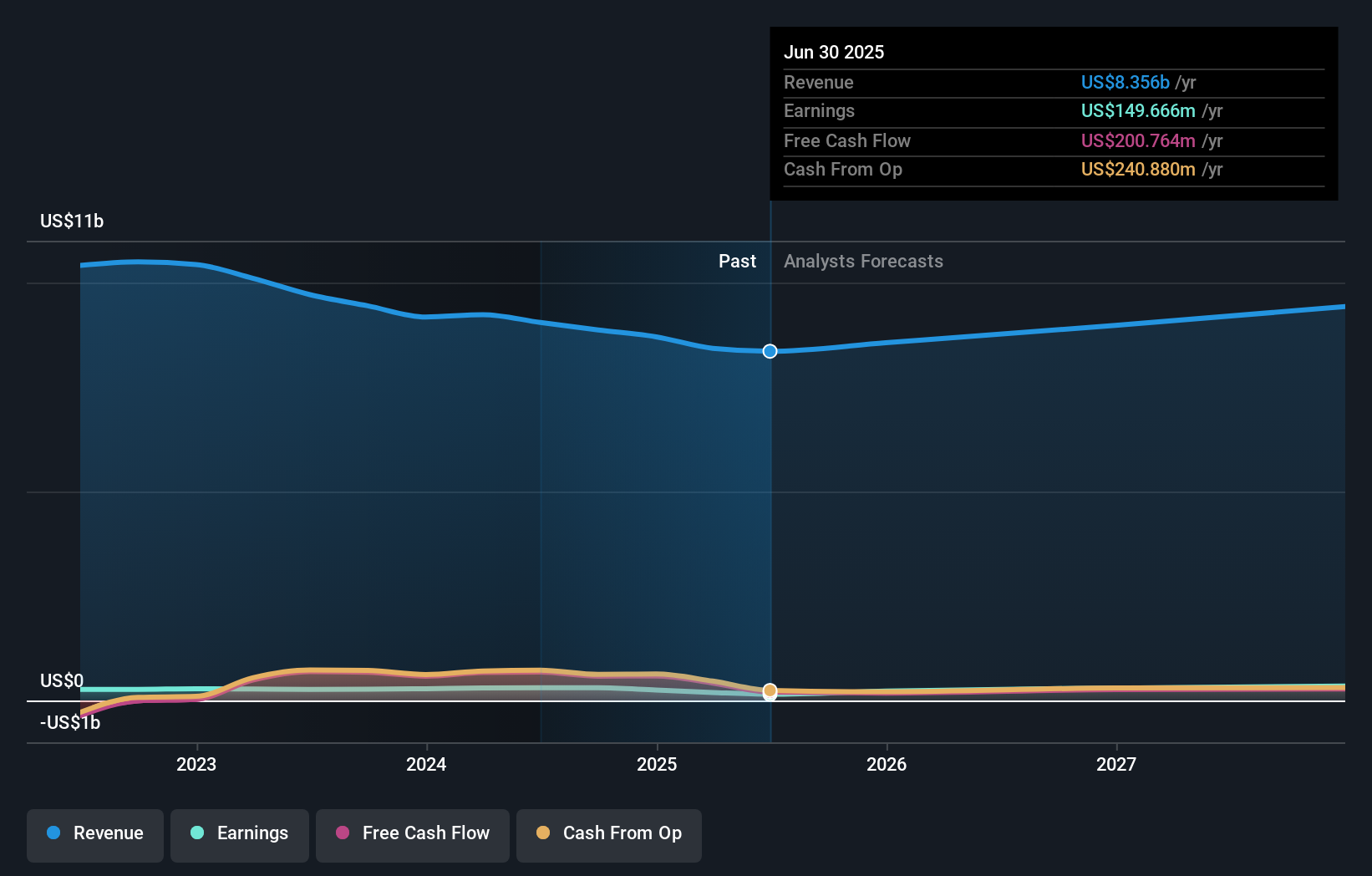

- Insight Enterprises recently reported its second quarter and six-month financial results, revealing that revenue declined to US$2,091.48 million and net income dropped to US$46.93 million for the quarter ending June 30, 2025, compared to the same period last year.

- The decrease in both earnings per share and overall profitability highlights ongoing pressure on the company's core operations and potential challenges in service and software revenue streams.

- We'll consider how this decline in quarterly revenue and earnings may impact Insight Enterprises' ongoing investment narrative and future expectations.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Insight Enterprises Investment Narrative Recap

To invest in Insight Enterprises, you likely need to believe in the company’s ability to drive earnings growth through its AI-led consulting services and expansion into higher-margin offerings, even as macro and client-specific headwinds weigh heavily on near-term results. The recent Q2 earnings miss may weigh on sentiment, but the most prominent near-term catalysts, like leveraging new AI solutions across client engagements, remain intact. However, ongoing declines in core software and service revenue streams remain the largest risk and are clearly present in these results.

One recent announcement that ties directly to current catalysts is the April 2025 launch of RADIUS® AI, targeting accelerated ROI for clients. This product underscores Insight Enterprises’ efforts to counter weakness in legacy segments by deepening value-added consulting, a focus that may add resilience if hardware demand rebounds as expected.

In contrast, investors must also be aware of the heightened risk from further declines in large enterprise service projects if...

Read the full narrative on Insight Enterprises (it's free!)

Insight Enterprises' outlook projects $9.6 billion in revenue and $410.6 million in earnings by 2028. This scenario assumes a 4.3% annual revenue growth rate and a $220 million increase in earnings from the current $190.2 million.

Uncover how Insight Enterprises' forecasts yield a $166.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for Insight Enterprises range widely from US$118.88 to US$172.84 per share. While community opinions differ significantly, ongoing pressure on on-prem software revenue highlights key headwinds shaping the company’s future performance.

Explore 4 other fair value estimates on Insight Enterprises - why the stock might be worth as much as 44% more than the current price!

Build Your Own Insight Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insight Enterprises research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insight Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insight Enterprises' overall financial health at a glance.

No Opportunity In Insight Enterprises?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSIT

Insight Enterprises

Provides information technology, hardware, software, and services in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives