- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Here's Why We Think Interlink Electronics, Inc.'s (NASDAQ:LINK) CEO Compensation Looks Fair

Shareholders may be wondering what CEO Steven Bronson plans to do to improve the less than great performance at Interlink Electronics, Inc. (NASDAQ:LINK) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 15 June 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Interlink Electronics

How Does Total Compensation For Steven Bronson Compare With Other Companies In The Industry?

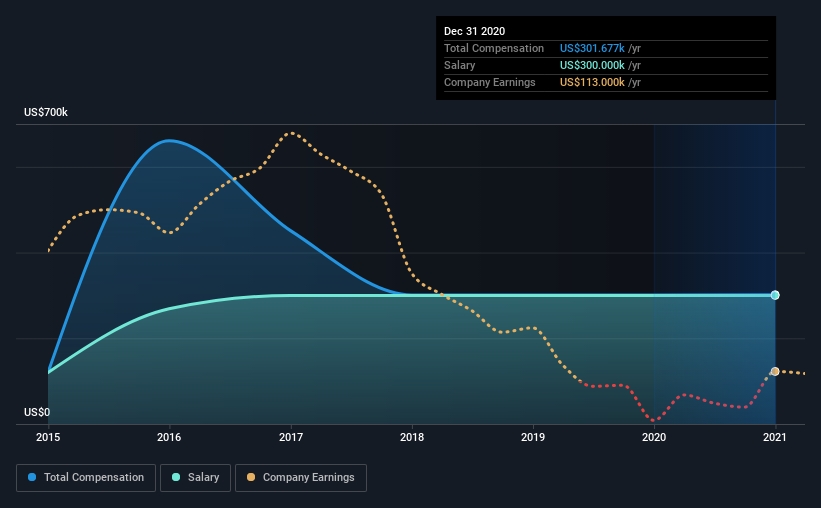

According to our data, Interlink Electronics, Inc. has a market capitalization of US$70m, and paid its CEO total annual compensation worth US$302k over the year to December 2020. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at US$300.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$453k. That is to say, Steven Bronson is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$300k | US$300k | 99% |

| Other | US$1.7k | US$897 | 1% |

| Total Compensation | US$302k | US$301k | 100% |

Speaking on an industry level, nearly 29% of total compensation represents salary, while the remainder of 71% is other remuneration. Investors will find it interesting that Interlink Electronics pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Interlink Electronics, Inc.'s Growth

Interlink Electronics, Inc. has reduced its earnings per share by 54% a year over the last three years. Its revenue is down 10% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Interlink Electronics, Inc. Been A Good Investment?

We think that the total shareholder return of 160%, over three years, would leave most Interlink Electronics, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Steven receives almost all of their compensation through a salary. Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for Interlink Electronics (1 is a bit concerning!) that you should be aware of before investing here.

Important note: Interlink Electronics is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Interlink Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026