- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

Should Flex’s (FLEX) Shift to Complex Manufacturing and New Credit Card Strategy Influence Investor Focus?

Reviewed by Simply Wall St

- Flex Ltd. recently reported first-quarter results with US$6.58 billion in sales, US$192 million in net income, and launched a Visa Infinite Business Credit Card tailored to small and mid-sized companies, marking the first U.S. fintech to offer this category with enhanced business benefits.

- An interesting insight is Flex's ongoing pivot toward high-value, complex manufacturing segments like data centers, healthcare, and automotive, while actively reducing its exposure to more commoditized markets, a shift paired with both expanded manufacturing capacity in Europe and deeper integration of AI-driven offerings.

- We'll explore how Flex's reinforcement of its data center and power businesses could influence its future earnings story and analyst expectations.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Flex Investment Narrative Recap

To own Flex Ltd. as a shareholder, you need to believe in its shift into higher-value, complex manufacturing, especially data centers, healthcare, and automotive, underpinned by operational discipline and global expansion. The recent share buyback, which completed $912.56 million in repurchases, is a positive for capital allocation but does not materially impact the main short-term catalyst: demand growth in AI-driven data center power solutions. Key risks like macroeconomic pressure and margin sensitivity remain unchanged following this news event.

Among recent announcements, the new $2.75 billion credit facility stands out. This move enhances financial flexibility as Flex pursues manufacturing expansion in cloud and power, positioning the company to seize opportunities in the growing AI infrastructure sector, which remains the most critical growth driver in the near term.

Yet, investors should keep in mind that rising competition in AI data centers could limit future profitability if...

Read the full narrative on Flex (it's free!)

Flex's outlook anticipates $29.0 billion in revenue and $1.3 billion in earnings by 2028. This scenario is based on annual revenue growth of 3.9% and an earnings increase of $462 million from the current earnings of $838.0 million.

Uncover how Flex's forecasts yield a $53.54 fair value, a 3% upside to its current price.

Exploring Other Perspectives

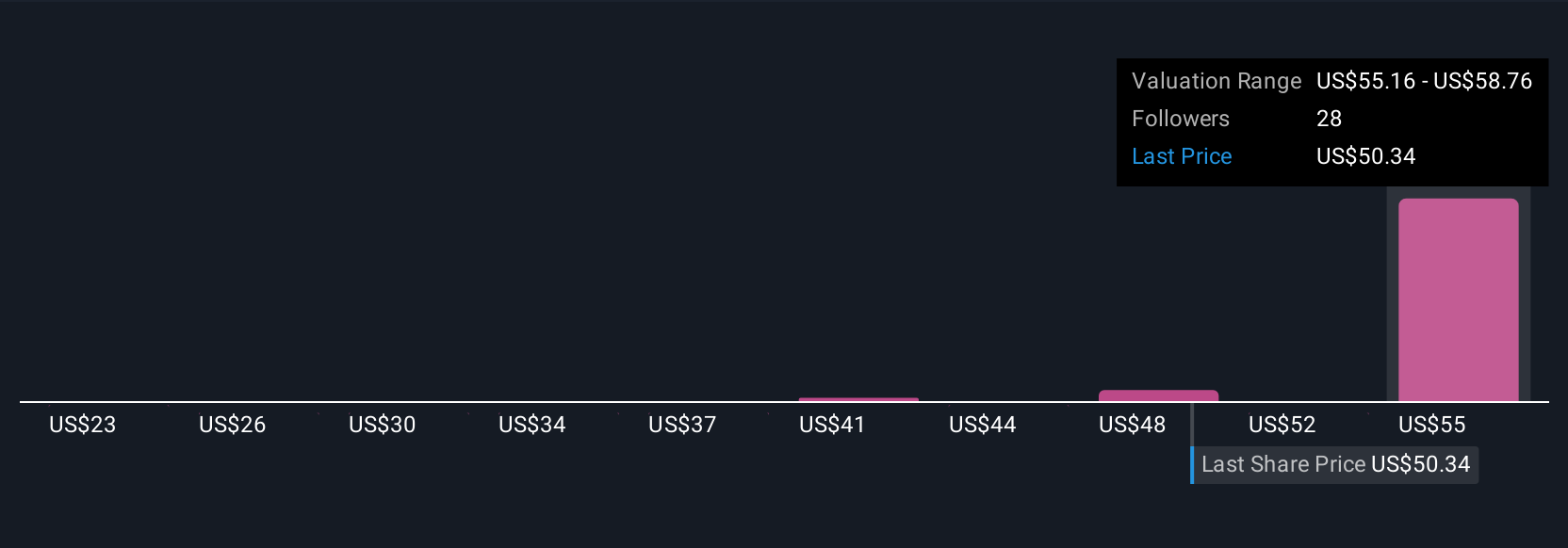

Simply Wall St Community members set Flex’s fair value between US$22.73 and US$63.21, reflecting six varying analyses. While Flex’s transformation attracts interest, competitive pressures in cloud and power remain a major factor influencing future results.

Explore 6 other fair value estimates on Flex - why the stock might be worth less than half the current price!

Build Your Own Flex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flex's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives