- United States

- /

- Communications

- /

- NasdaqGS:GILT

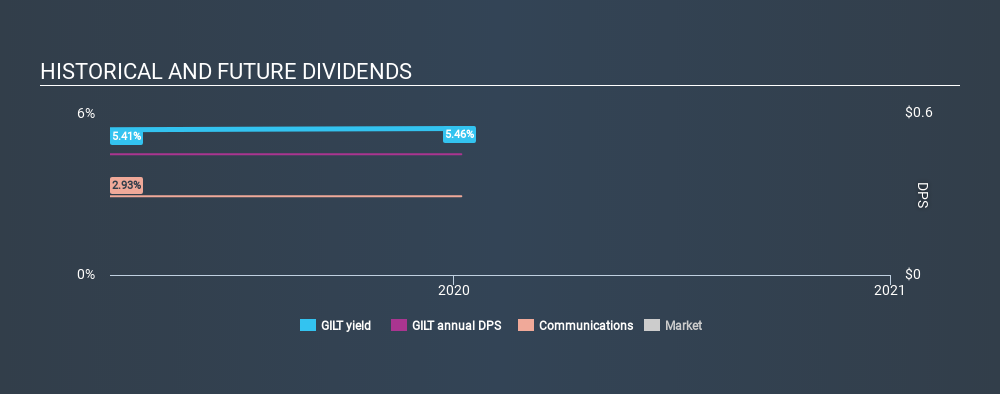

Key Things To Watch Out For If You Are After Gilat Satellite Networks Ltd.'s (NASDAQ:GILT) 5.5% Dividend

Today we'll take a closer look at Gilat Satellite Networks Ltd. (NASDAQ:GILT) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

Gilat Satellite Networks has only been paying a dividend for a year or so, so investors might be curious about its 5.5% yield. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 140% of Gilat Satellite Networks's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Gilat Satellite Networks paid out 243% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. As Gilat Satellite Networks's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

While the above analysis focuses on dividends relative to a company's earnings, we do note Gilat Satellite Networks's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Gilat Satellite Networks's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was US$0.45 per share.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Gilat Satellite Networks has grown its earnings per share at 57% per annum over the past five years. The company has been growing its EPS at a very rapid rate, while paying out virtually all of its income as dividends. Generally, a company that is growing rapidly while paying out a majority of its earnings, is seeing its debt burden increase. We'd be conscious of any extra risk added by this practice.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Gilat Satellite Networks paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. With this information in mind, we think Gilat Satellite Networks may not be an ideal dividend stock.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Gilat Satellite Networks stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:GILT

Gilat Satellite Networks

Provides satellite-based broadband communication solutions in Israel, the United States, Peru, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.