- United States

- /

- Machinery

- /

- NasdaqCM:NNDM

Further weakness as Nano Dimension (NASDAQ:NNDM) drops 11% this week, taking three-year losses to 66%

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Nano Dimension Ltd. (NASDAQ:NNDM) shareholders. So they might be feeling emotional about the 66% share price collapse, in that time. And over the last year the share price fell 25%, so we doubt many shareholders are delighted. On top of that, the share price is down 11% in the last week.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Nano Dimension

Given that Nano Dimension didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Nano Dimension saw its revenue grow by 65% per year, compound. That is faster than most pre-profit companies. In contrast, the share price is down 19% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

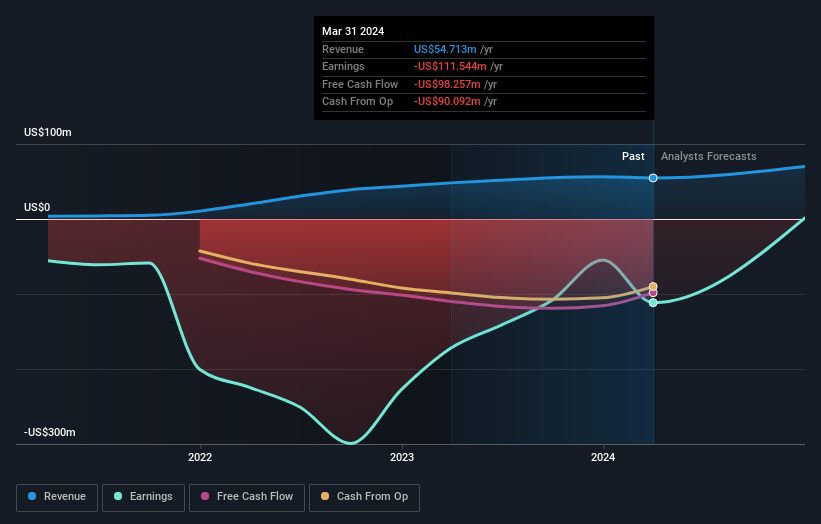

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Nano Dimension will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 16% in the last year, Nano Dimension shareholders lost 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Nano Dimension you should know about.

Of course Nano Dimension may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nano Dimension might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NNDM

Nano Dimension

BD QA., together with its subsidiaries, provides industrial manufacturing solutions for design-to-manufacturing of electronics and mechanical parts in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet minimal.

Market Insights

Community Narratives