- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Interlink Electronics (NASDAQ:LINK) Is In A Good Position To Deliver On Growth Plans

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Interlink Electronics (NASDAQ:LINK) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Interlink Electronics

When Might Interlink Electronics Run Out Of Money?

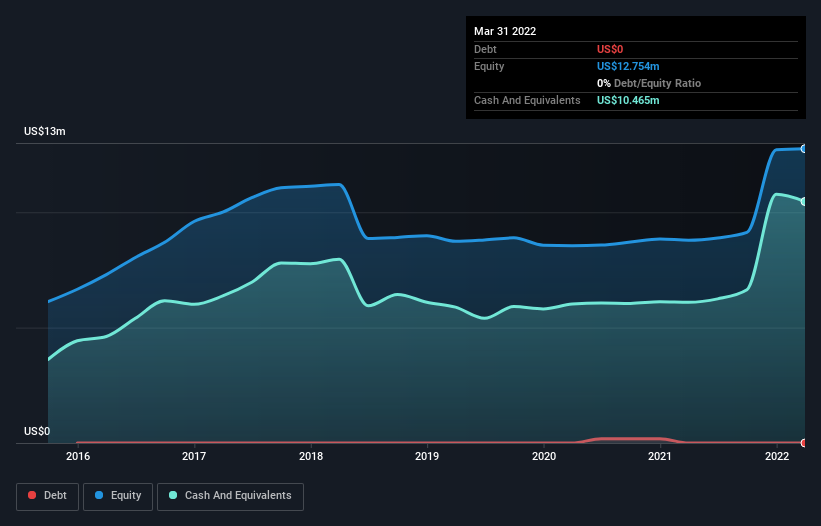

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at March 2022, Interlink Electronics had cash of US$10m and no debt. In the last year, its cash burn was US$288k. So it had a very long cash runway of many years from March 2022. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

How Well Is Interlink Electronics Growing?

Over the last year, Interlink Electronics maintained its cash burn at a fairly steady level. And its operating revenue is moving slowly in the right direction, up 17% year on year. On balance, we'd say the company is improving over time. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Interlink Electronics is building its business over time.

How Hard Would It Be For Interlink Electronics To Raise More Cash For Growth?

We are certainly impressed with the progress Interlink Electronics has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Interlink Electronics has a market capitalisation of US$60m and burnt through US$288k last year, which is 0.5% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Interlink Electronics' Cash Burn?

As you can probably tell by now, we're not too worried about Interlink Electronics' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. On this analysis its cash burn reduction was its weakest feature, but we are not concerned about it. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for Interlink Electronics (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Tesla will achieve a 392% PE ratio increase according to recent forecasts

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Bunker Hill Mine: A Case For $5 Per Share by 2030

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026