- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:INVZ

Innoviz Technologies (NasdaqCM:INVZ): Revisiting Valuation After New LiDAR and NVIDIA Edge AI Showcase Plans

Reviewed by Simply Wall St

Innoviz Technologies (NasdaqCM:INVZ) is back on investors radar after announcing it will showcase its latest LiDAR lineup, including InnovizThree and updated InnovizTwo and InnovizSMART platforms, at CES 2026 in Las Vegas.

See our latest analysis for Innoviz Technologies.

Even with the CES showcase and expanding LiDAR lineup, sentiment has been shaky, with a sharp 90 day share price return of around negative 45 percent and a five year total shareholder return loss above 90 percent. This suggests momentum is still under pressure.

If Innoviz has you watching the broader autonomous tech space, this could be a good moment to explore other high growth tech and AI names using high growth tech and AI stocks.

Yet with revenue still growing and analysts seeing upside to the current share price, the key question now is simple: Is Innoviz an overlooked LiDAR play trading below its potential, or is the market already discounting its future growth?

Most Popular Narrative Narrative: 59.6% Undervalued

With Innoviz closing at $1.07 against a narrative fair value of $2.65, the story leans heavily toward a potential mispricing in the stock.

Expansion into nonautomotive markets, such as smart infrastructure, security, robotics, and traffic management, is driving incremental growth, with recently launched products like InnovizSMART already gaining early traction and commanding higher ASPs and margins, thereby improving long-term gross margins and revenue diversification.

Curious how rapid revenue expansion, rising margins, and a premium future earnings multiple all fit together into that fair value? The projections behind this narrative might surprise you.

Result: Fair Value of $2.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant execution risks and potential delays in converting development contracts into full production could quickly challenge the upside baked into this optimistic narrative.

Find out about the key risks to this Innoviz Technologies narrative.

Another Angle on Valuation

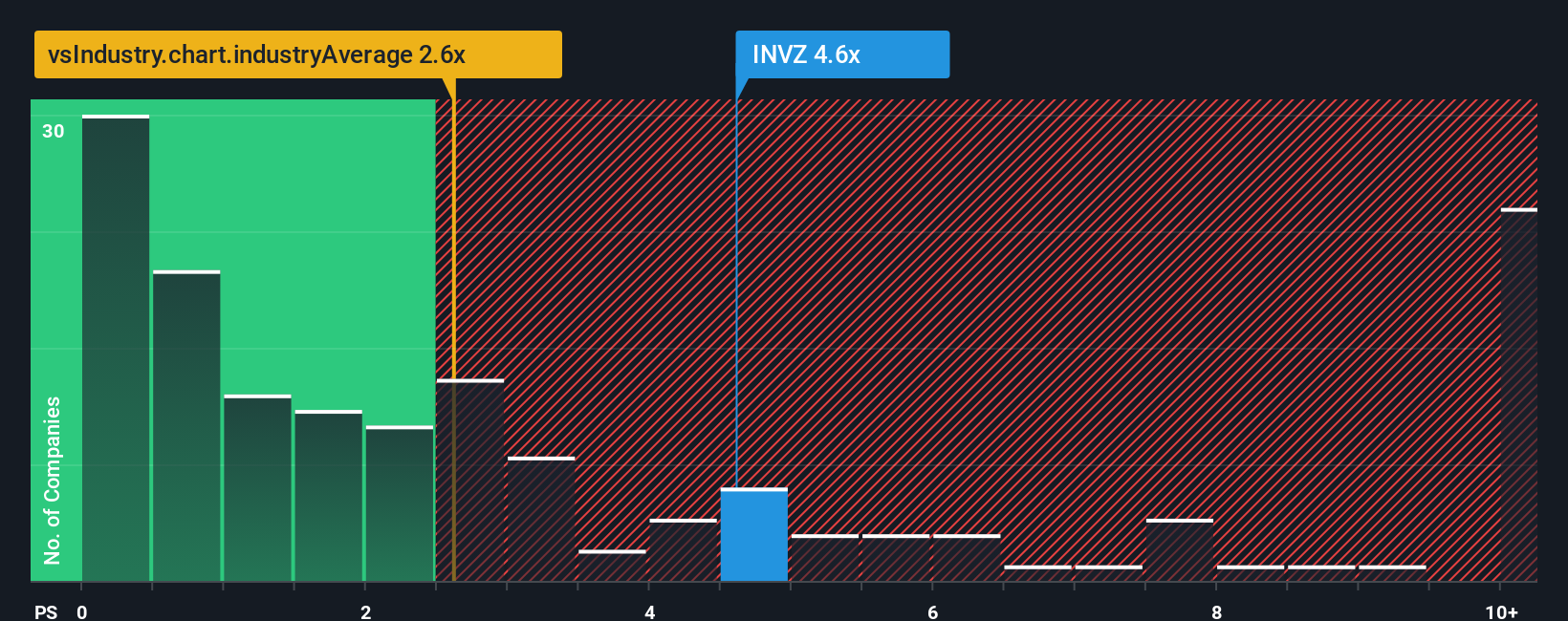

That narrative fair value of $2.65 paints Innoviz as a bargain, but its price to sales of 4.6 times tells a tougher story. The ratio is richer than the US Electronic industry at 2.6 times and twice its own fair ratio of 2.3 times. This points to real valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Innoviz Technologies Narrative

If the conclusion here does not quite match your own view, you can dive into the numbers yourself and build a custom take in minutes: Do it your way.

A great starting point for your Innoviz Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more stock opportunities?

If you stop with Innoviz, you could miss stronger setups, so use the Simply Wall Street Screener now to uncover fresh, data backed investment ideas.

- Capture early stage potential by targeting these 3629 penny stocks with strong financials that already show resilient balance sheets and improving fundamentals before broader investors catch on.

- Position ahead of the next tech wave by focusing on these 24 AI penny stocks riding structural demand for automation, cloud intelligence, and real time data processing.

- Lock in compelling value by filtering for these 898 undervalued stocks based on cash flows where cash flow strength suggests the current market price could be leaving serious upside on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:INVZ

Innoviz Technologies

Manufactures and sells automotive grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion