- United States

- /

- Communications

- /

- NasdaqGS:LITE

Lumentum (LITE) Is Up 9.0% After Strong Q1 Earnings and Higher Revenue Outlook – What’s Changed

Reviewed by Sasha Jovanovic

- Lumentum Holdings announced first quarter fiscal 2026 earnings, reporting sales of US$533.8 million and net income of US$4.2 million, a significant improvement compared to the prior year, and provided second quarter revenue guidance of US$630 million to US$670 million.

- The company's return to profitability and outlook for continued revenue growth highlight a turnaround in its operating performance, driven by demand for its optical and photonic products.

- We'll explore how Lumentum's stronger earnings and higher future guidance impact the company’s investment narrative and earnings outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Lumentum Holdings Investment Narrative Recap

To own shares of Lumentum Holdings, an investor needs to trust in ongoing demand for advanced optical and photonic solutions for cloud and AI infrastructure. The company’s strong return to profitability and higher revenue guidance for the second quarter bolster confidence in its ability to capitalize on hyperscale and AI-driven growth, but also bring attention to revenue concentration risk with a few major cloud customers, a factor that remains central to both the near-term catalyst and the biggest risk for Lumentum. The latest earnings news materially enhances visibility on execution in the core growth area, but does not fully address concerns around potential customer concentration risk.

The most relevant announcement here is Lumentum’s robust Q1 FY2026 earnings performance, showing sales of US$533.8 million and net income of US$4.2 million, an improvement both sequentially and year-over-year. This turnaround has added credibility to the company’s capacity expansion and next-generation product rollout as near-term growth drivers, directly supporting management’s confidence in raising Q2 revenue guidance to between US$630 million and US$670 million.

However, against these positives, investors should remain aware of the potential impact if just one major cloud customer reduces orders or shifts demand to a competitor…

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' narrative projects $3.1 billion revenue and $389.1 million earnings by 2028. This requires 23.4% yearly revenue growth and a $363.2 million earnings increase from $25.9 million today.

Uncover how Lumentum Holdings' forecasts yield a $217.75 fair value, a 14% downside to its current price.

Exploring Other Perspectives

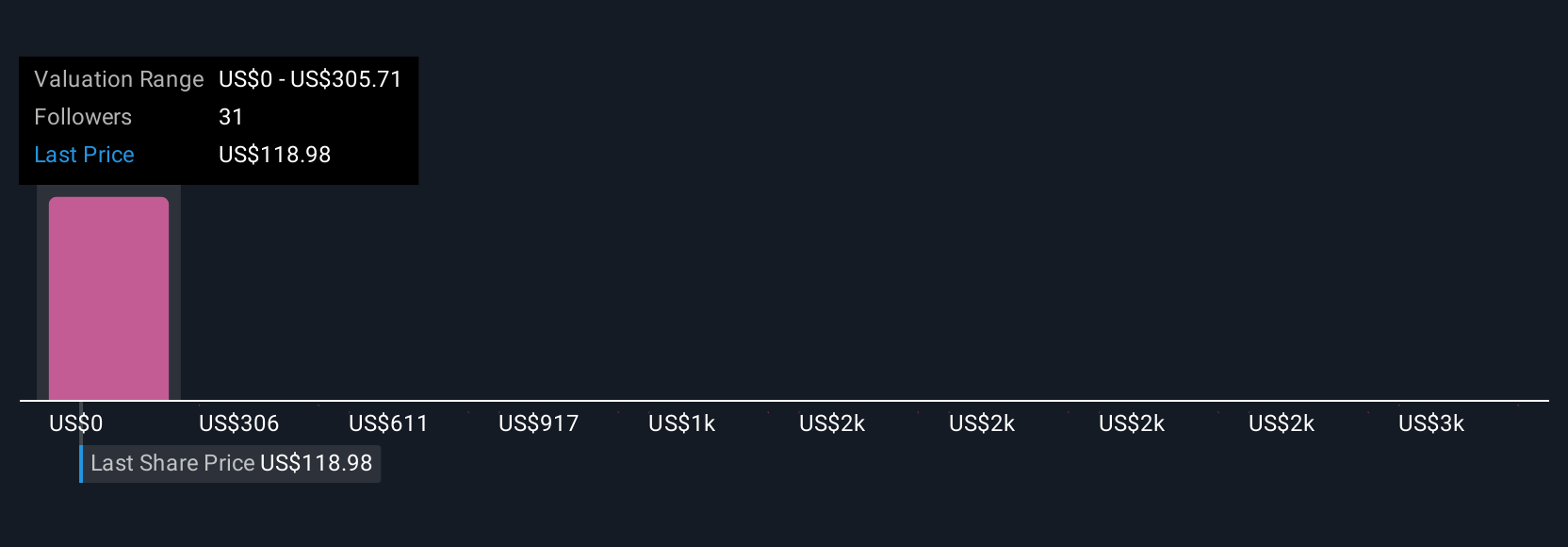

Eleven individual fair value estimates from the Simply Wall St Community range widely from US$68.28 to US$577.91. While some expect substantial upside, others signal caution in light of Lumentum’s dependence on a concentrated hyperscale customer base.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives