- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Interlink Electronics, Inc.'s (NASDAQ:LINK) Shares Climb 28% But Its Business Is Yet to Catch Up

Interlink Electronics, Inc. (NASDAQ:LINK) shares have continued their recent momentum with a 28% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.5% in the last twelve months.

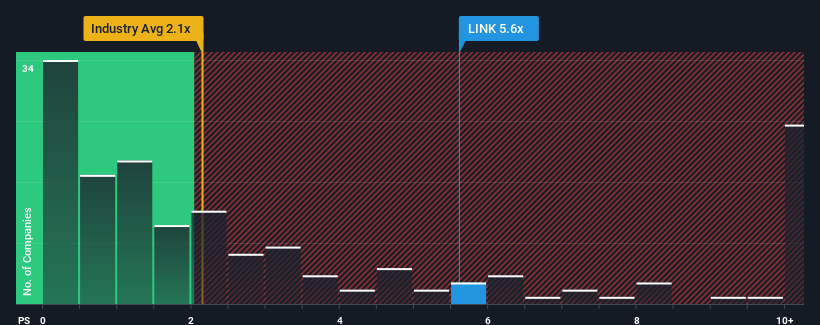

After such a large jump in price, given around half the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Interlink Electronics as a stock to avoid entirely with its 5.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Interlink Electronics

How Has Interlink Electronics Performed Recently?

There hasn't been much to differentiate Interlink Electronics' and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Interlink Electronics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Interlink Electronics' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to slump, contracting by 4.9% during the coming year according to the only analyst following the company. Meanwhile, the broader industry is forecast to expand by 9.1%, which paints a poor picture.

In light of this, it's alarming that Interlink Electronics' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Key Takeaway

Interlink Electronics' P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Interlink Electronics currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Interlink Electronics is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Interlink Electronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion