- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MASS

Investors Appear Satisfied With 908 Devices Inc.'s (NASDAQ:MASS) Prospects

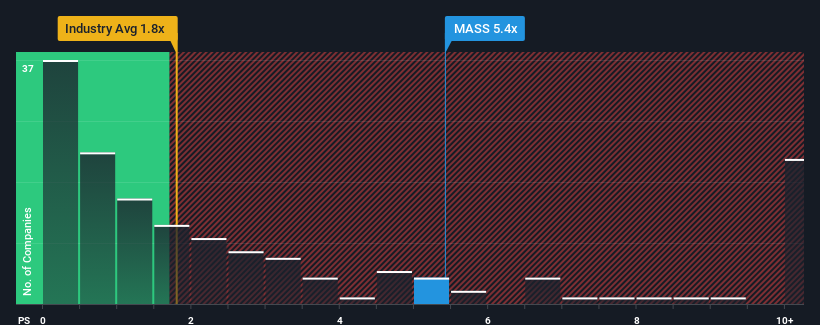

When you see that almost half of the companies in the Electronic industry in the United States have price-to-sales ratios (or "P/S") below 1.8x, 908 Devices Inc. (NASDAQ:MASS) looks to be giving off strong sell signals with its 5.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for 908 Devices

What Does 908 Devices' Recent Performance Look Like?

908 Devices hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think 908 Devices' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For 908 Devices?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like 908 Devices' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.9% decrease to the company's top line. Still, the latest three year period has seen an excellent 61% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.9%, which is noticeably less attractive.

With this in mind, it's not hard to understand why 908 Devices' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From 908 Devices' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of 908 Devices' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with 908 Devices.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if 908 Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MASS

908 Devices

A commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry devices for use in life sciences research, bioprocessing, pharma/biopharma, forensics, and adjacent markets.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.