- United States

- /

- Electronic Equipment and Components

- /

- OTCPK:MVLA

Further weakness as Movella Holdings (NASDAQ:MVLA) drops 21% this week, taking one-year losses to 83%

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. So spare a thought for the long term shareholders of Movella Holdings Inc. (NASDAQ:MVLA); the share price is down a whopping 83% in the last twelve months. That'd be enough to make even the strongest stomachs churn. Because Movella Holdings hasn't been listed for many years, the market is still learning about how the business performs. It's down 83% in about a quarter. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

After losing 21% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Movella Holdings

Movella Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Movella Holdings grew its revenue by 21% over the last year. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 83% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

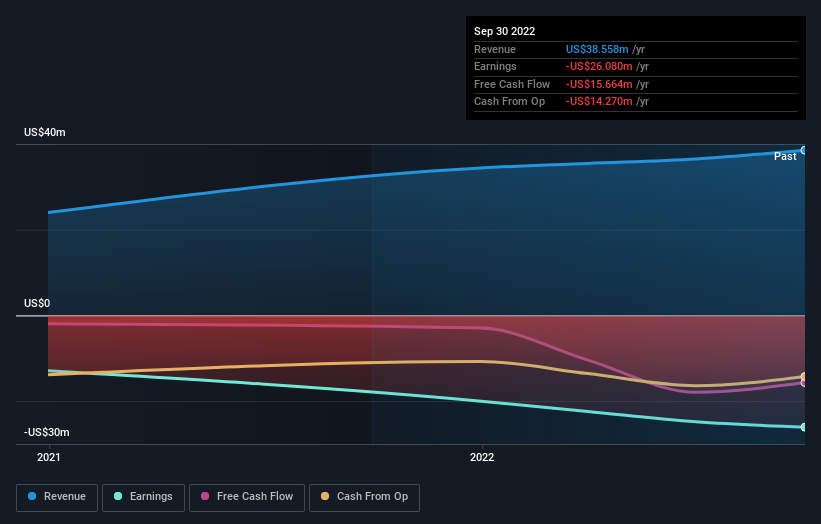

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Movella Holdings shareholders are down 83% for the year, even worse than the market loss of 10%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's worth noting that the last three months did the real damage, with a 83% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Movella Holdings (2 are a bit concerning!) that you should be aware of before investing here.

But note: Movella Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:MVLA

Movella Holdings

Operates as a full-stack provider of sensors, software, and analytics that enable the digitization of movement in the United States.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives