- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NOVT

Novanta (NOVT): $26 Million One-Time Loss Undermines Margin Recovery Narrative

Reviewed by Simply Wall St

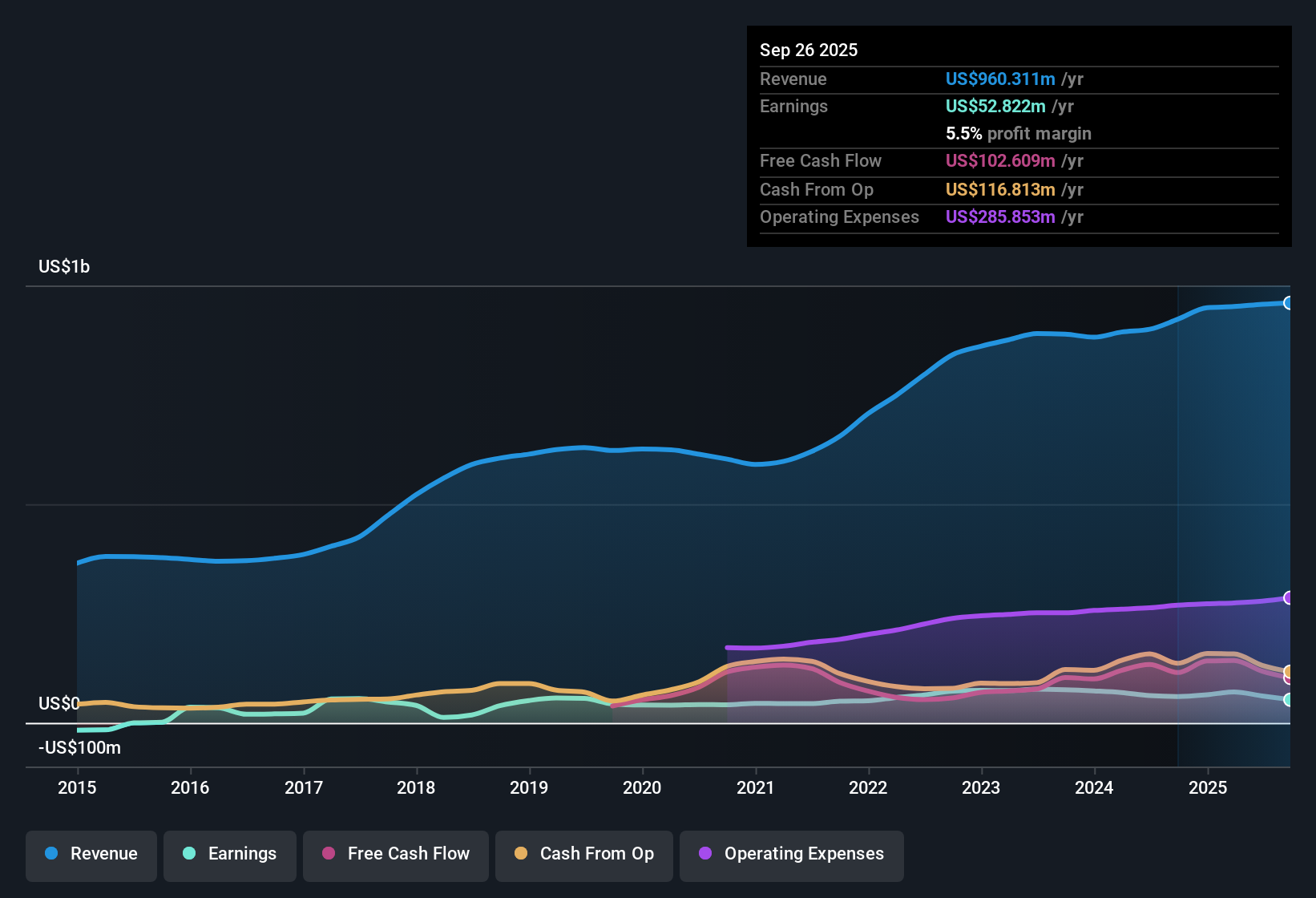

Novanta (NOVT) posted a 7.1% annual EPS growth rate over the past five years, but in the most recent year, earnings declined and net profit margins narrowed to 5.5% from 6.5% previously. The bottom line was further impacted by a one-time, $26 million loss, resulting in another layer of pressure on last year’s results. Looking forward, consensus is calling for profits to rebound sharply at 51.5% per year over the next three years, far outpacing the broader US market's 16% annual rate. However, revenue growth is expected to trail at 6.6% per year, which is slower than average. Shares currently trade at a lofty 87.6x earnings multiple, reflecting both optimism around future growth and investor caution regarding profitability headwinds and premium valuation.

See our full analysis for Novanta.Next up, we’ll see how these headline results measure up against some of the key narratives that drive sentiment among investors and analysts.

See what the community is saying about Novanta

Profit Margins Seen Recovering to 11.9%

- Analysts forecast that Novanta’s profit margin will nearly double from 6.4% today to 11.9% within three years, reversing the recent downturn that saw margins slip to 5.5% in the latest period after a one-time $26 million loss.

- According to the analysts' consensus view, steady expansion in the Advanced Surgery division and more recurring consumables sales are expected to boost margin resilience.

- Consensus narrative notes that ongoing operational improvements and supply chain adjustments are already supporting stable earnings and positioning Novanta to weather economic or trade disruptions more effectively.

- What is surprising is that despite slower forecast revenue growth of 6.6% a year, analysts still expect margin recovery to drive earnings improvement beyond typical market rates.

- For a deeper dive, see how analysts weigh Novanta’s margin rebound against future profit drivers in the full Consensus Narrative. 📊 Read the full Novanta Consensus Narrative.

Cost Pressures Linger Amid $20 to $25 Million Charges

- Novanta is preparing for ongoing restructuring charges estimated at $20 to $25 million linked to manufacturing regionalization and rising stock compensation, adding to recent expense headwinds that pressured last year's results.

- Analysts' consensus view flags that while aggressive cost-cutting and regionalization are intended to stabilize cash flow, persistent higher tariffs and manufacturing shifts pose risks to margin expansion.

- Critics highlight that muted US export sales to China, with $35 million at risk for 2025, and the potential for lingering restructuring expenses may offset some expected operational gains.

- Bears argue that execution around integration of acquisitions and containing these costs will be crucial for net profit trajectory going forward.

Valuation Soars: Shares at 87.6x Earnings

- Novanta’s shares trade at a price-to-earnings ratio of 87.6x, over three times the US Electronic industry average of 23.9x and well above its peers, demanding that rapid earnings growth and margin improvement are realized to justify the premium.

- Consensus perspective underscores that for the $141.50 analyst price target to be reached from today’s $129.33 share price, Novanta needs to grow revenue to $1.1 billion and earnings to $135.3 million by 2028, while also reducing its PE to 48.1x, still double the industry average.

- What stands out is that, despite these steep expectations, analysts remain largely in agreement about the achievability of these targets, provided operational execution stays on track.

- This optimism is tempered by the reality that a significant portion of projected growth still depends on successful integrations of new acquisitions and continued momentum in margin expansion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Novanta on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that stands out? Put your own spin on the story in just a few minutes, and Do it your way.

A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Novanta’s high valuation and reliance on rapid earnings growth leave investors exposed if profit margins or revenue expansion do not meet ambitious forecasts.

If you want to sidestep these lofty expectations, seek out better value opportunities among these 840 undervalued stocks based on cash flows that may offer more upside with less risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novanta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NOVT

Novanta

Provides precision medicine, precision manufacturing, medical solutions, robotics and automation solutions, and advanced surgery solutions in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives