- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSIT

How the Launch of Insight AI Has Changed the Investment Story at Insight Enterprises (NSIT)

Reviewed by Sasha Jovanovic

- On November 12, 2025, Insight Enterprises announced the launch of Insight AI, a comprehensive suite of services designed to help organizations overcome common barriers to AI adoption using pragmatic roadmaps, expert tools, and delivery accelerators.

- This new offering integrates Insight's recent acquisitions and its own internal AI expertise to provide clients with clear value realization and reduced risk in enterprise AI initiatives.

- We will explore how Insight AI's promise of faster, lower-risk AI deployment could influence the company's investment outlook going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Insight Enterprises Investment Narrative Recap

To believe in Insight Enterprises as a shareholder today, you need conviction in the company's ability to capture rising demand for practical, lower-risk AI solutions amid macro uncertainty that continues to slow enterprise technology spending. The introduction of Insight AI has the potential to sharpen the company's competitive position and accelerate adoption of higher-margin services, but with soft recent earnings and continued client hesitancy, its impact on near-term profit may not be material just yet; delays in enterprise spending remain the most important short-term risk to watch.

Of the latest company announcements, the CEO succession plan stands out as a relevant development against the backdrop of a major new product launch. As Joyce Mullen prepares to retire and Insight's leadership transitions in early 2026, investors may weigh the company's ability to sustain execution on AI and integration strategies without disruption to key catalysts such as operational efficiency gains and managed services expansion.

Yet in contrast to positive developments with Insight AI, the risk of further delays in large client spending, especially for complex infrastructure, remains a key issue that investors should be aware of...

Read the full narrative on Insight Enterprises (it's free!)

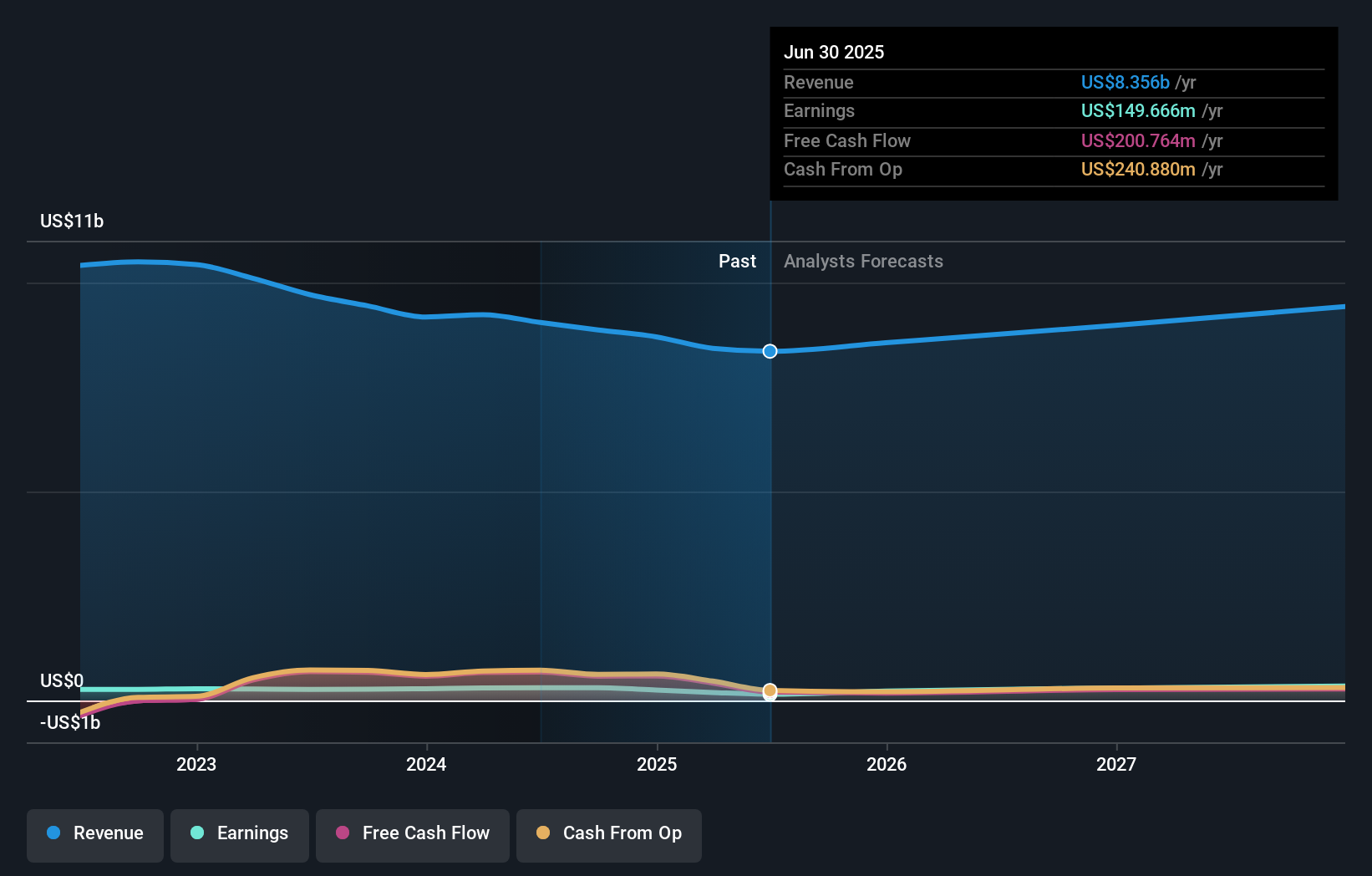

Insight Enterprises' narrative projects $9.6 billion in revenue and $420.5 million in earnings by 2028. This requires 4.9% yearly revenue growth and a $270.8 million earnings increase from $149.7 million today.

Uncover how Insight Enterprises' forecasts yield a $152.00 fair value, a 66% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community span a wide US$80 to US$173 range. While some participants see significant upside, continued client hesitancy on enterprise tech spending could influence whether the company fully captures future growth, so it pays to explore different views.

Explore 4 other fair value estimates on Insight Enterprises - why the stock might be worth 12% less than the current price!

Build Your Own Insight Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insight Enterprises research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Insight Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insight Enterprises' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSIT

Insight Enterprises

Provides information technology, hardware, software, and services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives