- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LPTH

LightPath Technologies, Inc. (NASDAQ:LPTH) Stocks Shoot Up 39% But Its P/S Still Looks Reasonable

LightPath Technologies, Inc. (NASDAQ:LPTH) shares have continued their recent momentum with a 39% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 76% in the last year.

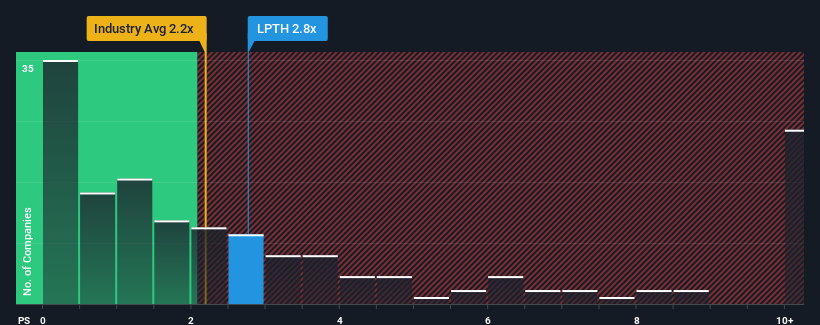

Since its price has surged higher, you could be forgiven for thinking LightPath Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for LightPath Technologies

What Does LightPath Technologies' Recent Performance Look Like?

LightPath Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think LightPath Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is LightPath Technologies' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like LightPath Technologies' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.7% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 16% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 14% over the next year. That's shaping up to be materially higher than the 9.0% growth forecast for the broader industry.

With this information, we can see why LightPath Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From LightPath Technologies' P/S?

LightPath Technologies' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into LightPath Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 4 warning signs for LightPath Technologies (1 shouldn't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LPTH

LightPath Technologies

Designs, develops, manufactures, and distributes optical systems and assemblies in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion