- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MVIS

Will MicroVision (NASDAQ:MVIS) Spend Its Cash Wisely?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for MicroVision (NASDAQ:MVIS) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for MicroVision

When Might MicroVision Run Out Of Money?

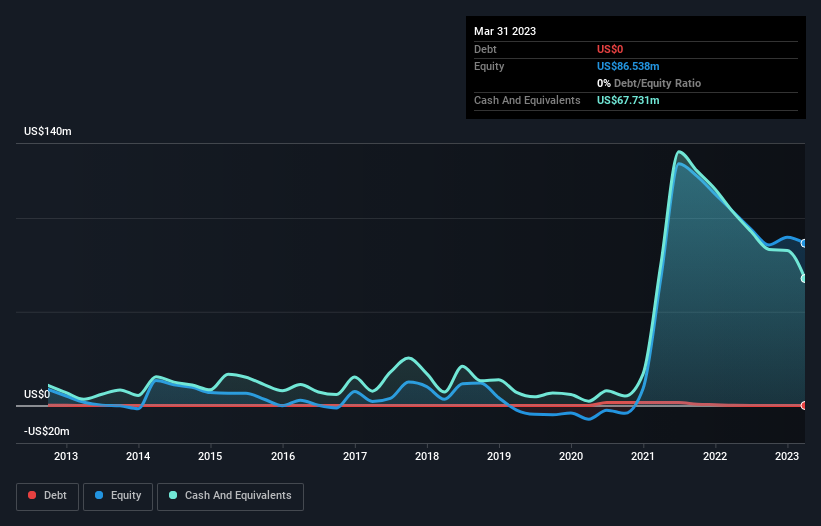

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2023, MicroVision had cash of US$68m and no debt. In the last year, its cash burn was US$45m. That means it had a cash runway of around 18 months as of March 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Well Is MicroVision Growing?

At first glance it's a bit worrying to see that MicroVision actually boosted its cash burn by 16%, year on year. The fact that operating revenue was down 54% only gives us further disquiet. Considering both these metrics, we're a little concerned about how the company is developing. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can MicroVision Raise Cash?

MicroVision revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

MicroVision has a market capitalisation of US$722m and burnt through US$45m last year, which is 6.2% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is MicroVision's Cash Burn A Worry?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought MicroVision's cash burn relative to its market cap was relatively promising. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about MicroVision's situation. Taking a deeper dive, we've spotted 3 warning signs for MicroVision you should be aware of, and 1 of them is a bit unpleasant.

Of course MicroVision may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MVIS

MicroVision

Develops and commercializes perception solutions for autonomy and mobility applications.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is This Lens Maker Mispriced? A Blind Spot in Plain Sight

From Porcelain to Silicon: Why the World’s Most Famous Toilet Maker is Now an AI Powerhouse

Droneshield is ramping up , 267% revenue increase in 2025

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks