- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Interlink Electronics, Inc. (NASDAQ:LINK) Not Lagging Industry On Growth Or Pricing

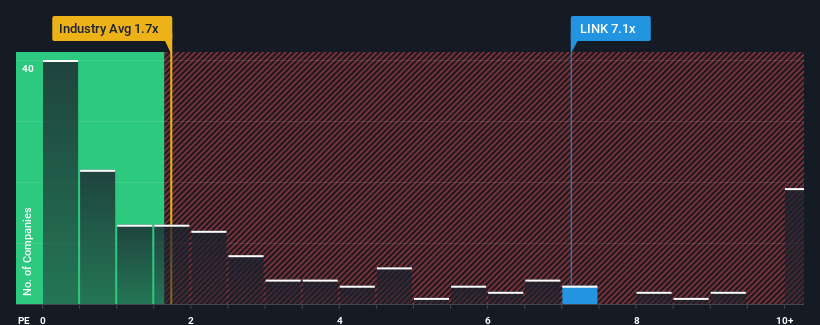

When close to half the companies in the Electronic industry in the United States have price-to-sales ratios (or "P/S") below 1.7x, you may consider Interlink Electronics, Inc. (NASDAQ:LINK) as a stock to avoid entirely with its 7.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Interlink Electronics

How Interlink Electronics Has Been Performing

Recent times have been pleasing for Interlink Electronics as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Interlink Electronics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Interlink Electronics' Revenue Growth Trending?

In order to justify its P/S ratio, Interlink Electronics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. The latest three year period has also seen an excellent 81% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.3%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Interlink Electronics' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Interlink Electronics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Interlink Electronics (2 are significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Tesla will achieve a 392% PE ratio increase according to recent forecasts

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Bunker Hill Mine: A Case For $5 Per Share by 2030

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026