- United States

- /

- Communications

- /

- NasdaqGS:LITE

Lumentum Holdings Inc. (NASDAQ:LITE) Stocks Shoot Up 30% But Its P/S Still Looks Reasonable

Lumentum Holdings Inc. (NASDAQ:LITE) shareholders have had their patience rewarded with a 30% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 6.9% isn't as impressive.

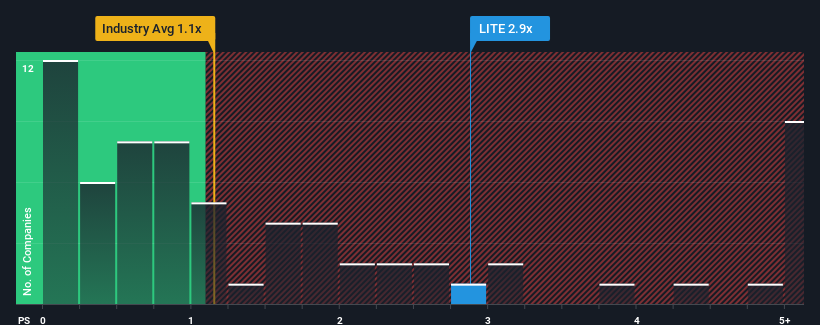

Since its price has surged higher, given close to half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Lumentum Holdings as a stock to potentially avoid with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Lumentum Holdings

What Does Lumentum Holdings' P/S Mean For Shareholders?

Lumentum Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lumentum Holdings.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Lumentum Holdings' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. As a result, revenue from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 17% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.3% each year, which is noticeably less attractive.

In light of this, it's understandable that Lumentum Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Lumentum Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Lumentum Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Communications industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Lumentum Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026