- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

The Price Is Right For Interlink Electronics, Inc. (NASDAQ:LINK) Even After Diving 29%

Unfortunately for some shareholders, the Interlink Electronics, Inc. (NASDAQ:LINK) share price has dived 29% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 4.4% in the last year.

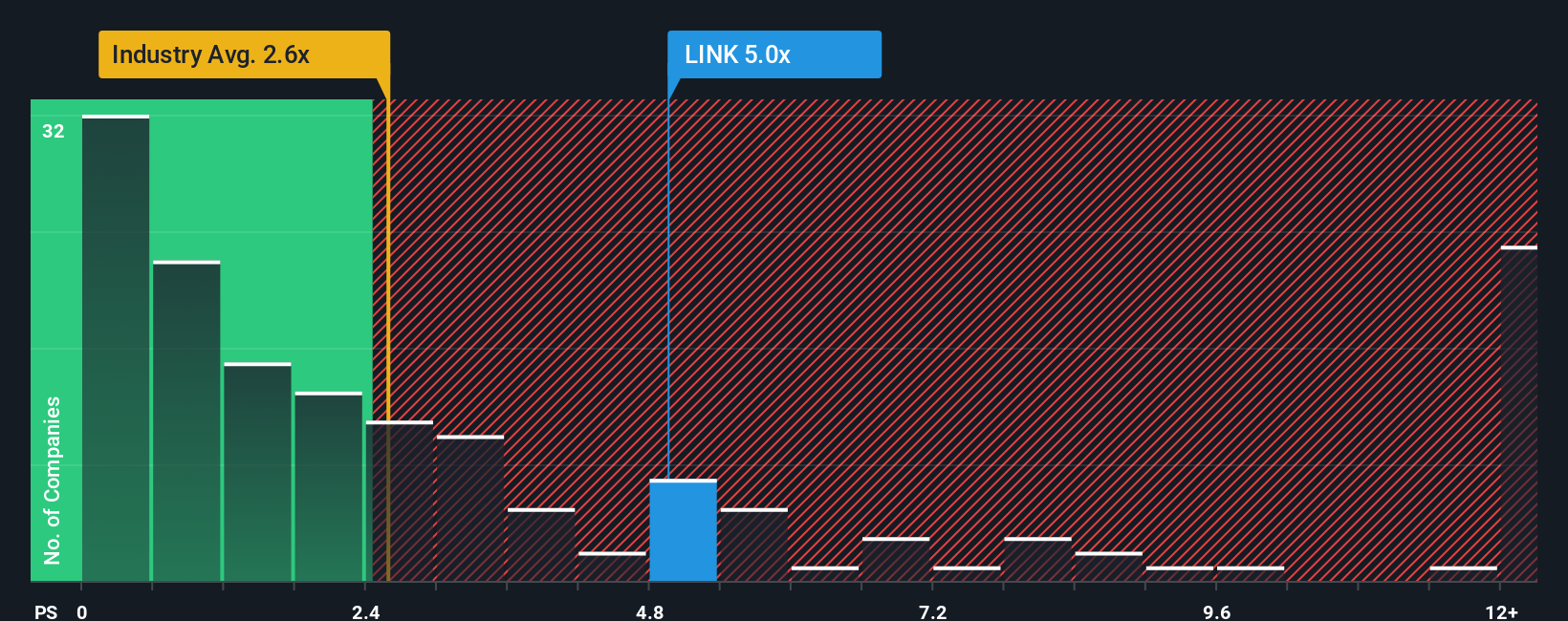

Even after such a large drop in price, you could still be forgiven for thinking Interlink Electronics is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Interlink Electronics

How Has Interlink Electronics Performed Recently?

Interlink Electronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Interlink Electronics.Is There Enough Revenue Growth Forecasted For Interlink Electronics?

The only time you'd be truly comfortable seeing a P/S as steep as Interlink Electronics' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. Still, the latest three year period has seen an excellent 60% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 30% as estimated by the one analyst watching the company. With the industry only predicted to deliver 18%, the company is positioned for a stronger revenue result.

With this information, we can see why Interlink Electronics is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Interlink Electronics' P/S

A significant share price dive has done very little to deflate Interlink Electronics' very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Interlink Electronics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Interlink Electronics that you should be aware of.

If these risks are making you reconsider your opinion on Interlink Electronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

DMCI Holdings will shine with a projected fair value of 68.43 in the next 5 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion