- United States

- /

- Machinery

- /

- NasdaqCM:NNDM

We're Not Very Worried About Nano Dimension's (NASDAQ:NNDM) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Nano Dimension (NASDAQ:NNDM) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Nano Dimension

Does Nano Dimension Have A Long Cash Runway?

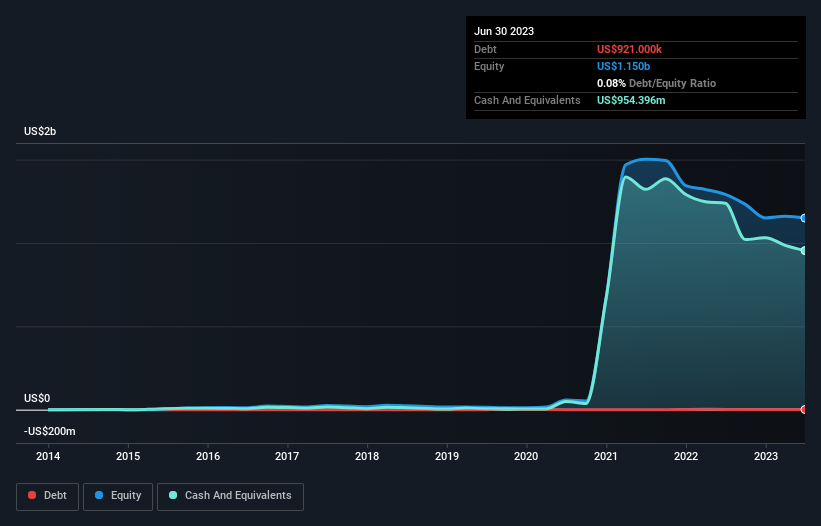

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2023, Nano Dimension had cash of US$954m and such minimal debt that we can ignore it for the purposes of this analysis. In the last year, its cash burn was US$117m. Therefore, from June 2023 it had 8.2 years of cash runway. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Nano Dimension Growing?

At first glance it's a bit worrying to see that Nano Dimension actually boosted its cash burn by 43%, year on year. Having said that, it's revenue is up a very solid 70% in the last year, so there's plenty of reason to believe in the growth story. The company needs to keep up that growth, if it is to really please shareholders. On balance, we'd say the company is improving over time. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how Nano Dimension is building its business over time.

Can Nano Dimension Raise More Cash Easily?

We are certainly impressed with the progress Nano Dimension has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Nano Dimension has a market capitalisation of US$620m and burnt through US$117m last year, which is 19% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Nano Dimension's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Nano Dimension's revenue growth was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Nano Dimension that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Nano Dimension might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NNDM

Nano Dimension

Engages in additive manufacturing solutions in Israel and internationally.

Flawless balance sheet minimal.