- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LASR

nLIGHT (LASR): Reassessing Valuation After Bullish Analyst Coverage on Directed Energy Defense Growth Potential

Reviewed by Simply Wall St

Recent bullish analyst coverage on nLIGHT (LASR) has put the laser maker back on investors' radar, highlighting its role in directed energy systems just as defense spending on these technologies gathers momentum.

See our latest analysis for nLIGHT.

That bullish coverage has landed against a backdrop where the share price has pulled back 2.2% over the last day and 8.3% over the week, but still boasts a 30 day share price return of 17.6% and a powerful year to date share price return of 233.3%. The one year total shareholder return of 242.8% hints that momentum, and expectations around its defense exposure, are still very much intact even after years of mixed capital efficiency.

If this defense led story has you rethinking your exposure, it might be worth seeing how nLIGHT stacks up against other aerospace and defense names using aerospace and defense stocks.

With shares already up over 230% year to date and trading about 21% below the average analyst target, are investors still getting in ahead of nLIGHT’s directed energy growth curve, or is the market already pricing in the future upside?

Most Popular Narrative Narrative: 16.5% Undervalued

With nLIGHT last closing at $34.66 versus a narrative fair value of $41.50, the popular view implies meaningful upside if its growth path holds.

The rapid growth and expanding pipeline in aerospace and defense, particularly around high power laser solutions (e.g., HELSI 2 program, DE M SHORAD, Golden Dome initiative, and increased directed energy orders internationally), positions nLIGHT to benefit from rising global defense spending and modernization, supporting strong multi year revenue growth.

Want to see the math behind that upside call? The narrative leans on aggressive revenue compounding, a sharp margin turnaround, and a future earnings multiple rarely seen in this niche. Curious how those moving parts stack up?

Result: Fair Value of $41.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on defense programs delivering as expected, with any budget shifts or execution stumbles in amplifier ramp up potentially derailing that upside.

Find out about the key risks to this nLIGHT narrative.

Another Way To Look At Valuation

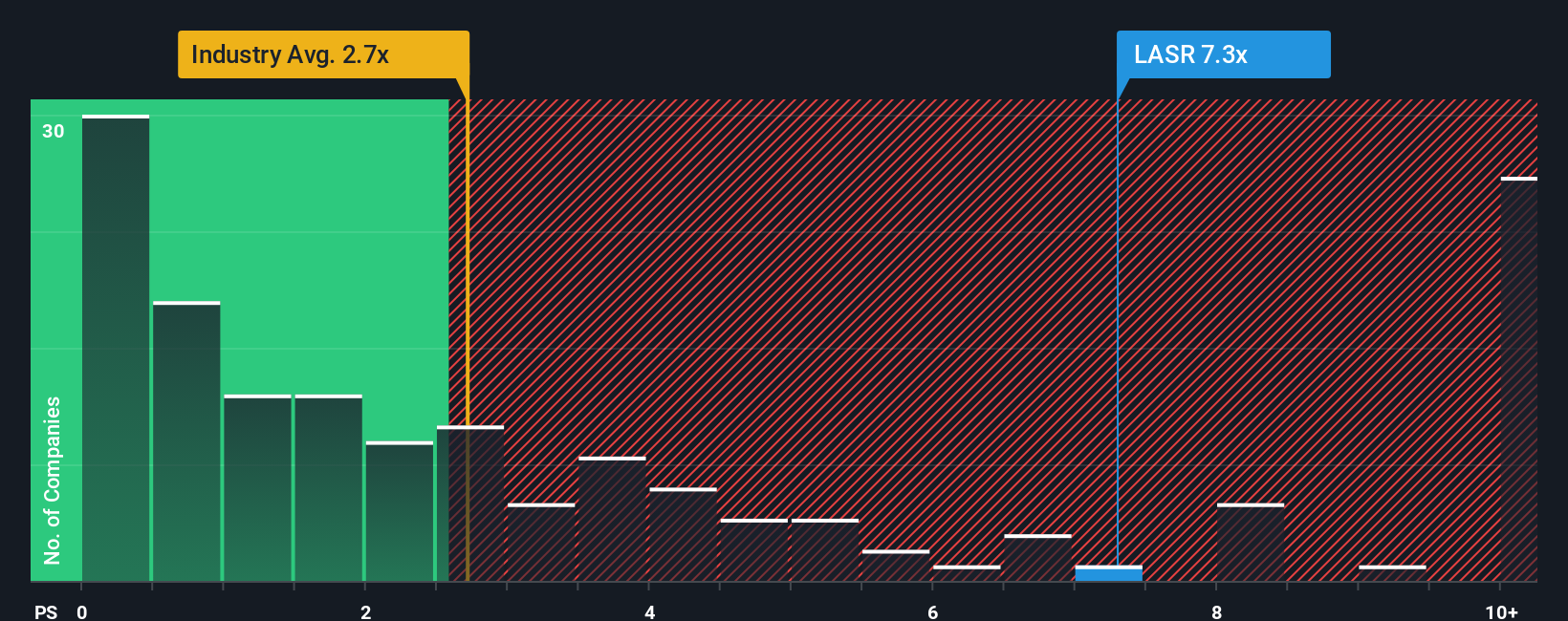

Price to sales paints a tougher picture, with LASR trading at 7.7 times sales versus 3.5 times for peers and 2.5 times for the wider US Electronic industry, while our fair ratio is just 1.4 times. That premium suggests real valuation risk if growth stumbles. Are investors being paid enough for that?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nLIGHT Narrative

If this angle does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your nLIGHT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in your next opportunity with targeted ideas from the Simply Wall St Screener, built to surface high conviction stocks fast.

- Capture income stability by focusing on dependable payers using these 13 dividend stocks with yields > 3% that aim to balance yield with fundamentals.

- Ride structural growth trends by zeroing in on transformational innovators through these 26 AI penny stocks shaping the future of automation and intelligence.

- Position ahead of sentiment shifts by scanning these 80 cryptocurrency and blockchain stocks tapping into blockchain adoption and digital asset infrastructure plays.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LASR

nLIGHT

Designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion