- United States

- /

- Communications

- /

- NasdaqGS:HLIT

Harmonic (HLIT): Evaluating Valuation After Landmark Comcast Fiber Expansion Partnership

Reviewed by Kshitija Bhandaru

Harmonic (HLIT) is making headlines after announcing a partnership with Comcast to expand fiber broadband access into more than 1.2 million new locations by the end of 2025. This collaboration uses Harmonic’s virtualized broadband platform to support major network growth in both urban and rural areas.

See our latest analysis for Harmonic.

Harmonic’s recent string of major partnerships, including with Comcast for fiber broadband expansion and Mediacom for live DOCSIS 4.0 deployments, has put a spotlight on its industry leadership and ongoing innovation in broadband technology. Despite this momentum and a wave of positive news, the company’s 1-year total shareholder return remains virtually flat, and its share price hasn’t shown a breakout move, hinting that investors may still be weighing up Harmonic’s longer-term growth prospects.

If broadband expansion trends have you thinking bigger, now’s a fitting time to discover fast growing stocks with high insider ownership

With recent analyst upgrades but little movement in the share price, investors now face a key question: are the company’s growth prospects undervalued, or has the market already priced in Harmonic’s future potential?

Most Popular Narrative: Fairly Valued

With Harmonic’s fair value narrative now at $10.50—just above its last close of $10.69—the market appears to be closely tracking expectations, with little room for surprises unless fundamentals shift.

Accelerating global demand for high-speed broadband and the ongoing transformation to next-generation virtualized broadband networks (including Fiber-to-the-Home and Unified DOCSIS 4.0) are driving a multi-year upgrade cycle among operators. Harmonic's leadership and recent customer wins in these areas signal a strong pipeline and are likely to fuel significant future revenue growth as operators ramp deployments in 2026 and beyond.

Want to see what’s powering Harmonic’s near-term price target? This narrative is built around bold projections for revenue expansion and fatter profit margins in the years ahead. Find out what unique financial levers are moving the dial, and which pivotal milestones analysts believe could unlock serious value in the next upgrade cycle.

Result: Fair Value of $10.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company’s heavy reliance on major clients and the risk of rapid technology shifts could quickly undermine this balanced outlook.

Find out about the key risks to this Harmonic narrative.

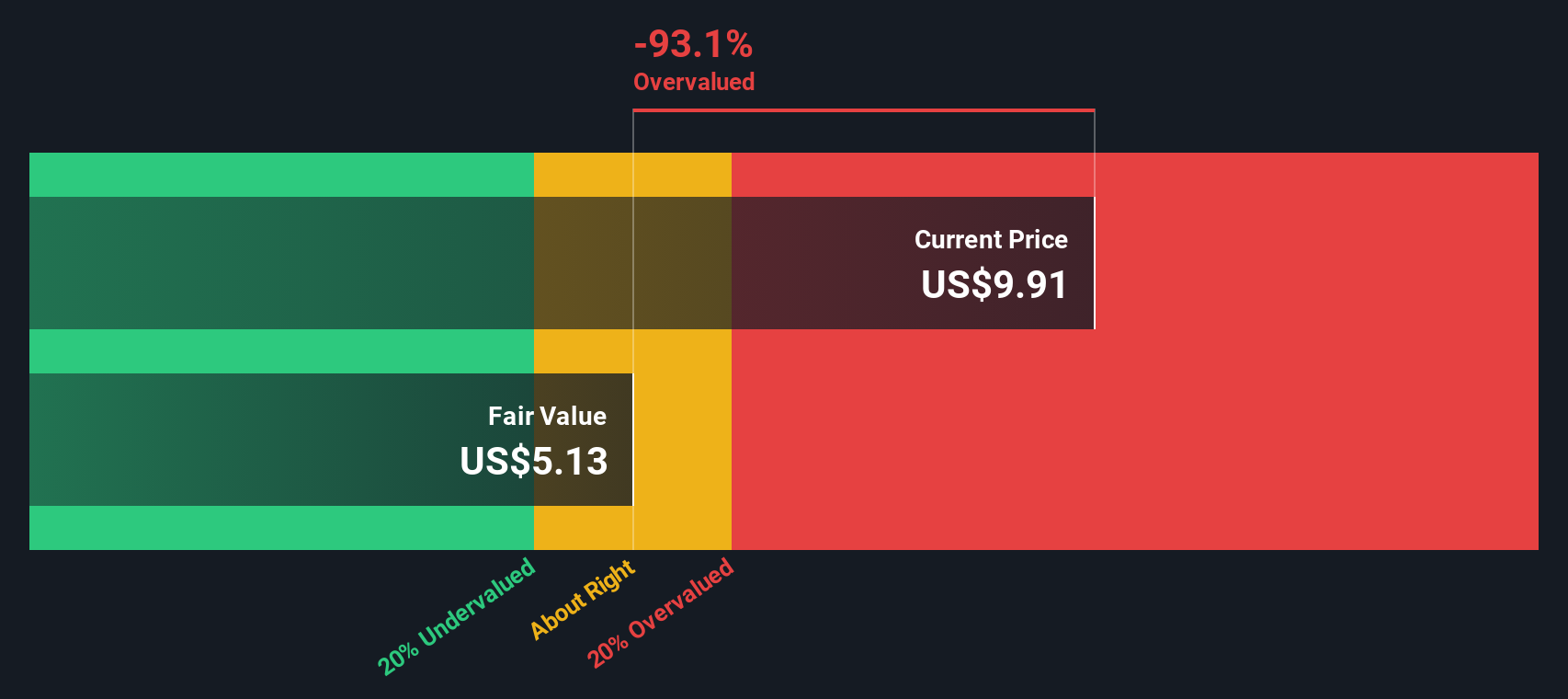

Another View: SWS DCF Model Signals Overvaluation

For a fresh perspective, our DCF model values Harmonic at just $5.17 per share, which is well below the current market price. This method suggests the stock may be overvalued if future cash flows do not pick up pace. This raises questions about the reliability of bullish earnings expectations.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Harmonic Narrative

If you see things differently, or want to dig into the numbers yourself, it’s easy to craft your own view of Harmonic’s outlook in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Harmonic.

Looking for more investment ideas?

Upgrade your portfolio strategy and get ahead of the curve by tapping into the most timely trends and forward-thinking opportunities on the market right now.

- Unlock growth by zeroing in on up-and-coming companies that may be undervalued. Start with these 896 undervalued stocks based on cash flows to spot new winners before the crowd.

- Maximize your income potential by checking out these 19 dividend stocks with yields > 3%, where you'll find companies consistently rewarding shareholders with robust yields above 3%.

- Get an edge in the booming tech sector by targeting these 24 AI penny stocks packed with artificial intelligence breakthroughs that have the power to reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives