- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LPTH

Does LightPath Technologies (NASDAQ:LPTH) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that LightPath Technologies, Inc. (NASDAQ:LPTH) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for LightPath Technologies

What Is LightPath Technologies's Debt?

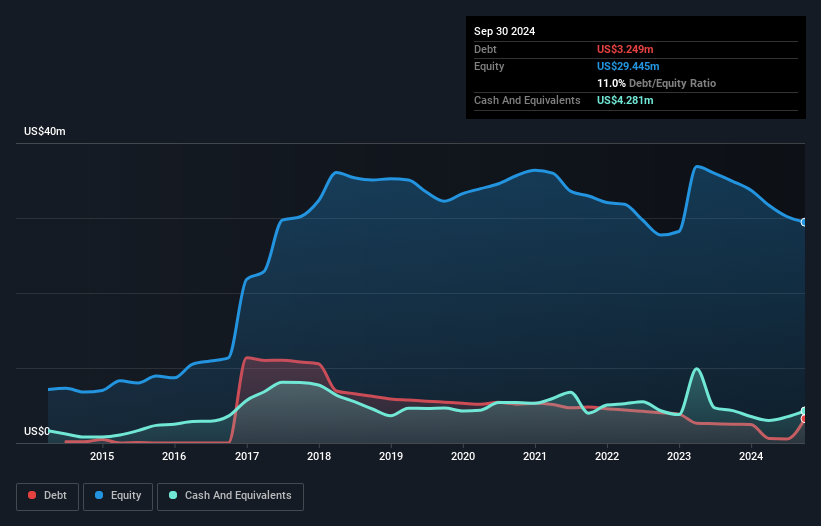

The image below, which you can click on for greater detail, shows that at September 2024 LightPath Technologies had debt of US$3.25m, up from US$2.51m in one year. However, its balance sheet shows it holds US$4.28m in cash, so it actually has US$1.03m net cash.

How Strong Is LightPath Technologies' Balance Sheet?

We can see from the most recent balance sheet that LightPath Technologies had liabilities of US$9.74m falling due within a year, and liabilities of US$9.26m due beyond that. Offsetting these obligations, it had cash of US$4.28m as well as receivables valued at US$5.20m due within 12 months. So its liabilities total US$9.52m more than the combination of its cash and short-term receivables.

Given LightPath Technologies has a market capitalization of US$130.9m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, LightPath Technologies boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine LightPath Technologies's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year LightPath Technologies had a loss before interest and tax, and actually shrunk its revenue by 4.7%, to US$32m. That's not what we would hope to see.

So How Risky Is LightPath Technologies?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year LightPath Technologies had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$3.6m and booked a US$8.3m accounting loss. However, it has net cash of US$1.03m, so it has a bit of time before it will need more capital. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for LightPath Technologies (of which 1 is potentially serious!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LPTH

LightPath Technologies

Designs, develops, manufactures, and distributes optical systems and assemblies in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

A fully integrated LNG business seems to be ignored by the market.

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale