- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ITRI

Itron (ITRI) Margin Expansion Reinforces Value Narrative Despite Slower Revenue Growth

Reviewed by Simply Wall St

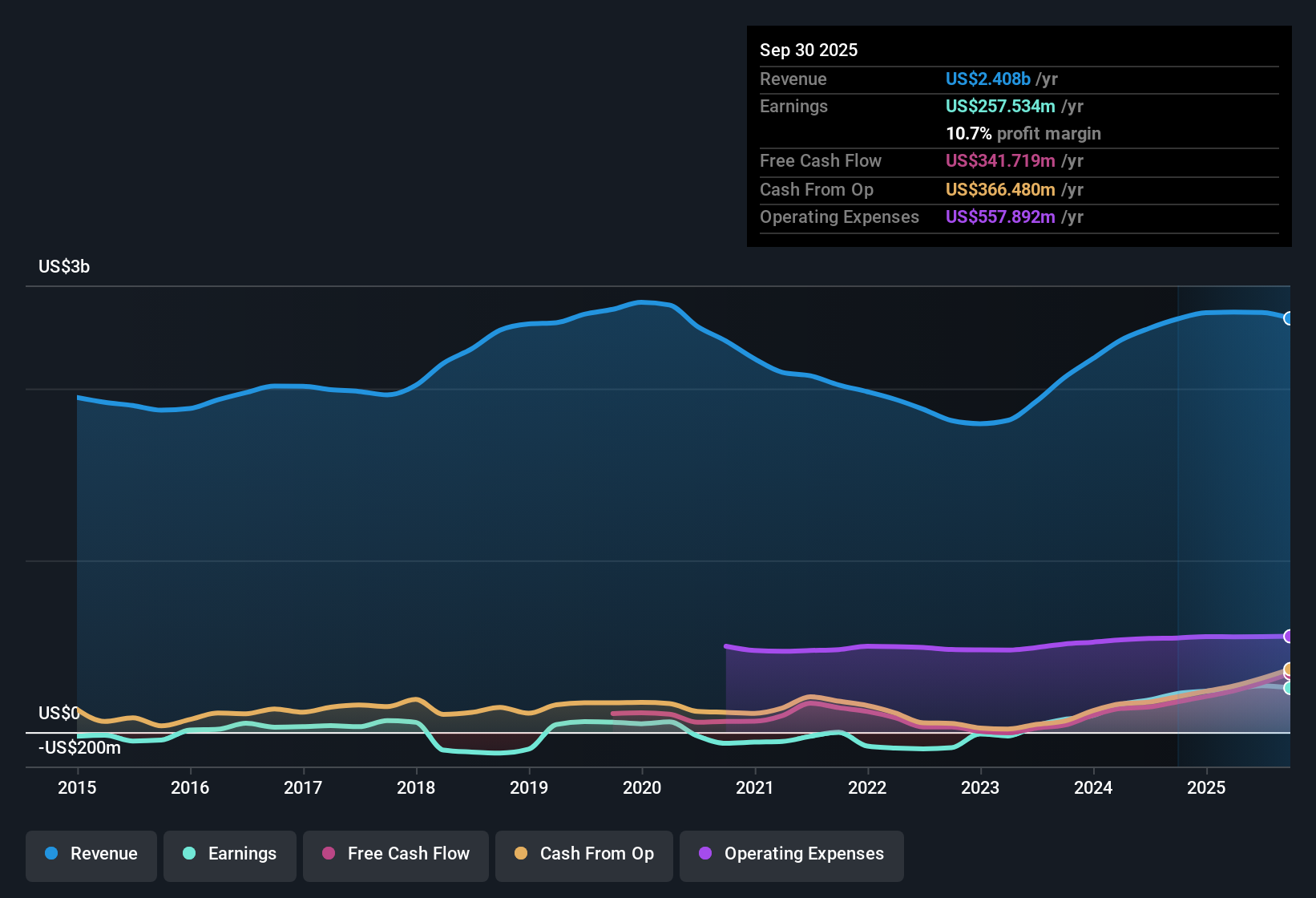

Itron (ITRI) posted a net profit margin of 11.1%, up from 8% last year, as EPS growth continues at a forecast pace of 14.2% per year. Shares look attractively valued, trading at a Price-to-Earnings ratio of 18.5x, which is below the peer average of 38.4x and the overall US electronic industry’s 25.7x. Last year’s earnings grew by 43.9%. With margins expanding and limited risk factors noted, the company’s market price of $108.99 remains well below a fair value estimate of $173.42. This positions Itron as a strong value play this season.

See our full analysis for Itron.Next, we’ll see how Itron’s latest results compare with the dominant community narratives, where the story aligns and where it might be tested.

See what the community is saying about Itron

Backlog-Driven Projects Delay Revenue Growth

- Projected annual revenue growth is 7.3%, trailing the broader US market average of 10.3%. Deployment delays and regulatory hurdles are pushing some large contract revenues into future periods, rather than lifting current results.

- According to the analysts' consensus view, strong structural cost cuts and a robust project pipeline set Itron up for longer-term upside. However, ongoing regulatory approval delays and utility budget scrutiny indicate that near-term topline performance may remain subdued.

- Consensus narrative notes global smart grid demand and digitalization are drivers, but short-term delays from regulatory and customer bottlenecks are weighing on growth forecasts.

- While analysts project revenues to reach $2.8 billion by 2028 if bottlenecks clear, the present outlook assumes slow catch-up growth due to backlog concentration in large, rescheduled projects.

Margin Expansion Outpaces SaaS Transition

- Itron's net profit margin improved to 11.1%, with analyst forecasts targeting further expansion to 13.7% over the next three years. This expansion is underpinned by cost cuts and higher-margin software adoption.

- The consensus narrative highlights that cost optimization efforts and a premium product mix have driven record gross and operating margins, boosting recurring earnings. At the same time, it warns that the Outcomes (software/data) segment grew less than 10% this quarter, which is slower than peers, suggesting the SaaS transition may be lagging.

- Structural margin gains depend on sustaining software momentum. Slower SaaS growth may challenge Itron's ability to permanently lift net margins if the recurring segment does not accelerate.

- Despite current margin expansion, a portion of the gains resulted from the exit of legacy products and facility closures, changes which may not be repeatable in future years.

Trading at a Discount to Industry and DCF Fair Value

- Itron trades at a Price-to-Earnings ratio of 18.5x, which is lower than both peer (38.4x) and industry (25.7x) averages. The current share price of $108.99 is also markedly below the DCF fair value estimate of $173.42.

- Analysts’ consensus narrative sees Itron as a compelling relative value. Current profitability and fair valuation multiples, amid limited risk factors, position the stock as offering strong upside potential versus industry peers, provided forecasted long-term growth materializes.

- With the analyst price target at $146.20, Itron’s current price offers a notable discount. This may appeal to value-oriented investors looking for growth in the smart grid and digital utility sector.

- However, to fully realize this value, the company must maintain its earnings trajectory while closing the SaaS growth gap that could limit margin durability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Itron on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the figures tell a different story? Share your outlook and build a personalized narrative for Itron in just a few quick steps with Do it your way.

A great starting point for your Itron research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Itron has made progress on margins, its reliance on catch-up revenue from delayed projects and sluggish SaaS growth highlights inconsistent topline performance.

If you want steadier results, check out stable growth stocks screener (2112 results) to discover companies delivering consistent growth and avoiding the pitfalls of unpredictable revenue cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRI

Itron

A technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives