- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Interlink Electronics, Inc. (NASDAQ:LINK) Stock Rockets 49% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Interlink Electronics, Inc. (NASDAQ:LINK) shares have been powering on, with a gain of 49% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 7.8% isn't as impressive.

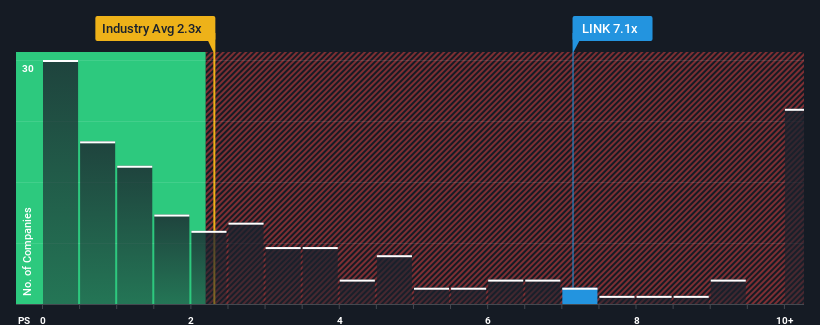

Following the firm bounce in price, given around half the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Interlink Electronics as a stock to avoid entirely with its 7.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Interlink Electronics

What Does Interlink Electronics' Recent Performance Look Like?

Recent revenue growth for Interlink Electronics has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Interlink Electronics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Interlink Electronics' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.9% as estimated by the sole analyst watching the company. That's not great when the rest of the industry is expected to grow by 9.9%.

With this information, we find it concerning that Interlink Electronics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Interlink Electronics' P/S

The strong share price surge has lead to Interlink Electronics' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Interlink Electronics' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 2 warning signs for Interlink Electronics (1 is a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of Interlink Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

Zero One +Tive report on Anime & $CTW

ICOP S.p.A. – Investment Narrative and Multibagger Monitoring Framework

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026