- United States

- /

- Communications

- /

- NasdaqGS:LITE

Will Lumentum Holdings (LITE) Adding onsemi CFO to Its Board Reframe Its AI Investment Discipline?

Reviewed by Sasha Jovanovic

- On December 15, 2025, Lumentum Holdings appointed onsemi CFO Thad Trent to its board and audit committee, adding deep semiconductor finance experience to its governance.

- This appointment comes as Lumentum leans further into AI- and cloud-related photonics, where disciplined capital allocation and cost control are increasingly critical.

- We’ll now explore how bringing on Thad Trent could shape Lumentum’s AI-focused investment narrative and its risk-reward profile for investors.

Find companies with promising cash flow potential yet trading below their fair value.

Lumentum Holdings Investment Narrative Recap

To own Lumentum today, you have to believe that its heavy tilt toward AI and cloud photonics can translate rapid top line growth into durable, improving profitability, despite rich valuation and volatile sentiment. The Thad Trent appointment primarily reinforces governance and financial oversight, and does not materially change the near term catalyst, which remains execution on AI data center demand, or the key risk around customer concentration and cloud module margin pressure.

The most relevant recent development here is Lumentum’s strong Q1 FY2026 revenue of US$533.8 million and return to profitability, which sharpen investor focus on whether the company can scale AI driven demand without further compressing margins or overextending capacity. Against that backdrop, adding a seasoned semiconductor CFO to the board and audit committee may matter most if growth meets constraints or if cloud module economics prove harder to sustain than expected.

Yet even with all this momentum, investors should be aware that a handful of hyperscale customers still account for a large share of Lumentum’s...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' narrative projects $3.1 billion revenue and $389.1 million earnings by 2028. This requires 23.4% yearly revenue growth and a $363.2 million earnings increase from $25.9 million today.

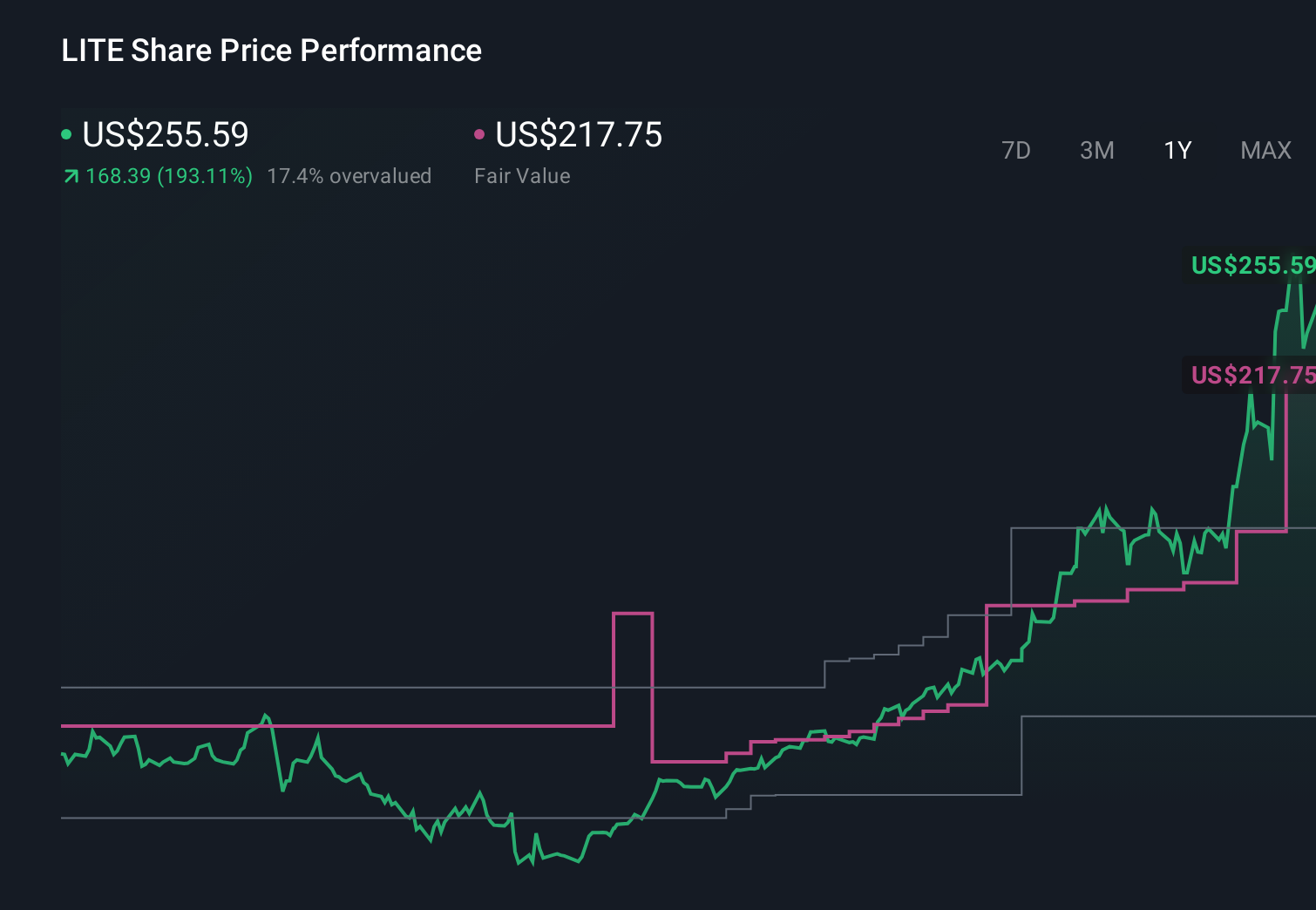

Uncover how Lumentum Holdings' forecasts yield a $255.14 fair value, a 31% downside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community value Lumentum anywhere from US$68 to US$578 per share, underscoring how far views can diverge. When a business leans heavily on a few hyperscale buyers for AI cloud revenue, it often pays to explore a range of independent opinions before deciding how that concentration might shape future performance.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth less than half the current price!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion