- United States

- /

- Communications

- /

- NasdaqCM:MOB

We're Hopeful That Mobilicom (NASDAQ:MOB) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. Indeed, Mobilicom (NASDAQ:MOB) stock is up 257% in the last year, providing strong gains for shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky Mobilicom's cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Does Mobilicom Have A Long Cash Runway?

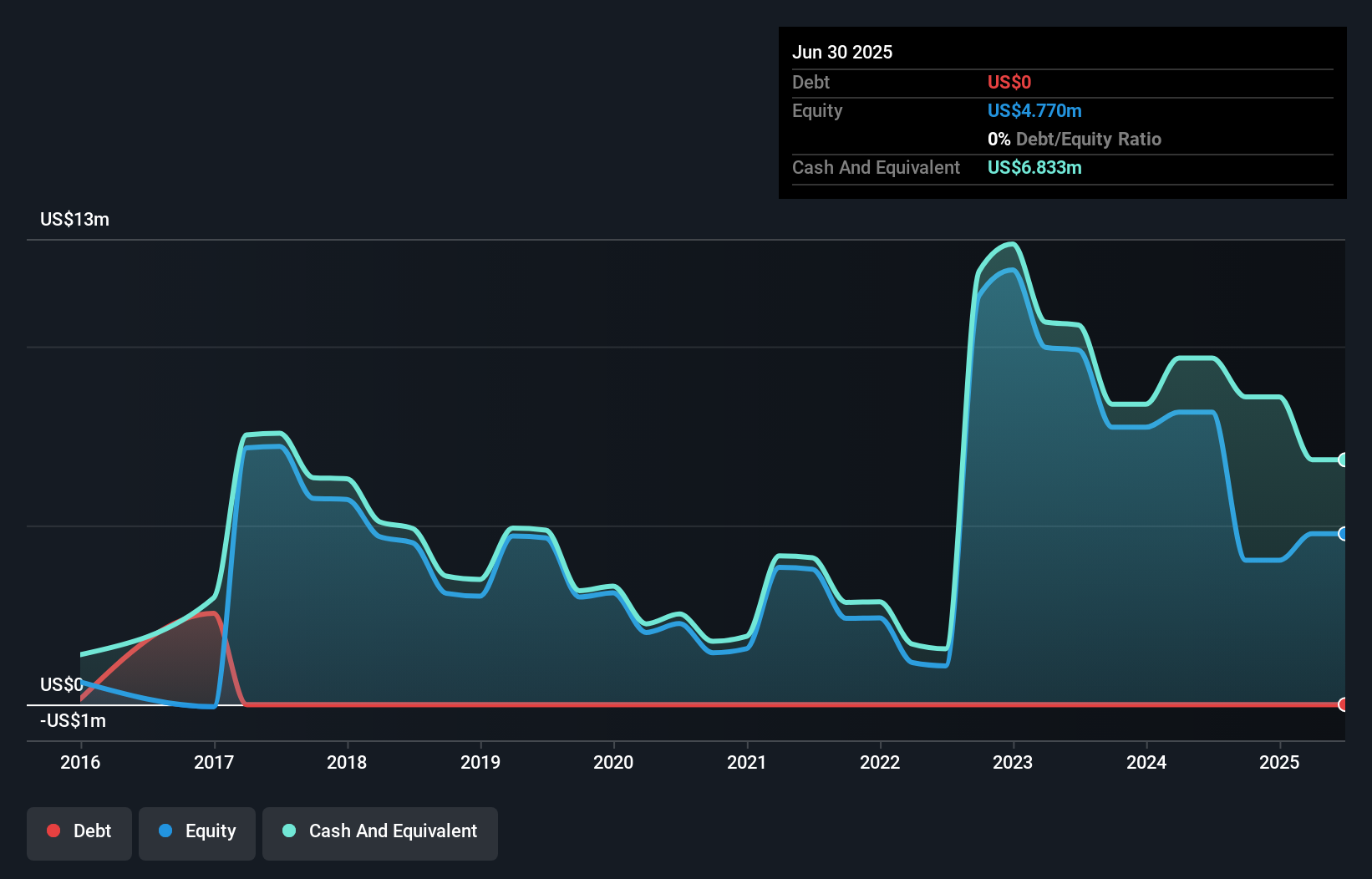

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Mobilicom last reported its June 2025 balance sheet in August 2025, it had zero debt and cash worth US$6.8m. Looking at the last year, the company burnt through US$3.7m. So it had a cash runway of approximately 22 months from June 2025. Notably, however, analysts think that Mobilicom will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

View our latest analysis for Mobilicom

How Well Is Mobilicom Growing?

Some investors might find it troubling that Mobilicom is actually increasing its cash burn, which is up 18% in the last year. And we must say we find it concerning that operating revenue dropped 18% over the same period. Taken together, we think these growth metrics are a little worrying. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Mobilicom Raise Cash?

While Mobilicom seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$50m, Mobilicom's US$3.7m in cash burn equates to about 7.4% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Mobilicom's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Mobilicom's cash burn. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. An in-depth examination of risks revealed 5 warning signs for Mobilicom that readers should think about before committing capital to this stock.

Of course Mobilicom may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MOB

Mobilicom

Engages in the provision of hardware products and software and cybersecurity solutions for drones, small-sized unmanned aerial vehicles (SUAV), and robotics in Israel, the United States, Canada, and internationally.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026